What follows is a 2 part weekly review; Part A is a non-descriptive summary view of the portfolio’s and model performance offered via subscription, whilst Part B is a short, bullet point type, review of the markets main talking points in the last week.

Part A : The Gryning Portfolio Review:

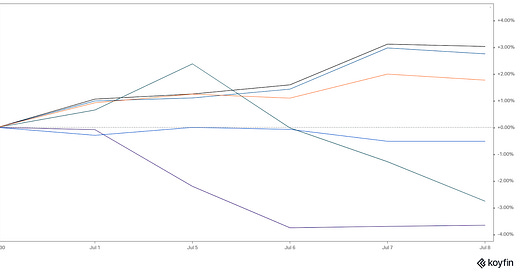

Anti Constrained Portfolio (MTD):

KEY:

Orange - Benchmark 60/40 Portfolio.

Black - Large Blend Equity exposure.

Purple - Commodities exposure.

Dark Blue - Options (Theta) focussed.

Blue - Systematic Trend focussed.

Green - Long Government exposure.

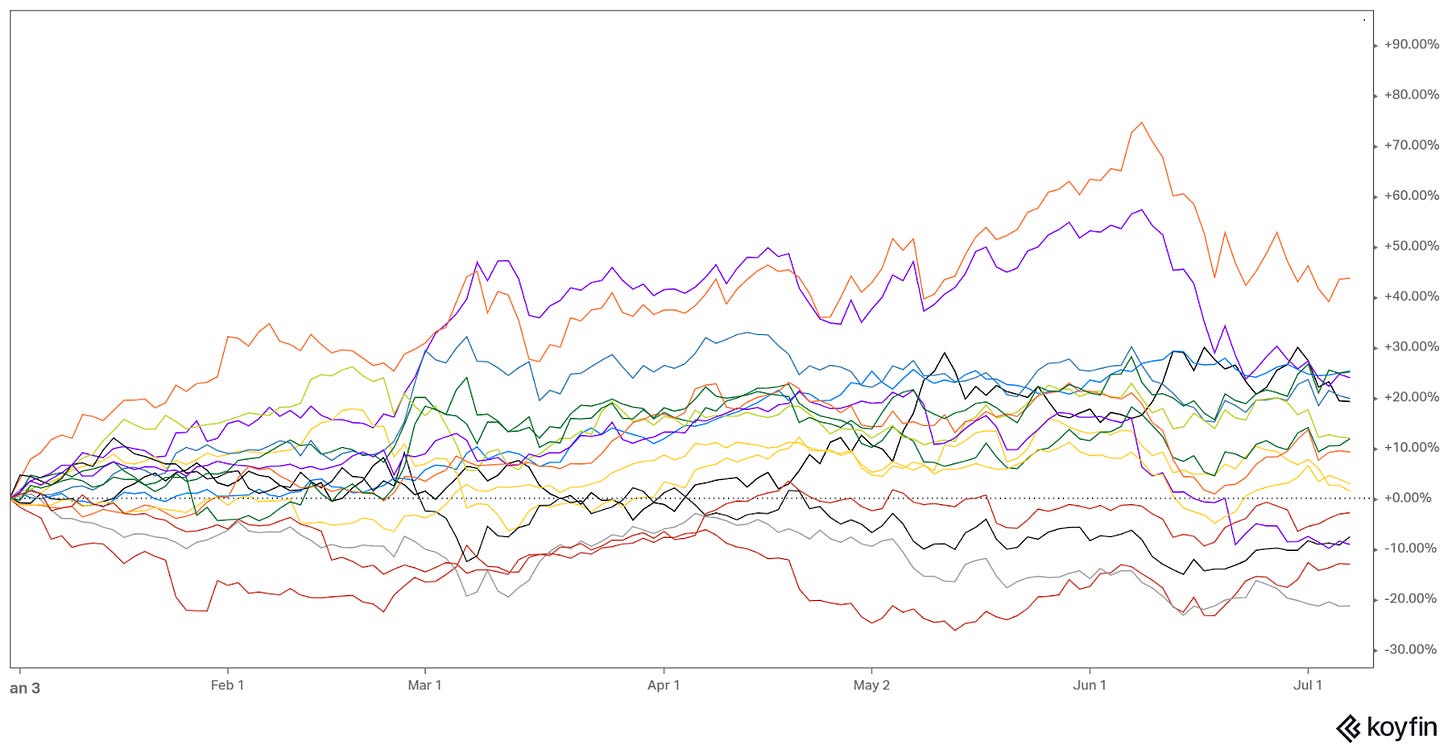

Uncorrelated Convexity Portfolio Returns (MTD & YTD):

