As we open the week, markets are pricing in a high probability that Biden will get to inauguration day.

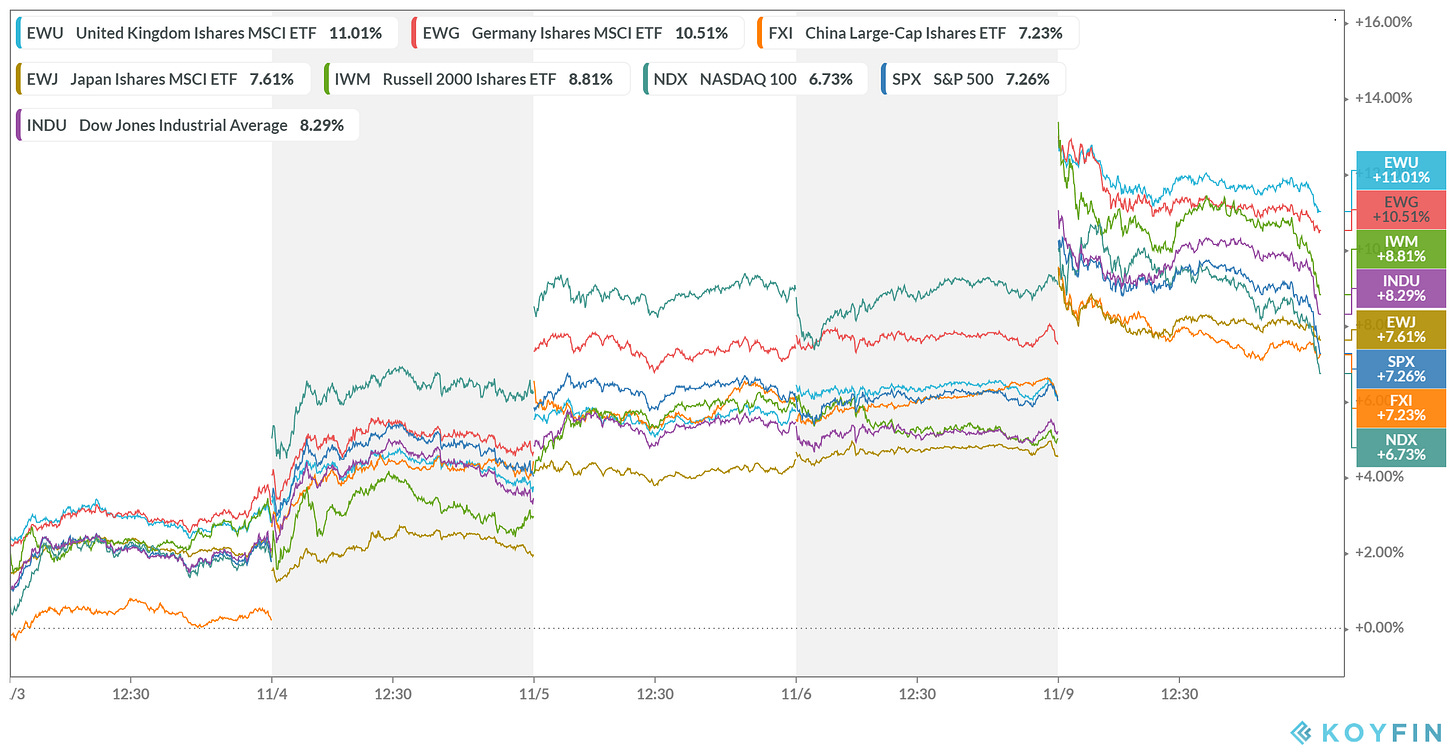

Add that perception of relative certainty (right or wrong), to a very well placed announcement of vaccine success, and you get a glimpse of what asset prices and financial markets will look like, when trillions of dollars of new money around the world (from fiscal and monetary bazookas), meets visibility on a fully open and functioning global economy.

The emergency fiscal and monetary policies around the world were an explicit devaluation of cash against asset prices, we've already seen lift-off in prices over the past seven months. And as we saw yesterday, the bull market in asset prices is still in the early days.

But with the news on a vaccine, we may have seen the catalyst to mark the end of a bull market in a very, very long trend in a very, very important asset class: Bonds, specifically U.S. Treasuries.

Investment in U.S. Treasuries has represented the safest parking place for global capital, in the world. We now have an environment in the United States that certainly doesn't look as safe and stable as it once did - a brew for inflation, with the clear risk that it may turn into very hot inflation.

It's a formula for higher rates and we may see global treasury owners making their way to the exits.