The 10-year yield climbed another 11 basis points, nearly touching 4.25%.

That puts it 117 basis points above the Fed Funds Rate (the overnight interbank lending rate set by the Fed). This signals a bond market that believes the threats the Fed has been making all year.

What's the threat? The Fed is threatening to keep hiking rates until they bring inflation back to their target of 2%.

Interestingly, it was just two years ago that the Fed made "significant changes" to its monetary policy framework (here). They adjusted their "target" level for inflation to be, an "inflation that averages 2% over time."

This was the Fed's response to an inflation rate that ran persistently UNDER 2% throughout the post-financial crisis period.

They said, "following periods when inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.”

What happened to this strategy? No one on the Fed is talking about this. They continue to say, definitively, they will bring inflation back to 2%. In fact, there aren't even dissenters among the Fed Board of Governors, about the current path, nor the talking points. That's very unusual, historically, to have a Fed all in agreement, all toeing the line, especially in such a complicated time.

Let's take a look at what this "average" inflation number looks like.

Below is the Fed's favored inflation measure, core pce. You can see it ran about 1.5% on average in the post-GFC period. Post-covid runs about 3%. If we narrow it to the Biden administration, it's running an average of 4%.

If we average the annualized monthly core pce dating back to the failure of Lehman Brothers, we get 1.50%.

With the above in mind, should this inflation be unwelcome by policymakers?

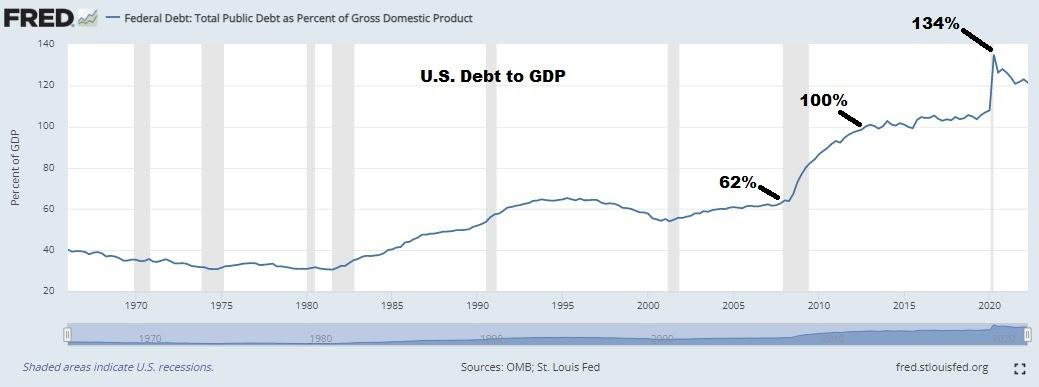

As you can see in the next chart, it's doing the job they want it to do. Deflating the value of a very high debt burden (the far right of the chart, finally declining).

Lastly, the circus that is U.K. politics continues with PM Lizz Truss resigning, marking her 6 week stay as the shortest PM tenure ever in the UK. In the last 5 months, the U.K. has seen;

Four Chancellors of the Exchequer.

Three Home Secretaries.

Two Prime Minister’s - a third is now coming.

Two Monarchs.

With news of her resignation, the markets initially reacted in an opposite manner to what was expected; $GBP up and yields down.