Stocks came back aggressively, rates closed higher, and commodities were broadly up.

The media gave (relatively) little attention to the California recall vote. It's fair to say that this vote represented a proxy on the democrat agenda and therefore, the Biden administration - it was a very big deal.

With that, with the Newsom win, any perception that there could be friction for the Biden agenda ahead, has been disabused. So, perhaps this was a greenlight today for markets. If we were looking for clues on this view of the fortification of the Biden agenda, we could see clues in the energy sector.

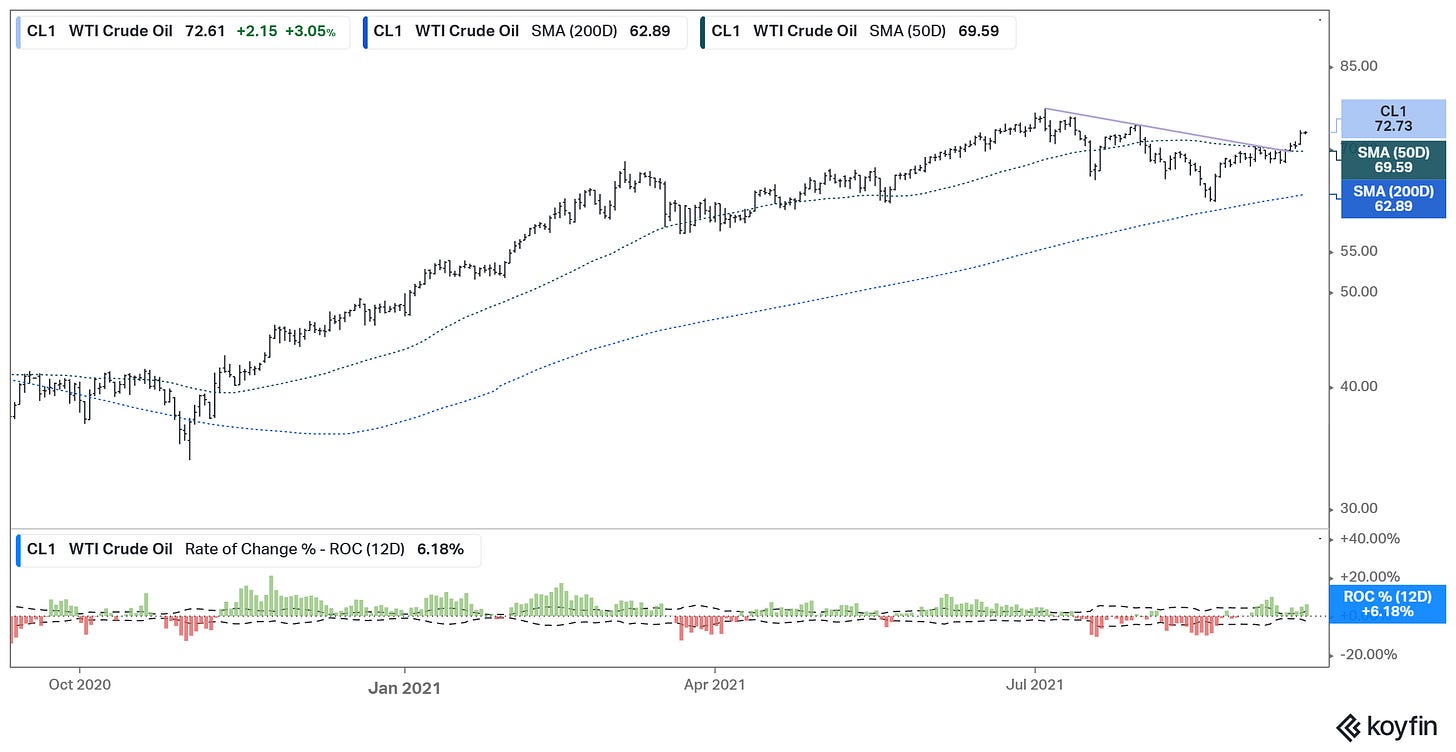

As I’ve said all along, the vow to kill fossil fuels in the name of climate action, only builds a moat around the existing producers and that ensures much, much higher oil prices. With that, let's take a look at the chart on oil...

As you can see, with the climate action agenda well telegraphed, oil prices took off from election day. With the outlook for U.S. production-driven supply constraints and a return of power to OPEC, the price of oil doubled in eight months. We've since had a nearly 20% correction over about two months and now the bull market in oil appears to be resuming with this “technical” trendline and moving average (50Day) breakout of the past two days - yesterday oil closed up 3%.

Also winning on the climate action front (for different reasons) is natural gas. The price of natural gas has soared in the past month - up ~50%...

Not surprisingly, the best performing sector of the day in stocks was energy (XLE). Nine of the top ten performers in the S&P 500, on the day, were energy stocks (most of them U.S. shale oil and gas producers), and as you can see, with these stocks you're getting levered returns to the performance of the underlying commodity.