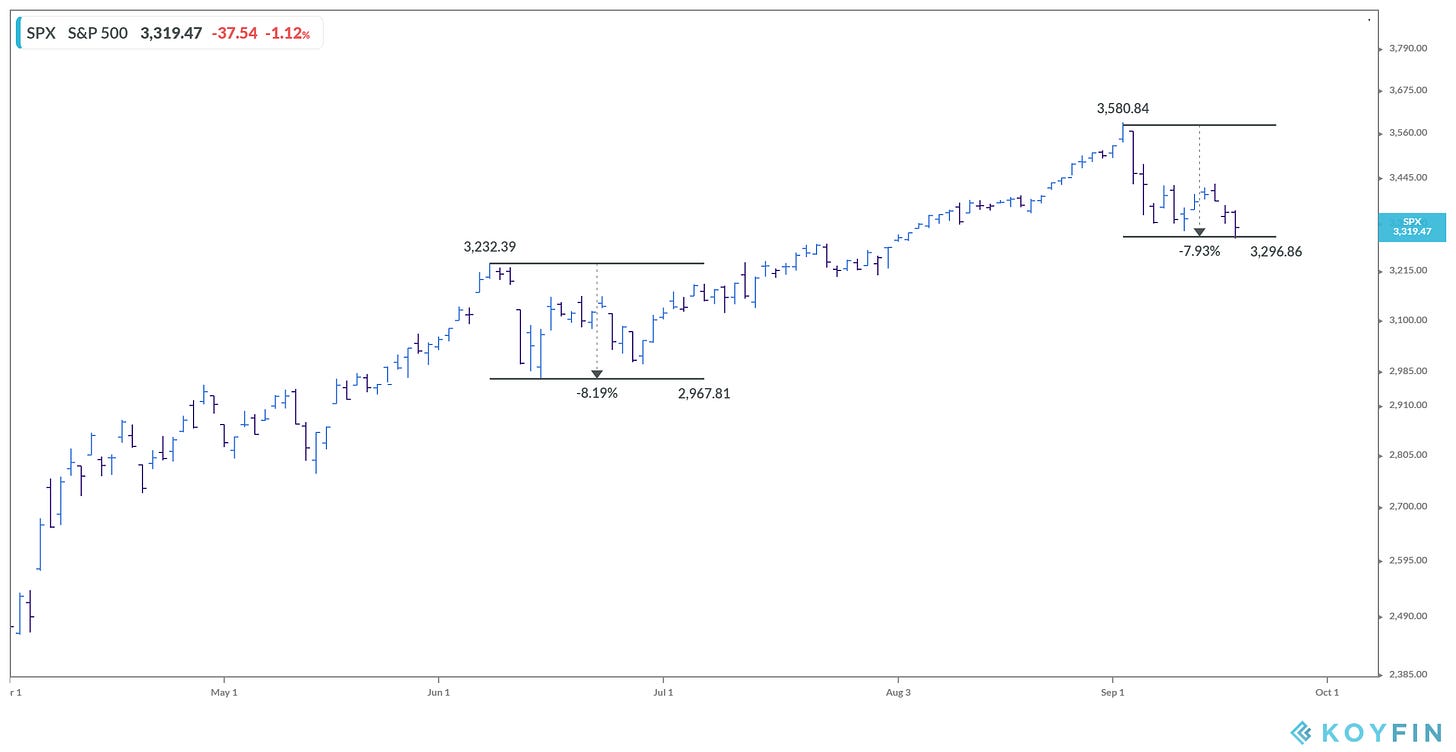

We ended last week with stocks having continued a September correction, making lower lows on the month.

This, just days after a very market-friendly Fed meeting, is looking very similar to June (which also coincided with a very market-friendly Fed meeting). We've had a ~8% correction in stocks in June and we’re nearing an 8% (so far) correction this time.

[NB: my decision making zones for US equities are; SP500 3200 & NASDAQ 10500].

Similar to June, the chatter about rising cases has returned, the noted difference being back then businesses were reopening, and those going back to work were forced to test. That did nothing but reveal the degree to which asymptomatic people were walking around.

