Strains

Wall Street closed on a mixed note on Wednesday as investors weighed steady Middle East ceasefire developments and digested Fed Chair Jerome Powell’s second day of congressional testimony.

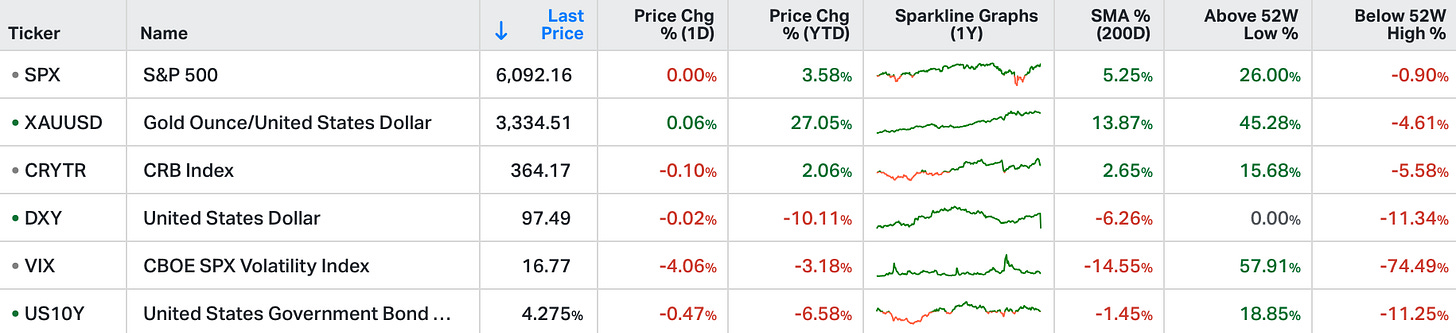

The S&P 500 finished flat, and the Dow slipped 105 points, while the Nasdaq 100 rose 0.2% notching a fresh record close.

Meanwhile, housing data revealed new home sales dropped to their slowest pace since October 2024 amid rising mortgage rates.

Tech stocks led the market, with Nvidia gaining 4.3%, Alphabet up 2.3%, and AMD advancing 3.6%.

On the downside, Tesla dropped 3.8% on weak European sales, and FedEx sank 3.3% after issuing a disappointing profit forecast.

The Fed Chair's visit to Capitol Hill has gotten a lot of attention over the past two days. But a speech on Monday given by Michelle Bowman, the recently confirmed Vice Chair for (Bank) Supervision, was the bigger news.

Bowman's speech was a major signal that bank regulators are open to reforming leverage-based capital constraints, soon.

How soon? She said Wednesday (yesterday), the Board would meet to consider amendments to the bank leverage ratio rule, which would be a "long overdue follow-up to review and reform what have become distorted capital requirements."

What does this all mean?

This is acknowledgement that the regulatory constraints on the banks is distorting markets and weakening liquidity, especially in Treasuries. This is getting to the issues we talked about back in April (my April 15th note, here).

On April 1st, the Fed dramatically dialled down its quantitative tightening programme. They effectively ended it (reducing it from $25 billion a month to just $5 billion). And the reason? As Jerome Powell said in his March post-FOMC press conference, there were "signs of increased tightness in money markets."

This is familiar language; in 2019, it was "strains in the money markets," that forced the Fed to slash rates, and go back to expanding the balance sheet (QE).

With that, back in my April note, we talked about some things Jamie Dimon (JPM CEO) had been warning about regarding liquidity conditions.

He complained that the banks have tonnes of excess cash but can't use it efficiently due to regulatory constraints. It affects their ability to provide liquidity in the Treasury market, while the Fed had been simultaneously extracting liquidity from the Treasury market.

It was a recipe for a bond market/liquidity shock.

So, Bowman is telling us they're going to (finally) fix it.

