The risk environment had a huge bounce yesterday, but let’s not get too excited.

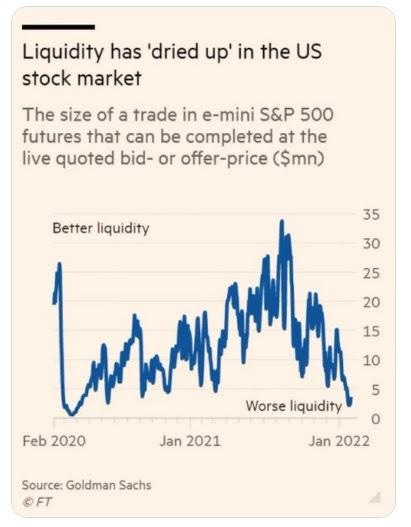

Remember this chart (we looked at last month)...

After two years of a liquidity deluge, we're now seeing the effects of illiquidity on markets. Translation: The swings become exaggerated.

By this time tomorrow, markets will have digested another big CPI number. Continuing along the lines of our discussions, with oil prices gapping higher, people will begin to extrapolate out the next CPI print (for March). It will be bigger (likely, much bigger), not smaller.

On the Russia/Ukraine front: Headlines will continue to create confusion/ whipsaw in markets - Over the last 2 days there was (again) talk that a potential cease fire was coming, and perhaps a concession on Ukrainian territory.

The safe assumption: This won't be a two-week war.

Back in 2014, when Russia annexed Crimea, the timeline was nine months, and the scale of global escalation is far greater this time.

With the above in mind (existing inflation + further commodity supply shocks, driven by geopolitical strife), dips in commodities prices (and commodity stocks) are a buy.

What's not a buy? Bitcoin.

Bitcoin rallied on the day of an executive order from Biden to "ensure the responsible development of digital assets." This follows a statement in kind, by the U.S. Treasury.

This got the crypto-enthusiasts excited, as they assumed this meant the government is taking steps toward accepting and legitimising private cryptocurrency. It's precisely the opposite. As the executive order says, "sovereign money is at the core of a well-functioning financial system, macroeconomic stabilisation policies and economic growth.”

The government wants to regulate away private crypto and strengthen their monopoly on money through a "central bank backed digital currency." Back in June of last year, Elizabeth Warren held a hearing on this - making it clear that a central bank-backed digital dollar would "help drive out bogus digital private money (bitcoin, stablecoins, etc.)." This executive order starts the ball rolling, toward this goal - and a cashless society (not good).