The GRYNING Essays

A Message from the Sponsor

The GRYNING Essays is the clearest way to change the way you see the financial markets.

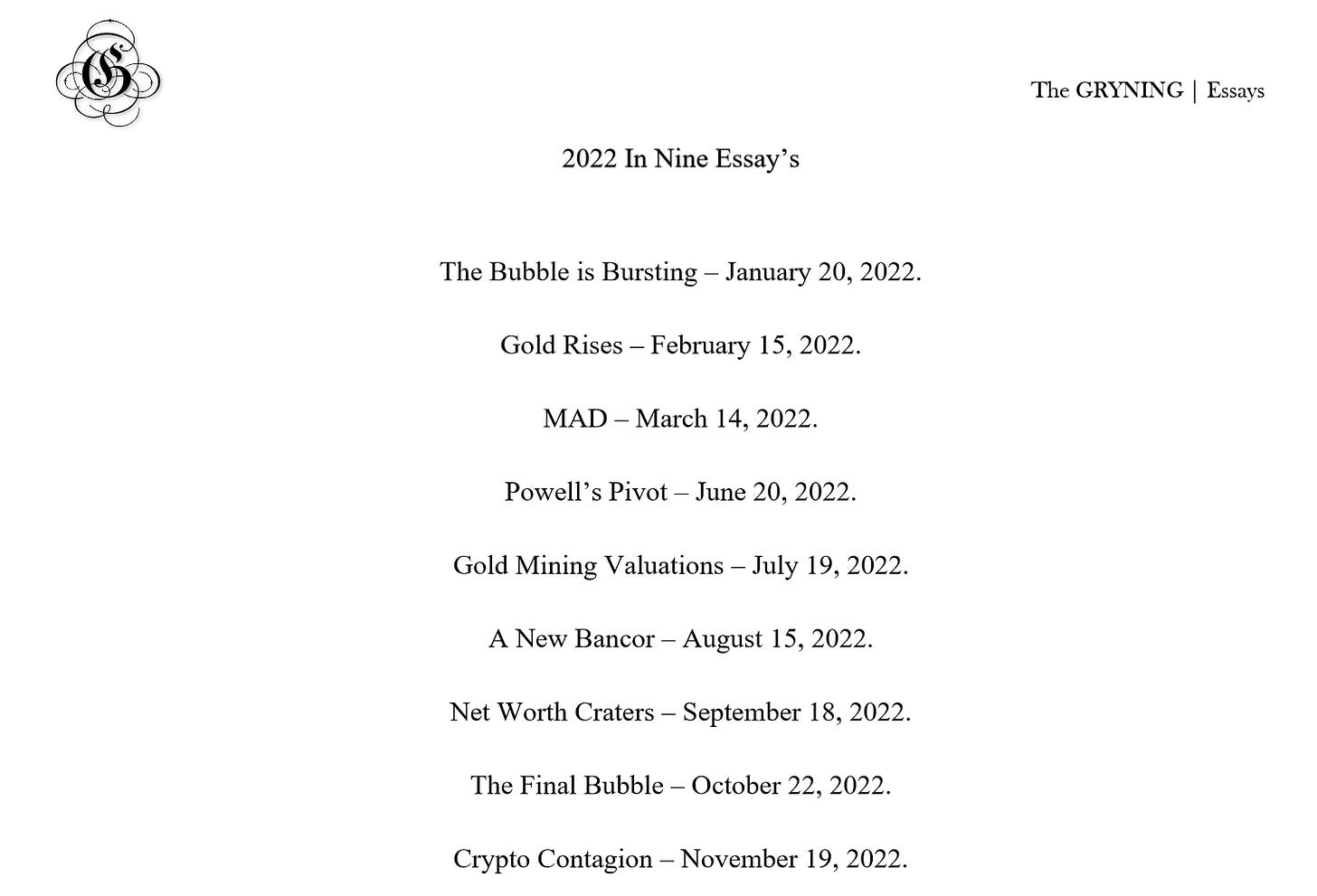

The book (pdf) consists of nine essay's, written through the course of 2022, looking at each of the major geo-political and macro-economic events that have impacted the financial market place.

They are designed to give you a better understanding of the current state of affairs, allowing you to make informed decisions on how best to protect your wealth, before pointing you towards where the best opportunities lie.

Click here to pick up the book.

Below I show the opening few paragraphs for each of the essays.

The Bubble is Bursting – January 20, 2022.

A year ago inflation was running at 1.4%; Fed economists were whining that inflation was too far below their 2% target. By June inflation had jumped to 5.3%— the Fed deployed the “transitory” defense. In November, Powell retired the word, saying:

“Transitory is a word that people have had different understandings of.”

The latest inflation report printed a 7.1% increase in prices. That rate for only ten years would cut the dollar’s purchasing power in half.

Politics dictates that the Fed pivot to support the dollar, and that means the end of QE, balance sheet runoff (letting the Fed’s securities mature and not replacing them), asset sales in extremis, and hiking rates. The 10-year Treasury bond yield has jumped from 1.35% in early December to 1.8% currently, the highest yield since before COVID lockdowns.

