Happy New Year! To get the New Year started, I wanted to invite you to join my premium service(s);

The Gryning Protocol - covering global single stock equity.

Gryning OMX - constituents of the OMX Stockholm index.

I will be rolling out some changes this week, expanding the scope and depth with which I cover the markets, whilst importantly, increasing our trade selection criteria to aggressively maximise the return potential.

The global market narrative has changed, as highlighted in numerous Macro Perspective’s last year - we have a stock pickers market and my models are positioned to take full advantage.

Market Review:

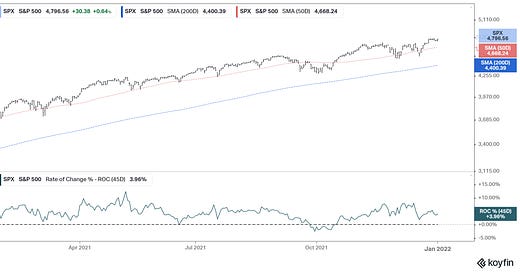

S&P 500 Index 4766.18 added 40.39 points or +0.85% last week after an important breakout above 4700 last Monday since a failure at this level would have increased concern of a triple top that began in early November. For the year it gained 1010.11 points or 26.89%. Now trading in new high territory be aware of the next pullback because that's what it does after making new highs. Some are very small and hardly noticeable, others more significant.

Market Breadth, as reported by McClellan Financial Publications, finally, after a long decline, last week advanced 228.38 points ending at -101.36. For the week ending December 23, it declined 1.53 points after reaching a low of -384.97 on December 21. Then it turned up on December 22 gaining 19 points after SPX advanced 81.21 points on the day before. Failure to turn thereby higher creating a divergence would have been troubling. Improving breadth confirms the market advance and should delight the bulls presuming it continues improving. While not quite a stampede, at least the herd turned in the right direction.

In the last two weeks (Dec 2021) rotation out of stocks with high price-to-earnings (P/E) multiples and those without earnings valued on price-to-sales basis continued. Further weakness in the tech sector will likely be attributed to more rotation out of high P/E growth stocks into consumer staples and dividend payers with shorter duration as the market adjusts to higher interest rates expected this year.

The new SPX highs renewed the medium-term upward sloping trendline shown in the chart above producing a good objective way to measure the severity of the next pullbacks that are sure to continue until shutdown fear due to Covid Omicron diminish. First, watch the 50-day Moving Average and then the trendline. Consider hedges should the trendline fail to support the next decline.

For now, the bulls have it.