The Hurdle is Lower

US Stocks closed a volatile session mixed on Friday, as uncertainty prevailed following the previous session’s rally, which was fuelled by the Federal Reserve's oversized interest rate cut.

The S&P 500 and Nasdaq slipped 0.2% and 0.3%, respectively, while the Dow Jones added 36 points, extending its record close from the previous day.

Federal Reserve policymakers expressed differing views on inflation, with Governor Christopher Waller supporting the half-point rate cut due to favourable inflation data, while Governor Michelle Bowman, the lone dissenter, warned it could signal a premature victory over inflation.

Among stocks, FedEx plunged 15.2% after posting weak earnings and lowering its revenue forecast, while Nike shares surged 6.9% following the announcement of Elliott Hill as the new CEO.

Despite the pullback, stocks posted a winning week, with the S&P 500 up 1.3%, the Nasdaq advancing 2.1%, and the Dow adding 0.8%.

A key component of investing is the expected rate of return versus a “hurdle” rate.

If the return prospects of an investment are above a hurdle rate, the investment opportunity is considered attractive. The hurdle rate usually includes a risk-free rate plus a return premium to compensate for the risks of the specific investment. This week, the Federal Reserve lowered the risk-free rate by half a percent.

Lower rates help create demand for private sector investment, including investment in the stock market, housing, and manufacturing.

Likely in anticipation of lower rates and a continuing healthy economy, housing starts increased 9.6% month-over-month, bolstered by a 15.8% increase in single-unit starts. Building permits increased 4.9% month-over-month. Single-unit starts and permits were up in every region of the United States.

The ISM Manufacturing index has contracted in 21 of the past 22 months - this is almost two straight years of contraction.

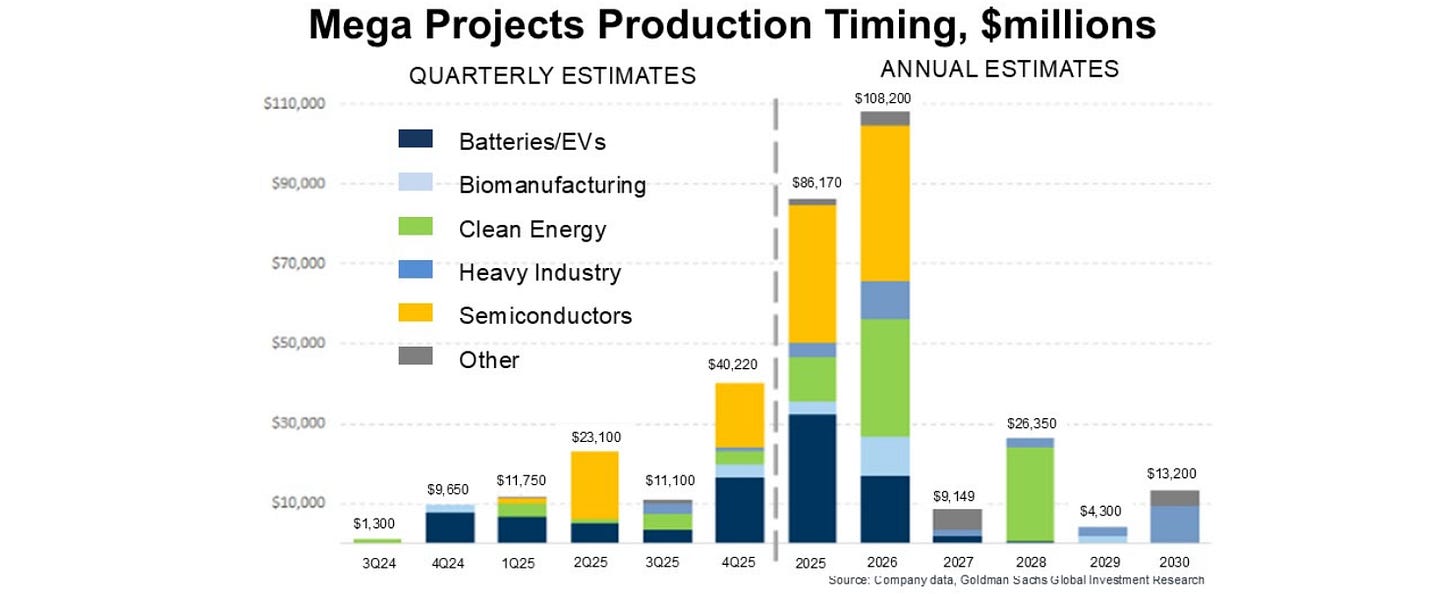

Goldman Sachs believes “mega” industrial production projects have reached a low and are turning significantly higher. Mega manufacturing projects are delineated at $1 billion or more in total spend. Goldman sees manufacturing production starts to be approximately six times greater in 2025 than 2024 ($86 billion, up from ~$15 billion). They are forecasting another 26% year-over-year increase for 2026 (~$108 billion).

The Federal Reserve lowered the hurdle rate for investors at a time when;

household net worth is at an all-time high,

mortgage rates are at 16-month lows,

gasoline prices are trending lower,

industrial production is rebounding,

the job market is healthy,

retail sales continue to surprise to the upside.

Given this backdrop, it is not much of a surprise that the Atlanta Fed GDPNow model for third quarter GDP growth is a robust 2.9%.

Increased investment in long-duration assets such as housing and manufacturing capacity tends to have long-duration bullish effects.

Employment, parts, materials, furniture, durable goods, etc. all experience higher demand over time as a result.

Bullish stock market price action this week reflects much of the above.