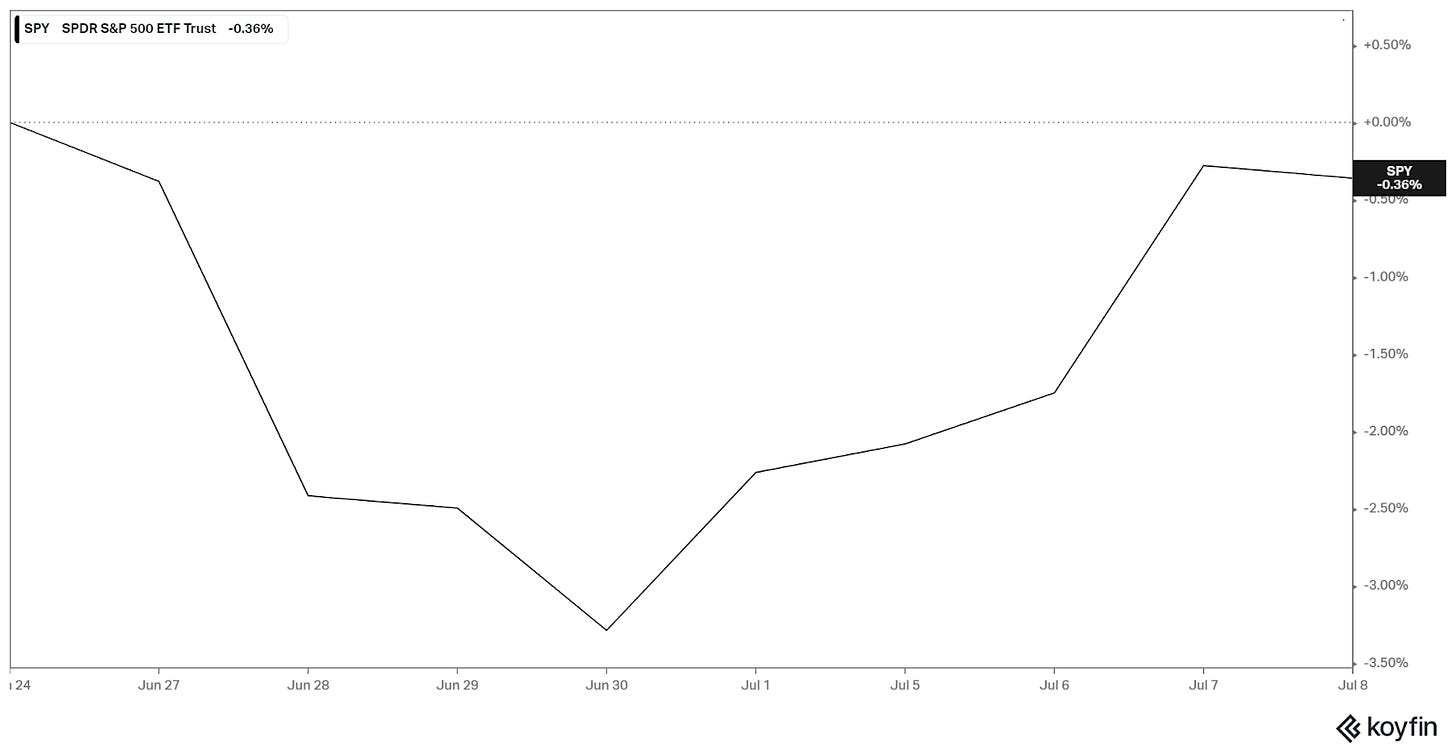

Risk On | Off Model:

Model flip date and price action shown in Chart 1 below.

Chart 2 shows market performance.

Part B : Macro Talking Points

US: better than expected ISM services and a strong payroll (increase 372K, vs 265k expected).

Europe: Germany had the first monthly trade deficit since 1991 (this is the great driver of EUR weakness). Furthermore, this week Scholtz signed the bailout for gas giant Uniper (impacted by the high cost of the raw material) while next week from 11th of July there will be a stop of flow on Nordstream1 for 10 days…

China: The Biden administration has talked about their desire to reduce some tariffs from China. At the same time China (where there is the great % of refining spare capacity) increased export quota of gasoline/diesel and jet fuel by 5M tons to 22.5M tons totally;

U.K.: Boris Johnson resigned as UK prime minister, dragged down by scandals and lack of support by government members.

