Let’s continue to talk about the similarities between the current environment and late 2018.

Back in December of 2018, as the stock market was in free fall through the first three weeks of the month, the Treasury Secretary called an emergency meeting with the President's Working Group on Financial Markets (better known as the "Plunge Protection Team").

When called upon, among the purposes and functions of this group, formed following the 1987 stock market crash, is to "enhance orderliness" and "maintain investor confidence."

The meeting marked the bottom for stocks.

On Friday, in a growing crisis of confidence in the banking system, the Treasury Secretary called an emergency meeting of the Financial Stability Oversight Council (FSOC).

Among the purposes and functions of this group, born out of the Global Financial Crisis, is to "mitigate risks to the U.S. financial stability." The meeting ended with a simple statement from the group, that "the U.S. banking system remains sound and resilient."

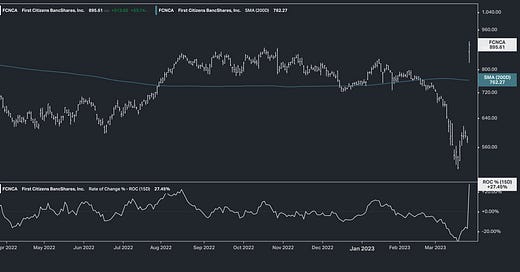

Following Friday's emergency meeting: Surprise! Markets opened yesterday morning to news of a deal - First Citizen's Bank (in coordination with the FDIC, part of the Financial Stability Oversight Council) bought the deposits and loans of the failed Silicon Valley Bank.

This was broadly a confidence boost for markets. The next most vulnerable of the recent fallout/teetering domino has been First Republic Bank. The stock was up 13%.

Remember, both the current and 2018 fallout have come from bad Fed policy (a tone-deaf Fed, mechanically tightening into clear warning signals).

So, did this FSOC meeting mark the bottom in the banks? Maybe the bottom. But to restore confidence, I suspect it will take at least a verbal pivot from the Fed on the direction of interest rates.

GRYNING | AI is Smart Investing Made Easy - get unique insights, boost your portfolios, and make data-driven investment decisions. This is where you gain access to state of the art, institutional grade analysis.