The result of "spiking cases" this summer: The rate-of-change in the death-to-cases ratio only declined more quickly as the rate-of-change in testing increased. This time around, testing has ramped up for back to school - again revealing the degree to which asymptomatic people are walking around. The death rate-to-case ratio continues to decline.

We're eight months in since the first U.S. case was recorded, with the death-to-diagnosed case rate is 2.9%. If you believe the CDC that at least 10 times as many people have it or have had it (undiagnosed), that death rate falls to 0.29%. Antibody tests from a July published study in JAMA suggest the multiplier could be as much as 24.

So while the absolute number of cases diagnosed might be reaching new daily highs, the trajectory on the rate-of-change in daily cases is down.

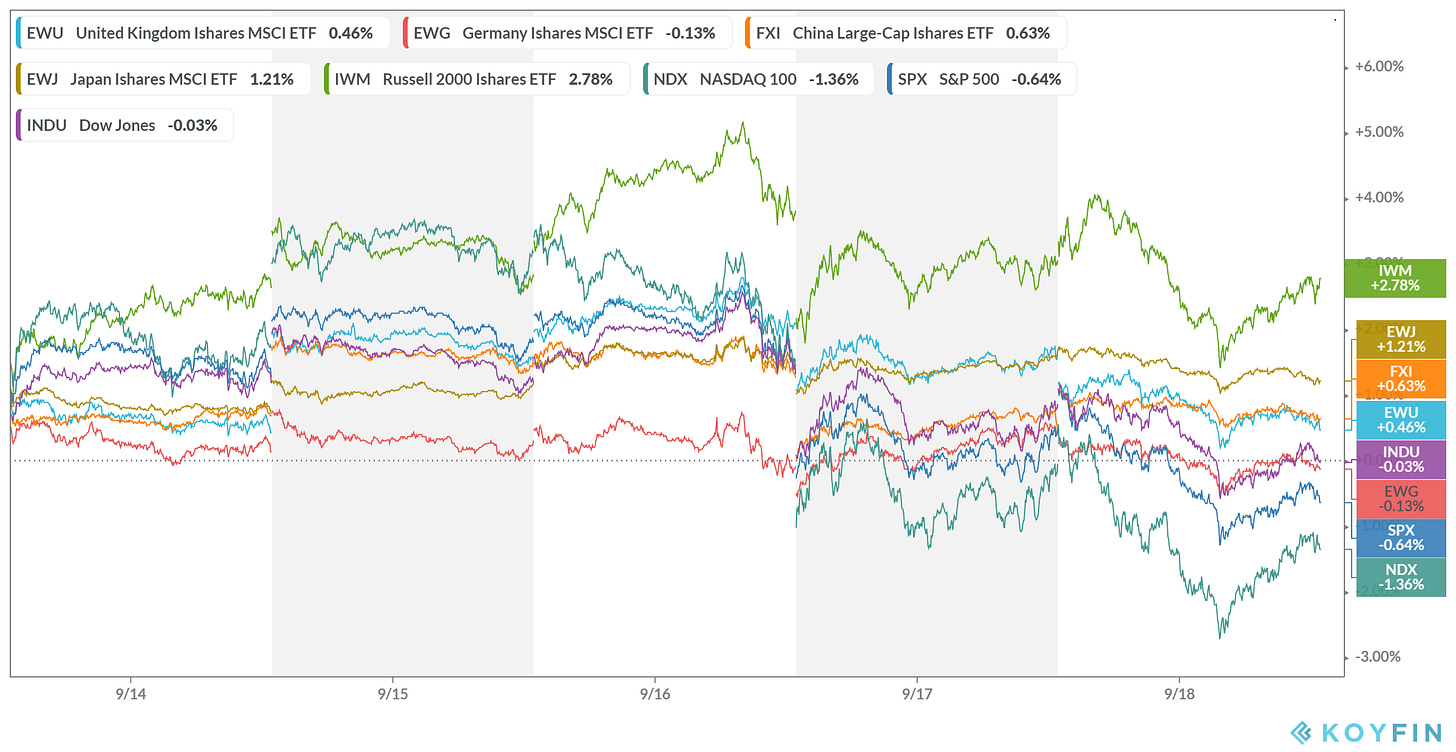

Here’s a snap shot of the global equity indicies last week.