Markets

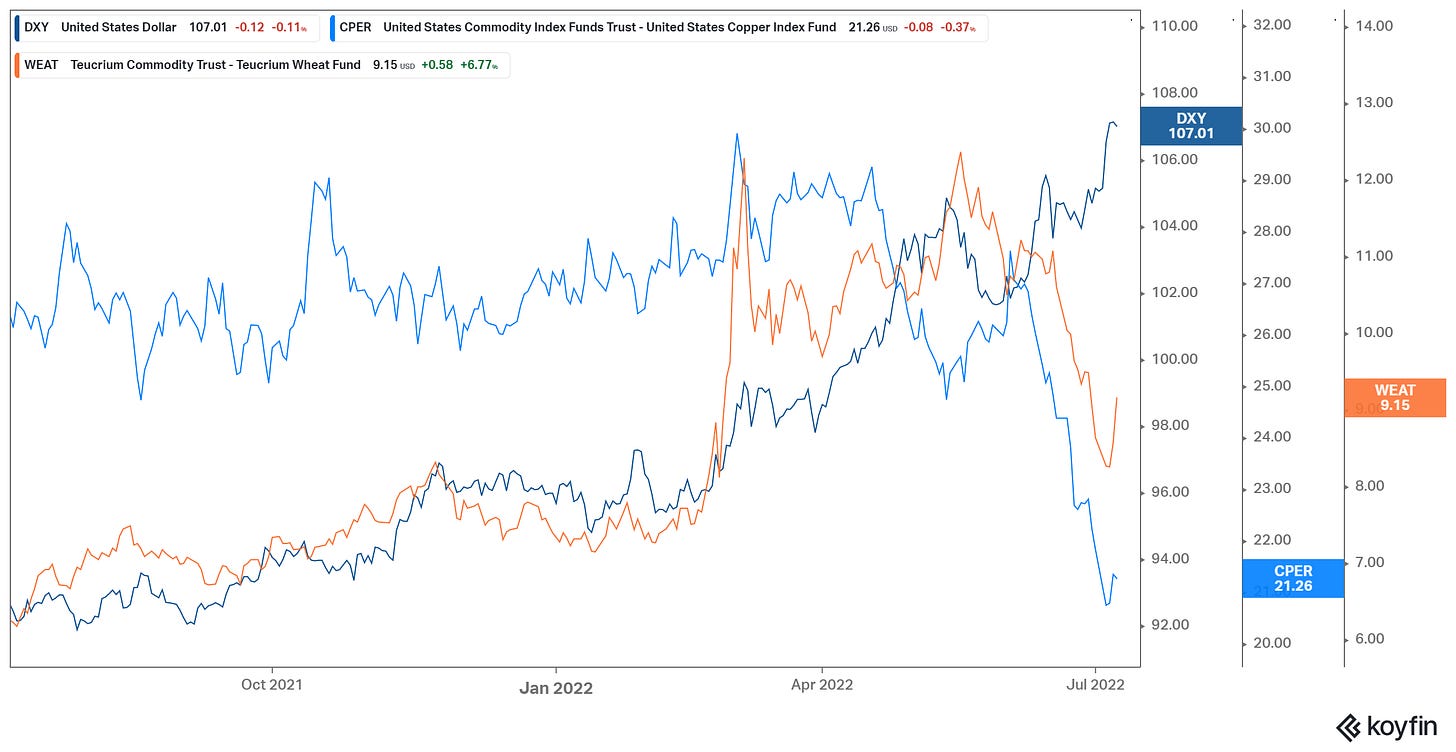

The biggest mover of the week from a Macro perspective is the Dollar, especially since we seem to be on cusp between stagflation and deflation.

Commodities: all the sub sectors were impacted by growth fear and liquidation - low open interest on the main futures. In agriculture wheat returned to it’s pre-Ukraine invasion level. In Industrial metals Dr. Copper sits at -26% YTD and oil succumbed at the main narrative despite a tight phisical market. Gas in Europe remained high due to Russia pressures on Europe and the fear of a strike in Norway.

Rates: due to the better than expected macro data in the U.S. and the hawkish FED, rates in the U.S. returned to growth (with some of the hike returned in the forwards), driven by high real rates. In Germany/Europe remained stable due to high risks of gas cuts by Russia and the possible impact on growth.

Looking at the drivers of US 10y we can see that copper/gold bounced a bit (thanks to newsflow of infrastructure stimulus in China), despite indicating a lower treasury yield target, while YTD rates are following oil and oil/gold.

Credit: spreads on IG and HY tightened this week (-15bp and -17) given the good macro sentiment that boosted the bear market rally but the underperformance of HY vs IG points to more recession risk priced now vs the past weeks. Given the further downside risk to economic growth going forward to me the sweet spot remains on IG or in the BB of the HY spectrum.

Equity: Financial conditions (and liquidity) were better this week with IG to Govt bouncing strongly from the low. This, together with the better than expected macro data allowed for equity to post a positive week ( +2% on average for SXXP and SPX).

The sentiment, using Bofa Bull & Bear Indicator (or AAII Bull-bear, Put/call ratio) remains very low, this is inclusive of breadth indicators too (with a lead driven by defensive sectors).

PS: If you know someone that might like to receive my daily notes, they can sign up by clicking below . . . And if you, or someone you know, wants to take control of their investments with a “do-it-yourself” approach, please consider subscribing to the paid service.