Stasis

Macro Perspectives: Mon 28 Sep 2020

The first U.S. Presidential debate is tomorrow, Tue 29 Sep 2020.

It appears at this point that both candidates will be in the same location, and on the same stage. If that is indeed the case, we can probably throw out all of the polling to this point - the debate will be the reset button.

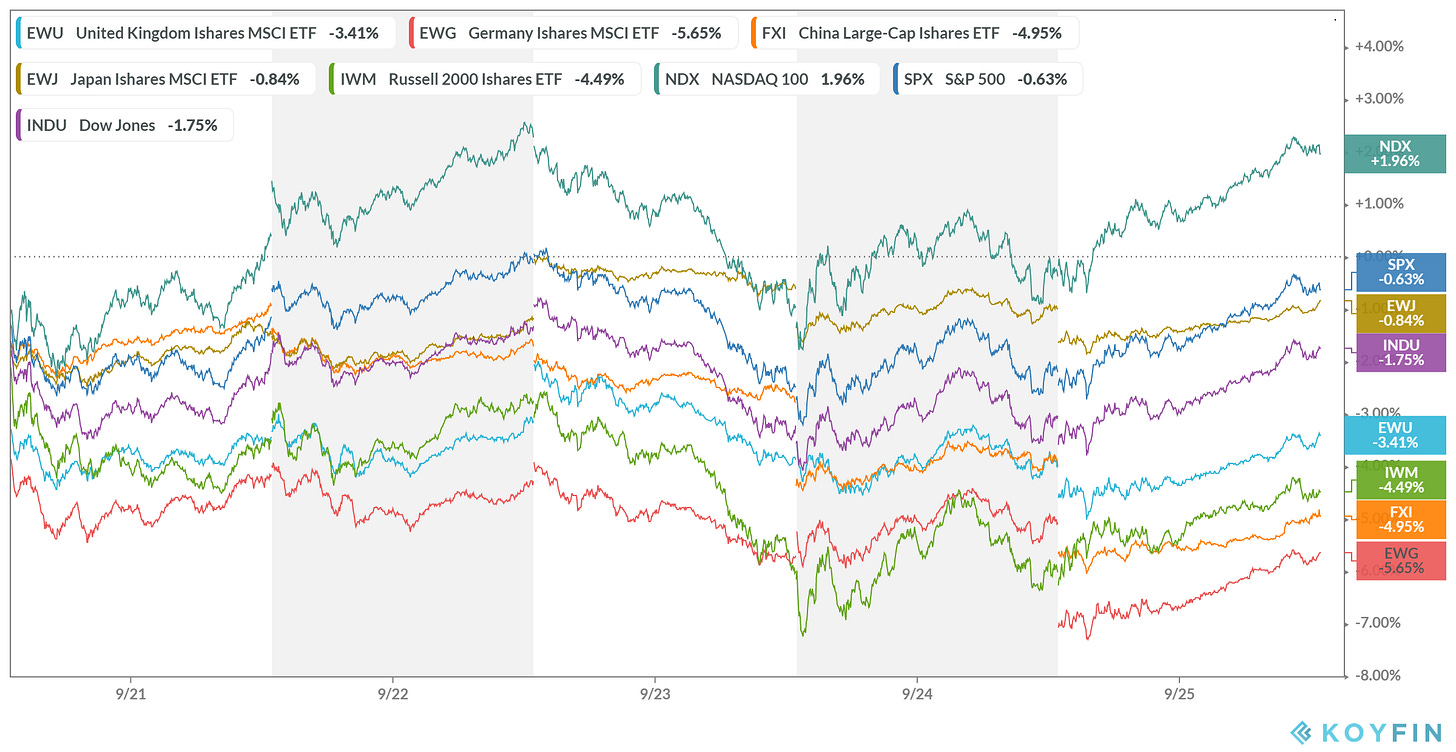

The markets have gone fairly range bound for the past two weeks heading into this event, so Tuesday will set the tone. If the biggest overhang for markets and the economy, right now, is the government policy on the virus, then we have two distinctly different strategies to evaluate.

Trump will clearly push to get the economy operating at full capacity, with the political obstacle of an election removed. That would be good for a continued economic recovery, and good for stocks, putting us on path to see the inflationary impact of a policy response that has been far bigger than the economic damage (i.e. trillions of excess dollars floating around).

Biden, if we listen to the broader party line on the virus, would likely ramp up government guidelines on virus mitigation, which would include more restrictions on business capacity - more economic damage increasing the risk of a deflationary bust. The strategy would be focused around the vaccine timeline and to counter that risk, he would need an aligned Congress to get a monster stimulus package passed. A scenario that requires a lot of pieces to fall into place.

As we near the end of Q2, the last 2 weeks have been range bound, potentially attributed to stasis - uncertainty about uncertainty - producing nervous trading with a series of what may be described as dead cat bounces. W

ith Quarter end rebalancing also underway, a potential support to the market, alongside funds that are underweight and need to buy, the late rally into Friday may set a minor tone for the week ahead.