Stretched

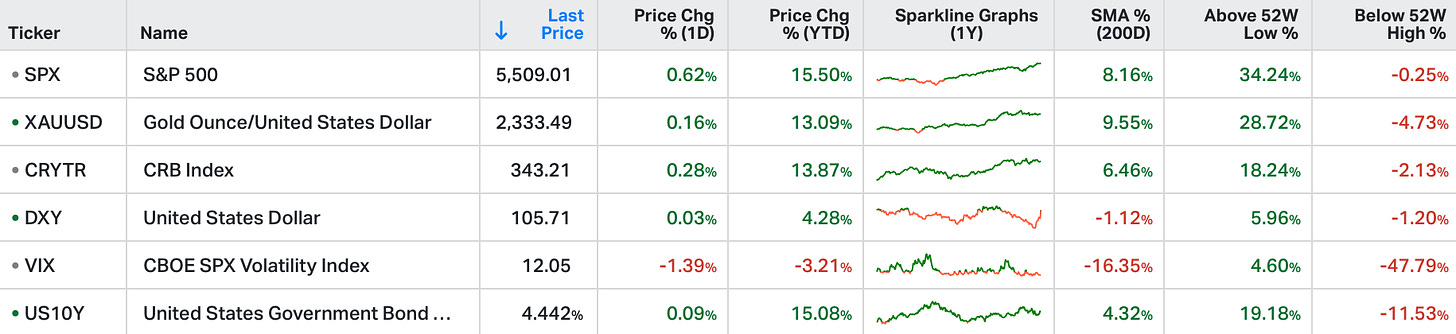

Both S&P 500 and Nasdaq closed at record highs on Tuesday, adding 0.6% and 0.8%, respectively, the blue-chip Dow rose 162 points, supported by megacap gains.

Investors also responded to remarks from Federal Reserve Chair Jerome Powell and the latest job report.

On the economic data front, the JOLTS report showed a slight increase in job openings in May compared to the previous month.

Jobless claims are scheduled for release on Wednesday, and the unemployment report for June is set for Friday.

Sector-wise, consumer discretionary and financials led the gains, while energy and health sectors lagged.

We get the June jobs report Friday morning.

The Fed has told us they are watching the job market "carefully" for "cracks" as a condition to start the easing cycle. Jerome Powell reiterated that yesterday, saying if the job market "unexpectedly weakens," it would cause the Fed to "react." Add to that, the Chicago Fed President, Austan Goolsbee said that the goal is to "get inflation down without stressing the labor market."

Keep in mind the May unemployment rate was last at a 28-month high, and the under-employment rate is at 30-month highs.

With that in mind, we've talked about the playbook executed by the European Central Bank and the Bank of Canada last month, where they positioned the start of the easing cycle as just "removing restriction" - as to not fuel market euphoria about the easing cycle. That's an easy playbook for the Fed to follow, if the job numbers come in soft, reducing restriction just to maintain the level of restriction as inflation falls.

On a related note, the top central banker from the Fed, ECB and the Bank of Brazil sat on a stage in Portugal and fielded questions.

Most notably, the Brazilian central banker warned that the "higher for longer" rate regime in the Western world (mainly the Fed) combined with record high debt will "start to stretch (global) liquidity." He noted that emerging market countries feel the pain first, when liquidity becomes "stretched." He noted that in recent weeks, there are signs of that happening.

Perhaps not coincidentally, the Fed's measure of liquidity (SOFR) hit the most "stretched" level since early January.

And perhaps no coincidence, the Bank of Japan, which was the (very important) global liquidity provider throughout the Western world's interest rate tightening cycle, is due this month to announce its plan to begin the end of its QE program (begin to taper bond purchases/ removing liquidity from global markets).

As I said in my March note, when the BOJ made its first step toward exiting its role as the global liquidity provider, "global central banks (led by the Fed) may now have less leeway to hold rates too high, for too long."

As the head of the Brazilian central bank alluded to, doing so risks global liquidity swinging the direction of too tight (i.e. a liquidity shock).