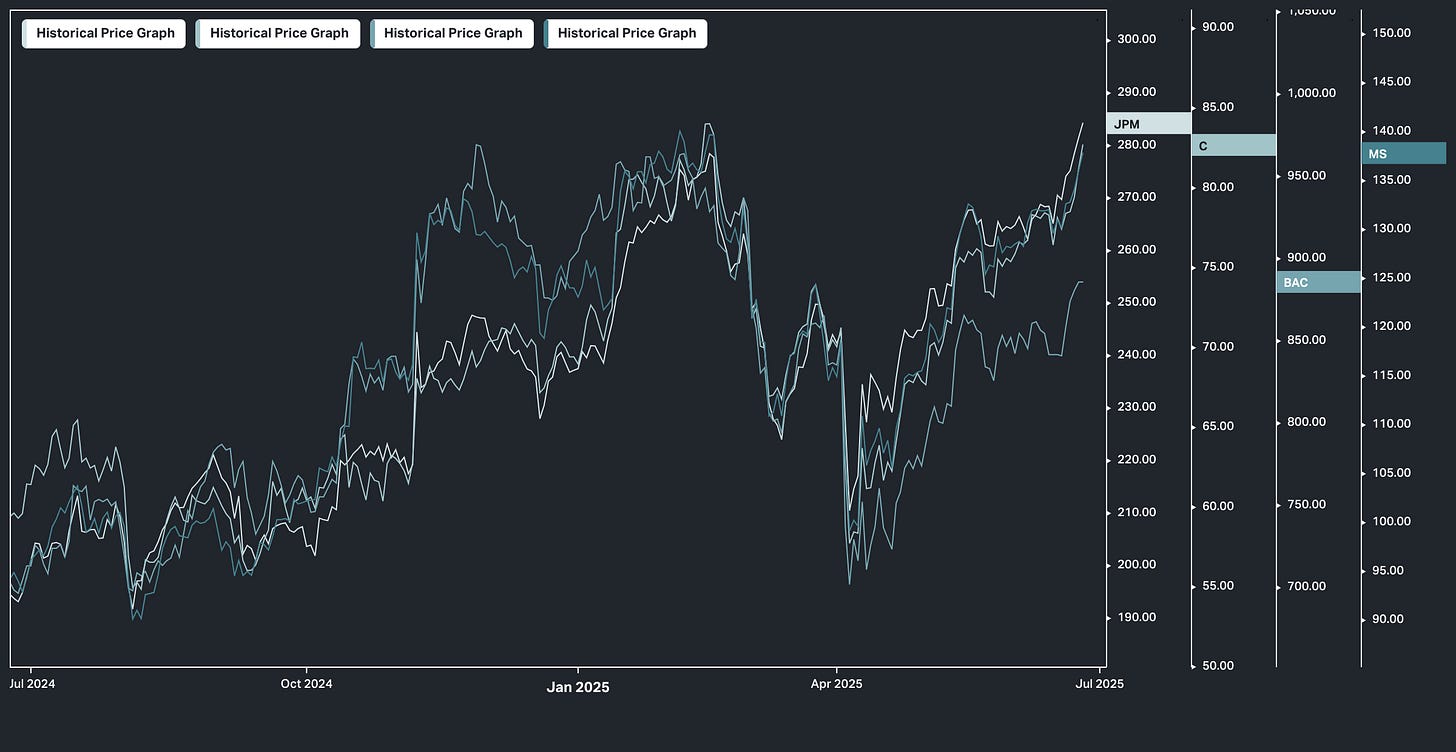

This will free up bank balance sheets. That's huge news for the big banks whose stocks have been responding since Monday - the big four are up 4% on the week, on average.

It's huge news for the Treasury market - a relief valve. The 10-year yield is down 10 basis points since Monday morning.

And it will reduce risks of a liquidity shock. That should be "risk on" for broader markets.

We publish the June Global Trend Report today - Trend Summary page shown below - become a member to access the May, June and July reports!

Become a member to access the report(s) and stay ahead with actionable insights tailored to help you navigate today’s dynamic financial landscape. For daily monitoring and advanced diagnostics for a bespoke 100 ticker portfolio of your choice, click on the button below.