US stocks fell on Friday, weighed down by concerns over a slowing labour market and a tech selloff.

The S&P 500 dropped 1.7%, the Dow lost 409 points, and the Nasdaq fell 2.5%.

The August jobs report, which showed 142K new jobs versus the 161K expected, added to market jitters.

In addition, Federal Reserve Governor Christopher Waller’s comments heightened expectations of a larger rate cut in September.

He emphasised rising risks in the labour market and expressed openness to a more substantial rate cut if necessary.

Building on Waller’s comments, we have several members of the Federal Open Market Committee (FOMC) that fear policy is already far too restrictive - that may soon become the consensus view of the committee.

But there is discord in the current market setup;

Bond markets are pricing an aggressive cutting cycle over the next couple of years.

Equity markets, meanwhile, are buoyed by the sugar rush of lower front-end interest rates. Yet they expect rapid growth in corporate earnings, forecasting 9.4% EPS growth over the next 12 months for the median S&P 500 stock.

If the economy is strong enough to produce such profit growth, one wonders whether inflation will be sufficiently benign to permit the 150-200bps of rate cuts now expected by the end of 2025.

And this is without considering the policy platforms of the two candidates in November’s presidential election.

Joe Biden’s administration has been as hostile to China as the one that preceded it (even if the tone has been less inflammatory). Strategic rivalry with China – economic, technological, financial and geostrategic – is one of the few issues that commands bipartisan support, meaning Kamala Harris is unlikely to chart a different course.

If Trump wins, Sino-US economic warfare could significantly intensify. Neither Trump nor the broader Republican movement has laid out exact plans; but substantially higher tariffs on China look likely if Trump returns to the White House.

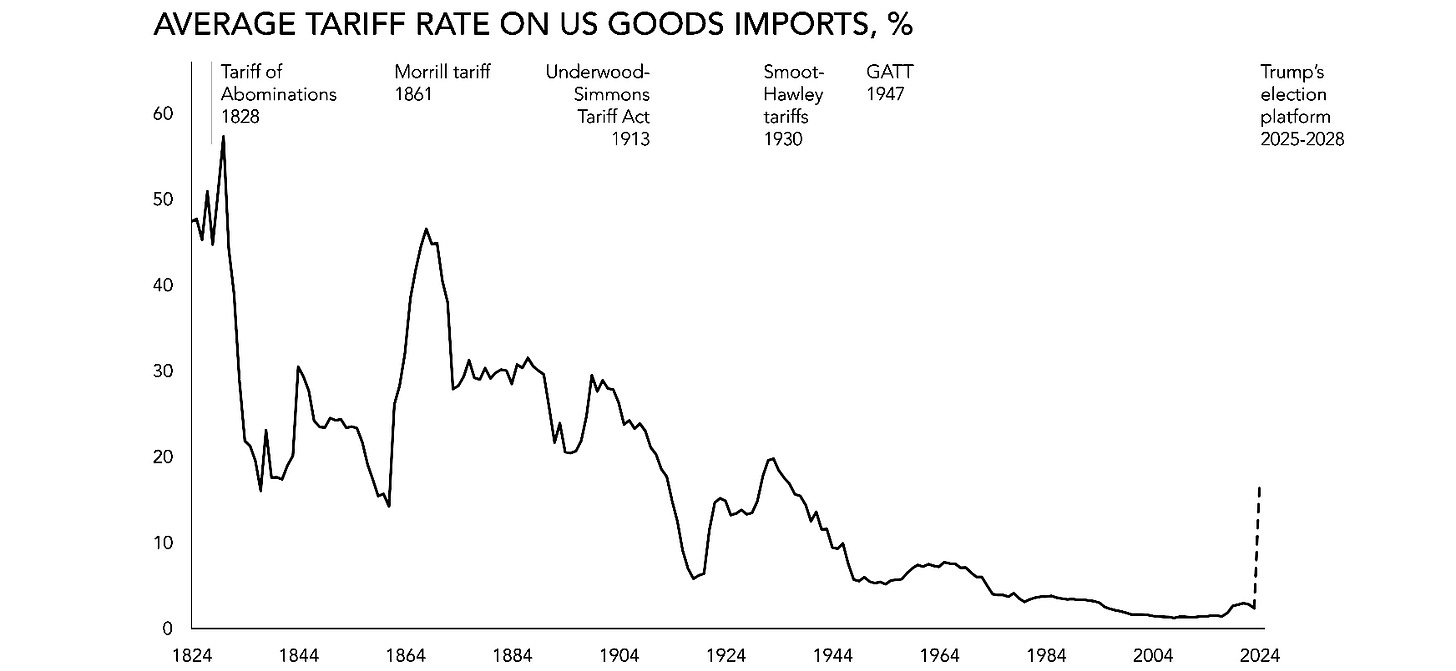

The media are currently touting a 60% tariff on Chinese-made goods and 10% on goods from all other countries. Trump implementing these tariffs would return the average rate to a level last seen in the 1930s.

The inflationary dangers in 2025 and beyond are not limited to Trump’s trade agenda. A surge in immigration since the pandemic has helped tame inflationary pressures.

A second Trump term could involve dramatically lower migrant flows, as well as intensified efforts to deport existing illegal migrants.

In a Harris presidency, the threat of big losses in the midterm elections would exert considerable political pressure on the White House’s immigration policy.

If Trump does return to the Oval Office, the combination of sharply higher tariffs and squeezed immigration could reignite the inflationary dry tinder that remains in the US economy. And if the Democrats win, the toxic political atmosphere post-election may tie the hands of Kamala Harris, forcing her to pursue a different, but nonetheless inflationary, policy agenda.

Either outcome could bring the Fed’s cutting cycle to a premature end, dashing investors’ hopes of easier and more asset-friendly monetary conditions.

I agree, there are many things that seemingly could abort the idea of 200bps of cuts in the next 18 months