The Fed meeting is a week away, and the markets are coming unhinged.

It's not just a decline in stocks, but there are warning signals in the currency and interest rate markets - something isn't right.

As we know, the Fed is way behind in the inflation fight - the Fed Funds rate (the short term interbank lending rate, which they set) is 825 basis points below the rate of inflation.

History tells us, to stop this rate of change in prices, the Fed has to ratchet up the Fed Funds rate to exceed the rate of inflation. Not only do they have a long way to go, but they have publicly played the denial game on what it will take to bring inflation under control.

They've set expectations that it will be a shallow rate hiking cycle (ending somewhere under 3%).

That's a bad way to manage inflation expectations. It’s a big deal, for this reason: When people expect more inflation, they tend to behave in ways that promote more inflation (i.e. buying today, what they expect to be more expensive in the future). Add to this, the Fed has told us that they will be shrinking the balance sheet, starting next week - this means they will be withdrawing liquidity from the economy ("quantitative tightening").

As a reminder, we have no record of this working. We don't have an historical reference point of a successful exit of QE. Not for the Fed, not for any other central bank. For the reference points we do have, we find that unforeseen consequences arise, and central banks are forced to respond with...a return to quantitative easing.

With all of this in mind, I posed this question last week: "Will the Fed even get the opportunity, this time, to start the process of "normalising" the Fed balance sheet (i.e. quantitative tightening)?"

The answer is looking more and more like, "no."

The interest rate market is sending warning signals - the 30-year mortgage rate is trading at the widest spread to the 10-year yield, since the March 2020 pandemic-induced economic shutdown. Prior to that, the last time we had seen this wide of a spread was when IndyMac failed in July of 2008 (and the subsequent global financial crisis).

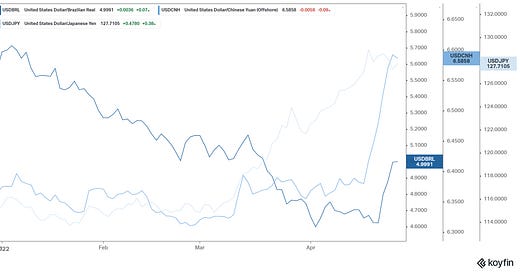

Now the currency market is also sending warning signals. With the prospect of rising rates in the U.S., global capital is moving into the dollar. But there seems to be more to it, the dollar is broadly very strong. In the past week;

China has devalued its currency by 3% against the dollar.

The Japanese yen has lost 12% of its value, relative to the dollar, in the past month.

The Brazilian real has lost 8% in three days.

Something is amiss, and it may be a dollar shortage within the global financial system.

Remember, as we discussed earlier this month, back in 2019, after spending eighteen months shrinking the balance sheet (2017-2019), the Fed quietly started reversing course (back to QE) - due to "strains in the money market." Things started breaking.

Are we, again, seeing cracks (this time, before the Fed even gets started)? As I've said, we have a better chance of seeing more Fed (and global central bank) intervention in markets, rather than less. And it may ultimately come in the form of resetting global debt, and a new monetary system - and maybe soon.

Elon Musk, Tesla & Twitter - Interesting tidbits on the Musk margin loan…

The terms of the margin loan are 20% initial LTV with a 35% margin call level - this means that for a $12.5B loan, Musk must pledge $62.5B worth of $TSLA based on share price at closing, and gets called if TSLA drops ~43%.

BUT - Tesla's own rules on director/officer share pledges is actually stricter and imposes its own max level at 25% LTV. (Below is from the 2021 proxy statement). Under this requirement only a 20% decrease in $TSLA price would trigger a call. A much smaller cushion.

There is talk of those who think he can satisfy his equity check ($21B ECL) by borrowing rather than selling...are...you sure?

It took half of Wall Street to come up with $12.5bn...with 5x collateral cushion. $21bn more means $105B of collateral (and of course finding a lender).

The whole saga is undoubtedly entertaining and bizarre but there are still so many questions that really can't be answered until we see the actual merger agreement - conditionality, drop dead dates, break fees etc.

Personally, I find the dynamics fascinating. It seems like one of the largest and most complex buyouts in history was cobbled together in two weeks including a HUGE term loan, enormous margin loan on the most volatile and high performing stock, etc…

I like to imagine the calls to the lesser banks in the club like:

MS: hey are you in?

Mizuho: on what?

MS: Biggest deal of the decade.

Mizuho: umm yea could you provide some more details?

MS: Biggest deal of the decade. Elon Musk. we are lead

Mizuho: Say no more fam…