The Fed released its report on a digital dollar yesterday afternoon - Stocks had been in rebound mode for much of the day, but went south when the report hit.

The Fed was due to deliver this report, on the viability of a central bank-backed digital currency (CBDC), back in September. It never happened. And throughout this period, when Jay Powell was being scrutinised for re-nomination, the Fed Chair carefully avoided taking a position on it. His talking point has since been that it will be a decision made by all stakeholders (namely, Congress). The report said the same.

On that note (a decision for Congress - those in power), we have some clear direction. They want it - and they want to kill private digital currency. Back in June, Elizabeth Warren held a hearing on this, making it clear that a central bank-backed digital dollar would "help drive out bogus digital private money (bitcoin, stablecoins, etc.)."

It's not only U.S. officials that may be challenging the rise of private money. Just as the "build back better" and clean energy transformation is an agenda highly coordinated by major global economic powers, so is the concept of CBDCs. The BIS (Bank for International Settlements) consists of 63 global central banks, and nearly 90% of them are having conversations about adopting a CBDC.

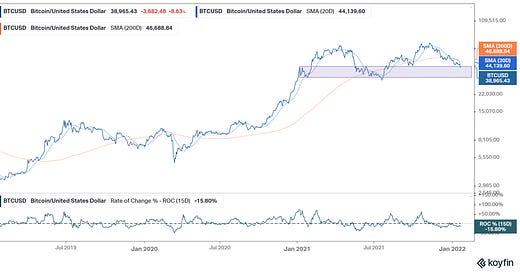

With the release of this new report, Bitcoin swung from a positive day, to close down, and on the lows, and as you can see in the chart above, the future of bitcoin mania may hinge on how it reacts in the highlighted ‘support’ zone.

Why would stocks get hit on this currency report? Maybe it was just an additional catalyst in a market that has already been unwinding overvalued/bubbly tech stocks. Now we may see an unwinding of a bubble in private crypto.

The former, has been orderly, with money moving from growth to value stocks. The latter may create some waves.

Nonetheless, the technical picture in the big stock indices became considerably uglier by the close. As you can see, the S&P 500 is testing the 200-day moving average (the purple line).

The support has already given way in the Nasdaq (chart show’s a support line highlighted in previous notes)

This brings us back to the discussion we had yesterday, on the Fed meeting next week. Through the post-financial crisis era, the Fed's hand was forced, more than once, by instability in stocks. As we discussed yesterday, we should not expect the Fed to react, in this environment.

But, more pain in stocks from here would likely get a fiscal response. We're already seeing some signs that "Build Back Better" will be carved up and done in pieces. I suspect we would see a deal like that, where the clean energy piece (wish list) was approved. My view: That would be the shock absorber for markets, if needed.