We talked about the SEC approval of the new bitcoin ETF - it started trading yesterday under the ticker BITO.

Whether you believe bitcoin will ultimately survive government regulation or not, the introduction of an ETF that tracks bitcoin futures, creates access for a new audience. For institutional investors, now they can allocate to bitcoin, within their mandate, and it allows individual investors who may have never participated in bitcoin, to buy it in their normal brokerage account.

With that, we talked about the similarities to the 2004 launch of the first gold ETF (GLD). GLD offered a new and easy way for traditional long-only institutional investors, as well as individuals, to allocate to gold. Gold prices took off. Gold was low $400s at the time, and never looked back, with the price of spot gold rising almost five-fold over the following seven years.

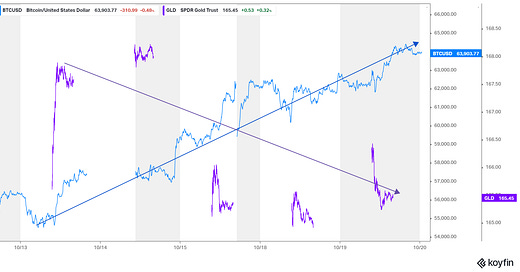

So, this bitcoin ETF should benefit similarly from these new flows. However, there may be more to this GLD comparison with many viewing bitcoin as the new gold - as a store of value and hedge against inflation. With that, in the face of the hottest inflation we've seen in decades, we will see if money moves out of GLD, to fund new investments in BITO.

It's early, but so far we can see some divergence in the charts that suggest that, at least, speculators are taking bets that this "swap" (GLD for BITO) may happen.