The economic growth number in China for the third quarter came in at 4.9%. It may sound like a good number - it's not for China - it's recession territory.

If we exclude the ugly numbers from the depths of the crisis last year, this is the slowest economic growth in China since 1990. Of course, the world continues to emerge from the disruptive pandemic, but the China data is something to keep an eye on.

There are similarities to 2009. Early on in the Global Financial Crisis, China weathered the storm better than the developed world; the economy quickly bounced back to double-digit growth by late 2009, and with $3 trillion of foreign currency reserves in the coffers, and a beaten down global commodities market, they took advantage and started stockpiling valuable natural resources on the cheap.

China's buying in the commodity market was a huge contributor to the recovery in commodity-centric emerging markets - Brazil went from recession to growing at close to 8%.

As you might remember, many were saying that emerging markets had survived the recession better than advanced markets, and they were driving the global economic recovery. Wall Street was claiming/cheerleading a torch passing from the developed world to the emerging world as the future of growth and leadership.

It didn't last long. Soon it became clear that China and emerging markets couldn't do well, without healthy consumers in the advanced economies (namely the U.S. & western Europe).

Fast forward to today, and China's economy is thought to have withstood the pandemic better than the advanced world.This time again, China has taken the opportunity, with cheap commodity prices to stockpile key commodities; with record volumes of crude oil, copper, iron ore and coal in 2020 alongside having imported a record amount of corn, wheat and soybeans. So they've definitely contributed to driving commodity prices higher, in a fragile recovering global economy - which creates a headwind for global economic recovery.

And now, China's economy is sucking wind. With the above in mind, let's take a look at some of the key economic data in China.

First, here's a look at GDP. You can see here, excluding the decline of last year, China hasn't had an economy running this slow since 1990 (the economy was 2% of its current size, back then).

If you don't like the year-over-year comparison with the big bounceback numbers of last year, the growth in the third quarter, compared to last quarter was just 0.2%. That would be an annual run rate of less than 1% growth.

This next chart is Industrial Output in China. Again, excluding last year, it's at the worst levels since 2002.

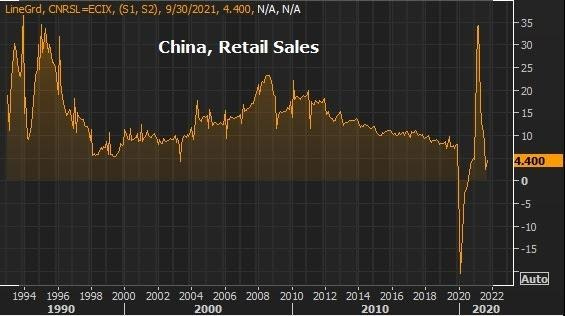

And here's a look at China retail sales growth...it's hovering around the lower levels of the past 30 years (ex-last year).

We should remember, prior to the pandemic, China's economy was in trouble. The trade tariffs had taken a toll, and most of these key economic measures were running at levels worse than the depths of 2009.