The highest nominal yield, that is. With inflation running at 7.1%, the real yield is -5.3%, a new 50-year record, lower than the two spike lows of 1974 and 1980, both of which corresponded with epic gold bull markets. The fact that gold hasn’t gone parabolic, yet, prompts a deeper look into what drives gold prices.

Gold Rises – February 15, 2022.

February 10, 2022, offered a microcosm of the markets. Inflation came in hot, printing at a 7.5% increase, higher than last month, higher than Wall Street estimates, the highest in forty years. Gold got slammed from $1,831/oz to $1,821/oz in the first minute after the announcement. The U.S. dollar index jumped 0.28%, a sizable move in currency land. Oil fell $1/bbl.

For the past few decades, inflation has been dollar positive and gold negative because higher inflation forces the Fed to tighten financial conditions, or so the thinking goes. For example, inflation was running hot in 2007, ending the year at 4.4%—Fed chairman Bernanke slammed on the financial brakes, ushering in the 2008 panic. By 2011, QE had sent inflation back to 3.8%—the ensuing halt of QE cut gold nearly in half, from a peak above $1,900/oz in 2011 to $1,050/oz by the end of 2015.

This pattern is, no doubt, how algorithms are trained, which is why the markets moved so fast and furiously after the inflation data release (humans can’t trade that fast). But the machines are missing another pattern: rising nominal rates boost gold’s nominal price.

Bernanke raised rates from mid-2004 to mid2006, during which time gold surged from $400/oz to $700/oz, a 75% increase (a similar move today would put gold over $3,200/oz). Then again, the Fed raised rates from the end of 2015 to early 2019, and gold moved 24% higher, from $1,050/oz to $1,300/oz.

MAD – March 14, 2022.

“I cannot forecast to you the action of Russia. It is a riddle wrapped in a mystery inside an enigma; but perhaps there is a key.”

So spoke Winston Churchill at the outbreak of World War II. The Germans and Soviets—two totalitarian states—had just signed a nonaggression pact, and it was unclear on which side Russia would ultimately fight.

Yet Churchill understood history, and he surmised, correctly:

“That key is Russian national interest. It cannot be in accordance with the interest of the safety of Russia that Germany should plant itself upon the shores of the Black Sea, or that it should overrun the Balkan States and subjugate the Slavonic peoples of south eastern Europe. That would be contrary to the historic life-interests of Russia.”

Noted investor Simon Mikhailovich (who grew up in the USSR) points out that Churchill’s view was informed by the conflict of the 1850s. In 1854, twice-UK prime minister Lord Palmerston stated:

We are pledged by the national interest, by European interests, and by our convention with France to prevent the recurrence of the causes which have brought the war on, and this can be accomplished only by weakening Russia for a time at least, if we cannot do so permanently, in some material point.

The best and most effectual security for the future Peace of Europe would be the severance from Russia of some of the frontier territories acquired by her in later times, Georgia, Circassia (Chechnya), the Crimea, Bessarabia (Moldova), Poland & Finland.

If these were taken from her she would still remain an enormous power, but far less advantageously posted for aggression on her neighbors.

Powell’s Pivot – June 20, 2022.

The S&P 500 is down 22% from its all-time in December. It is going lower. That’s not just my opinion: that mandate comes straight from Bill Dudley, former chief economist for Goldman Sachs, former manager of the System Open Market Account for the FOMC, former president of the New York Fed.

Dudley began his recent Bloomberg column:

“It’s hard to know how much the U.S. Federal Reserve will need to do to get inflation under control. But one thing is certain: To be effective, it’ll have to inflict more losses on stock and bond investors than it has so far.”

The reason:

“the stock market is important [is] because a lot of people have exposure to the stock market and the level of the stock market effects their wealth. . . .”

In other words, the more the stock market goes up, the richer people feel, and the more they spend. With inflation roaring at 8.5%, it is obvious that there is too much money chasing too few goods (try getting a hotel reservation in any resort town. . .).

Gold Mining Valuations – July 19, 2022

Gold shares had another jarring month in June, with the GDXJ gold miners ETF losing 18.39%, down 28% year-to-date, putting its price well below where it was at the start of the COVID panic in March 2020. Though unpleasant, such enormous swings in value are not threats to a long term investment strategy in the same way that extreme losses might be to a trading strategy, for example, for which recovery from such losses would be nearly impossible. The market can mark gold lower, the value of gold mining assets then go lower, and the companies that own them sink lower still. But the assets themselves remain physically unchanged, usually improving through development, in fact. When the gold price recovers, so do the value of the assets, and the values of the companies that own them.

This played out in 2015 when mining companies lived in fear that the accountants would impair officially the values of the projects on their balance sheets. The market had done that already, of course, and, unlike a typical impairment, which recognizes permanent loss (the collapse of a building or loss of patent or fraud or other such things), gold resource impairments get reversed as soon as the gold price recovers.

A New Bancor – August 15, 2022.

Gold shares have skidded sharply in recent months: the GDXJ gold miners ETF and HUI Gold Bugs index both fell 41% from mid-April to mid-June. The TSX/S&P500 Global Gold Index of larger miners fell 39%. Gold shares have rebounded by roughly 15% in the past three weeks as gold seems finally to have found a bottom. Gryning maintains that gold shares remain efficient (and now cheap) vehicles to guard against the collapse of the central banks’ monetary experiments and to hedge against the global chaos being fomented by the ebbing power of the American empire.

We see that power vacuum in many divergent spheres, from U.S. internal politics, where the rule of man usurps the rule of law, where the establishment left encourages violence (against Supreme Court justices, for example), where the ruling regime politicizes law enforcement, both in terms of who it prosecutes (republicans and those defending themselves against violence) and who it doesn’t (the violent and friends and family of the regime), from the corruption and humiliation of the Afghanistan occupation, to the ongoing implosion of America’s European allies, and the spectacular failure of America’s surgical strike against the Russian Ruble.

The ruble began 2022 at 75 to the dollar. U.S. financial sanctions following the outbreak of hostilities in Ukraine sent the ruble down 46% within three weeks. Ejected from the Western banking system and with U.S. financial players freezing local operations, Russia was supposed to default, hyperinflate, collapse economically, and have a swift change in leadership.

Net Worth Craters – September 18, 2022.

Gold stocks had another frustrating month, erasing early gains to end down sharply. Having dropped nearly to the bottom seen earlier in the summer, gold stocks are rallying hard in September and are heading higher again despite yesterday’s stock market rout. We continue to think that gold and gold miners are finding (or have found) a bottom to complete the 50% correction that began in August of 2020.

In recent months, the Fed has hiked interest rates at unprecedented speed. Fed officials (and politicians) have long acknowledged that monetary policy effects take time to percolate through an economy as enormous as America’s. When Nixon wanted his Fed chairman Arthur Burns to lower rates for his reelection, for example, he ordered him:

“I think we’ve really got to think of goosing it. Shall we say late summer and fall this year in order to affect next year? As you know, there’s a hell of a lag.”

The Fed has, therefore, always moved cautiously when raising rates, worried it will go too far too fast and cause a recession. It acts suddenly only to abate widespread panic.

The results of the Fed’s sharp interest rate hikes already taken will, therefore, affect the economy for many months into the future regardless of its future actions. And the Fed is still hiking, with expectations of at least another 75 basis point increase this month.

The Final Bubble – October 22, 2022.

It has been a dark two years for gold investors. As with the crash in 2013, which occurred while the Fed was printing money, it seems bizarre that gold should be going down during high inflation. The gold market is forward looking, however, and has been telegraphing the collapse in commodity prices, real estate, and equity markets that has only recently commenced. Yet recent travails in the largest finance markets—the yen, the pound, large banks like Credit Suisse, and now illiquidity in the U.S. Treasury market—all suggest we are near the next run in the gold price.

The Fed’s decision to spike interest rates has put foreign countries in a quandary: either increase domestic rates commensurately, accepting the economic and political consequences, or keep rates low and watch the currency collapse as traders sell it to buy dollars to capture the higher rates in the U.S.

Japan chose the latter path and saw the yen travel from 114 to the dollar in March to 149, a 23% devaluation in just seven months. Ominously, the yen paused at its current level only because on September 22, the Bank of Japan dumped $21 billion USD onto the market to buy yen. This currency intervention was Japan’s first since the Asian crisis in 1998, and it worked! The yen rose 2.3%. But, now, only three weeks later, the yen is already 2% lower than it was before the intervention. The Bank of Japan has $110 billion in a cash account at the Fed. After that is gone, it will have to start selling its $1.2 trillion in U.S. Treasury bonds, pushing U.S. rates higher and, therefore, the yen lower even while the intention will be to do the opposite.

Crypto Contagion – November 19, 2022.

The very promise of bitcoin and other crypto assets was that the crypto technology makes it mathematically impossible for them to be subject to theft or fraud. Each crypto coin is stored in a wallet, and each wallet has a long, uncrackable code necessary to effect transactions. The transactions themselves occur on the blockchain and are a matter of public record, so everyone at all times can determine the precise location of each and every crypto asset and its entire trading history - only the identity of the wallet owner and its transaction code are uncrackable secrets (though they may be disclosed or stolen).

The market challenge is that holding crypto assets in pure mathematical form is illiquid - it is like holding a physical stock certificate. With such a certificate, a holder is entered into a company’s books as a direct owner - there is no risk that a broker, such as MF Global, can abscond with the position. But it is virtually impossible to trade a physical certificate until it is deposited into a brokerage account, and so with crypto assets. Once a customer has deposited his asset into a bank or brokerage account or exchange, he no longer owns that asset directly - he instead has a claim on that asset which is backed by the general pool of assets of the institution holding it.

If you enjoyed the above, you can pick up the book by clicking on the link below.

Have a fantastic New Years Eve. The Gryning Times will return to normal service in the new year, where I will look to continue providing value as we navigate the financial markets.