Change is what reprices stocks, and we've had significant change introduced into markets.

First it was the game-changing earnings call from Nvidia, where the Founder/CEO of the world's leading player in AI compared the significance of the ChatGPT launch (in November of last year) to that of the iPhone, where all of the advancements in technology came together.

And now we have what looks like a debt ceiling deal.

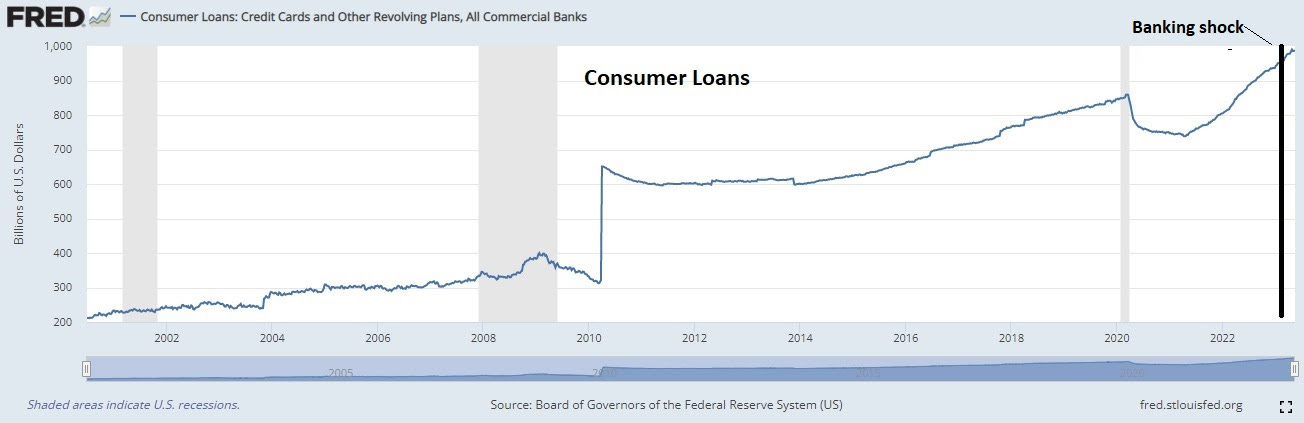

What about the bank shock from March? To what extent has that resulted in credit tightening? Here's the latest from the Fed - there is barely a wiggle in the expansion of credit ...

With all of the above in mind, the market had been pricing in cuts by year end. It was 100% probability, a month ago. Now it's a coin flip. But unless we have a shock event, at this stage, a cut seems to be overpriced/overestimated at a coin flip (i.e. my view, given the above, more likely to be no cuts).

We've talked about the boom in productivity growth that should accompany the transformative generative AI technology - productivity growth drives economic growth.

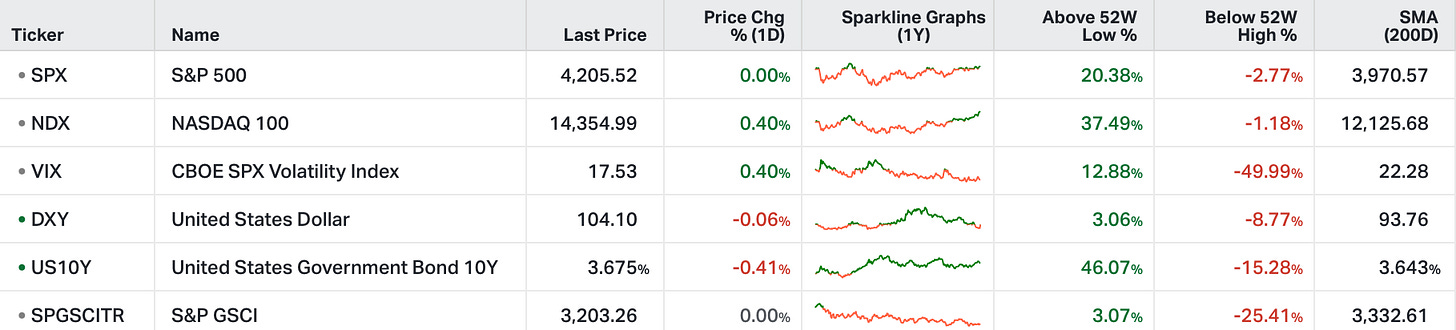

With that, the S&P trades at a forward P/E of 18. The average P/E in the post-GFC era (Global Financial Crisis) is 21.6. In the late 90s, the Fed Funds rate averaged 5.2% (between '95 and '99). That's about where the Fed Funds rate stands now. During that time (late 90s);

P/E averaged 25x.

Economic growth grew at a better than 4% annualized rate for the period.

Stocks averaged 28% a year.

If your looking for a quantitative analysis base on which to build your portfolio, I encourage you to click below:

We rank stock’s according to the scale below, which historically has shown to have a statistical advantage in producing the results below.