We now have job growth running twice as hot as December 2015 levels, when the Fed started normalising rates coming out of the Global Financial Crisis. The unemployment rate is currently 110 basis points lower than that 2015 reference point.

For perspective, this is all as pandemic restrictions (like threats of firings for vaccination status) continue to be a negative drag.

How hot would the data look without that drag?

Some napkin math: if we extrapolate out the change in wages from December to January, you have wage growth running at an 8%+ annualised rate.

For workers that sounds great, until you back out inflation, and the wage increase becomes insignificant, if not insufficient.

This brings me back to my note from May of last year, when we were discussing an inflation number (YOY Core PCE) that had just been reported as the biggest monthly change on record (dating back to 1960).

I said, "despite easy access to money, and despite rising stock and housing prices, and despite a tightening labor market, this type of economy is not a 'feel good' economy. In an inflationary economy consumers feel like they are sprinting on a treadmill just to maintain the status quo."

U.S. Equity Mrkets:

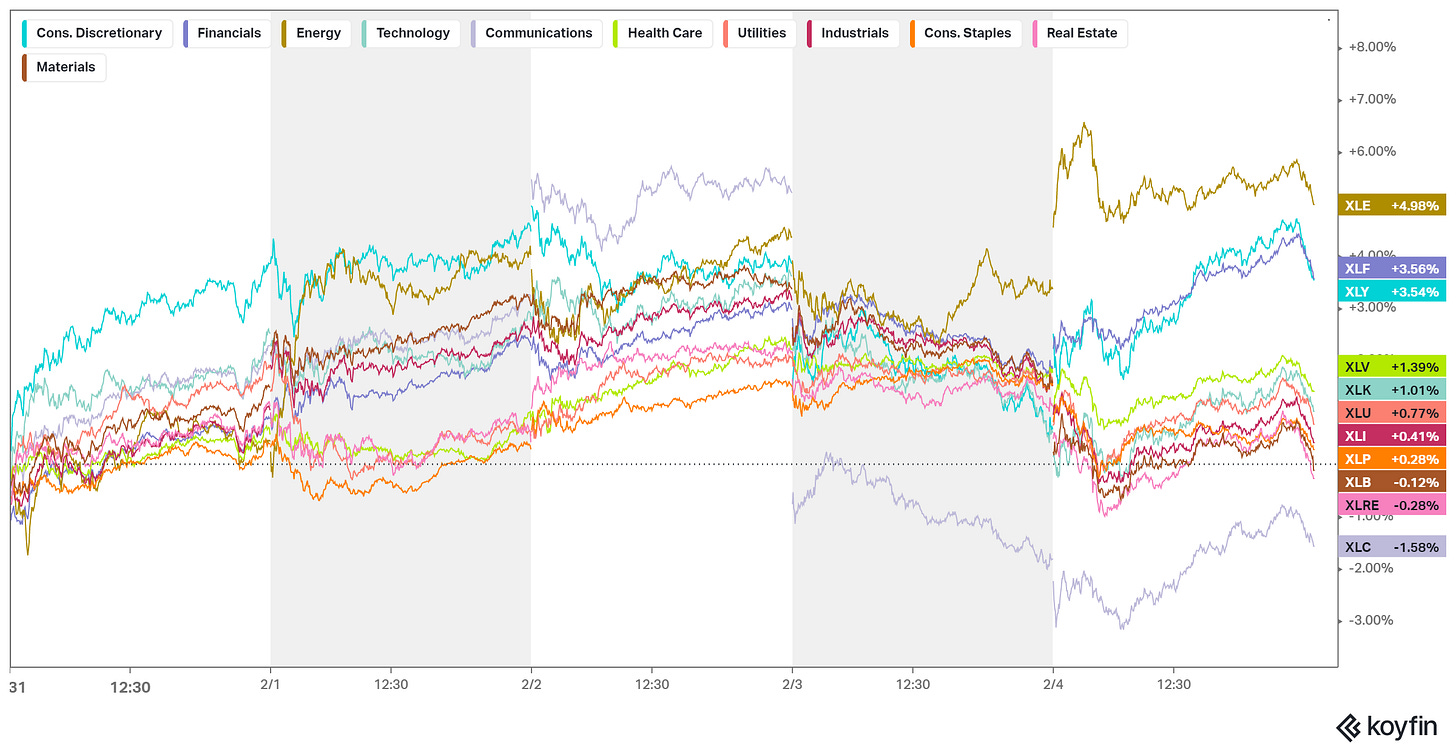

U.S. Sector ETF’s: