Part A: Portfolio Update

Anti-Constrained Portfolio (MTD): -2.09%

Key:

Black - Options Exposure.

Purple - Commodities Exposure.

Dark Blue - Systematic Trend Exposure.

Light Blue - Large Blend Equity Exposure.

Green - Long Government Exposure.

Orange - Vanguard Balanced Index Fund (benchmark).

Uncorrelated Convexity (MTD) (individual components): -33.87%.

Key:

Orange (thick line) - Vanguard Total Stock Market Index $VTI.

Individual Component Returns (unweighted & without costs):

Risk On | Off Model:

Latest Signal Point.

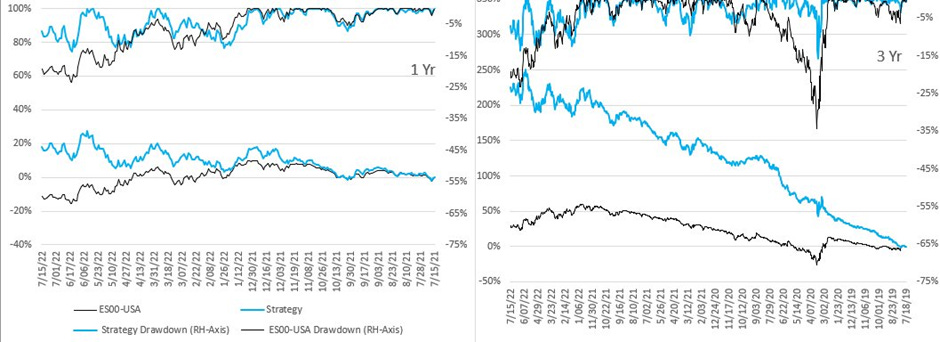

Strategy Performance & Draw-downs (-1Yr & -3Yrs).

Part B : Macro Talking Points

U.S.: The CPI print for July was 9.1% from 8.6% (while expectation was for 8.8%) - under the surface price pressure are persistent, widespread and sticky.

Gas: In Europe, we had (from 11th of July) the stop of gas flow through Nord Stream 1 for a 10 days period of maintenance - the risk is that for some political reasons the flow will not restart anymore.

Europe: We had the start of a new political crisis in Italy with the 5-Star Movement's (M5S) failure to take part in a confidence vote in the Senate on a government decree. Draghi offered his resignation . . . that the President Mattarella rejected ! Now this week there will be a confidence vote and the risk of going to vote earlier than what market expected.

ECB: Their job just got more complicated, do they hike 50bp to fight inflation or only 25bp given the political risk and on growth? Plus, they’re due to release the date for the presentation of the “Anti Fragmentation” tool - spread widened to 220bp.

Commodities: Market had an other week of sell-off. All subsectors were impacted but the bulk of the movement come from industrial metals (copper -9%, Aluminium -5%; Iron ore -9%).

Rates: Market responded at the macro environment with an increase in the front-end of the curve (the 2y) with some rate hike talk by central banks again on the table and a more front-loading cycle (job market & retails sales are good enough for the Fed). The long end of the curve (I’ll speak of the 10Y) was volatile around the data but closed with low rates (price action vs newflow confirm that positioning is short on rates) indicating more focus on growth and recession.

Credit: We had underperformance of HY vs IG, whilst the spread on cash bond of IG and HY were flat on the week - total return was driven by rates. Crossover (the HY CDS) remain above 600bp. I continue to prefer the quality rating (BBB/BB to B/CCC), like also defensive sectors.

Equity: Liqidity is negative and will impact EPS. Breadth (below the % of stocks of SPX above moving average) remain’s at depressed level - likely a good contrarian indicator for a short term rebound.

PS: If you know someone that might like to receive my daily notes, they can sign up by clicking below . . . And if you, or someone you know, wants to take control of their investments with a “do-it-yourself” approach, please consider subscribing to the paid service.