Tactically Murky, Strategically Bullish

The S&P 500 rose 0.9%, the Nasdaq added 1.2%, while the Dow Jones set new record gaining 341 points.

September jobs report showed labour market added 254K jobs, surpassing expectations of 150K.

This robust data reinforces Fed Chair Jerome Powell's view that the economy is in "solid condition," suggesting the Federal Reserve is not in a hurry to cut interest rates, which dampens hopes for a significant rate cut in November.

Financial sector was leading the gains, with JP Morgan adding 3.5%, BofA advancing 2.2% and Wells Fargo jumping 3.6%.

Consumer discretionary also outperformed with Tesla (3.9%) and Amazon (2.5%) leading the gains.

The S&P 500 is trading at a P/E of 21.5x. The 30-year average P/E is 16.7x.

The Middle East is experiencing an escalating war.

U.S. East Coast ports are shut down.

We are a week away from the beginning of the third quarter earnings season. Nike (withdrew forward guidance) and Tesla (disappointing Q3 deliveries) reported soft conditions this week, albeit company specific.

We are roughly 30 days away from a contentious national election.

Some of the largest drawdowns in market history have occurred in the month of October.

Tactically, an investor may view the near-term trading environment as murky. Whilst strategically, it appears all is well. US real GDP has averaged 2.8% over the last 8 quarters - well above the expected long-term normal rate of 1.8%.

There are many active “bazookas” of liquidity including government spending, easy credit markets, all-time high money market balances, all-time high net equity in homes and high stock prices. The Federal Reserve is keeping the liquidity pumps running with planned cuts for the next year and a half.

One encouraging signal for the intermediate and long-term health of the economy is the U.S. savings rate was revised higher. The U.S. Bureau of Economic Analysis (BEA) just revised its estimate for the savings rate from 3.3% to 5.2% from 2021 through 2023. The higher savings rate was achieved at a time of higher-than-average consumer spending and business investment.

The recent stock advance could be viewed as a situation destined to disappoint. But stock market strength has come alongside a strengthening growth outlook. The best performing sectors in the S&P 500 recently have been materials, industrials, and consumer discretionary - all sectors that do well in a better economy. The 10-year treasury rate has climbed from about 3.6% to 3.8% with a reduction in the Fed Funds rate of 0.5% (effective rate 9/18 5.33%, effective rate 9/19 4.83%). A rising long-term treasury rate implies a higher economic growth outlook.

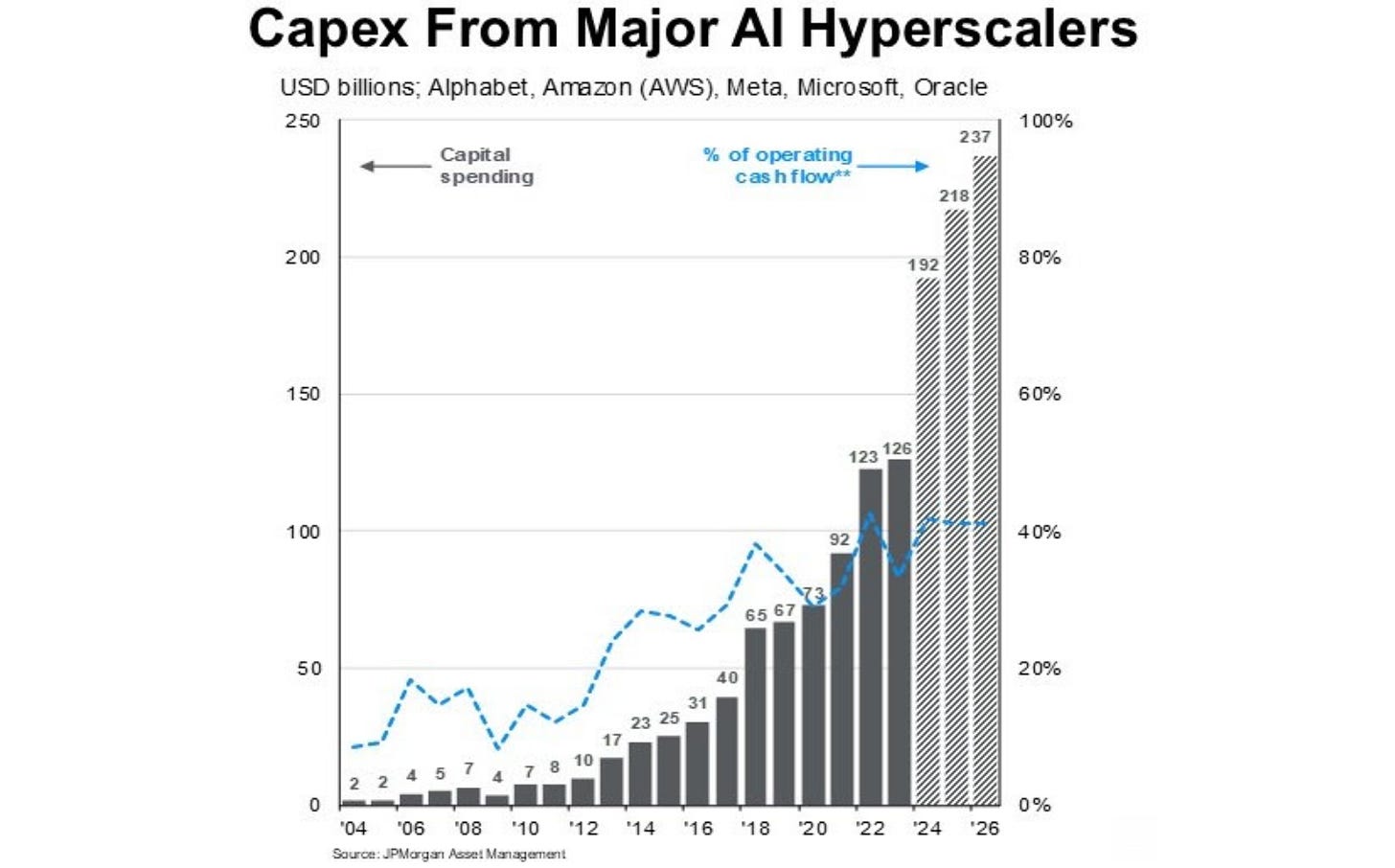

The acceleration in the development of Artificial Intelligence (AI) is a major reason why growth is robust. The chart below shows capital expenditures (Capex) from the major AI hyperscalers (large cloud computing companies that own and operate data centres that are capable of operating AI workloads) including Alphabet (Google), Amazon, Meta, Microsoft and Oracle.

As an example of the size and pace of AI growth, Microsoft just signed a deal to turn back on the Unit 1 reactor of the Three Mile Island power plant and buy all of the power from this reactor (835 megawatts) for the next twenty years to power its data centres. This amount of electrical power could supply the electrical needs for 800,000 homes.

Consensus analyst estimates for 2026 S&P 500 earnings are $311. Some estimates are as high as $325. If the S&P 500 retains its current P/E multiple, we could see the S&P 500 at about 6,500 about a year from now.