Trump signed a $900 billion stimulus package on December 30th, that has fueled a jump in, already lofty, personal income levels and in the personal savings rate.

Let's take a look at what this has done to a sample of asset prices, over just a two month period...

Now, consider what will happen to asset prices after another package is signed into law (maybe by the end of this week) that is twice as big, and will more than double(relative to the December package) the amount of money that is dropped directly into the hands of consumers.

Prices will run wild.

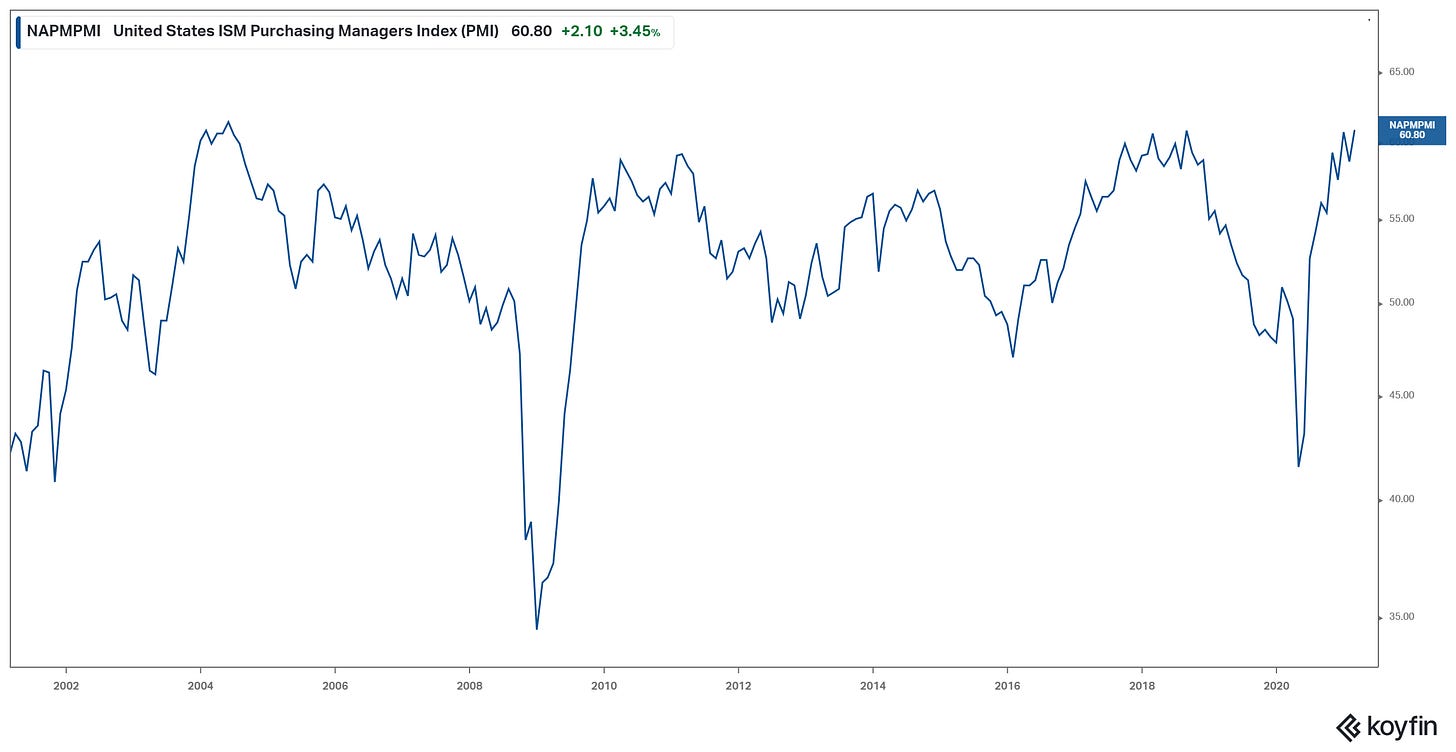

On that note, we had another inflation data point yesterday - The Prices Paid component of the ISM Manufacturing report for February came in hot, again. One of the hottest readings in close to 20 years, it was the ninth consecutive month of price growth, and came from hotter demand AND "scarcity of supply chain goods" - that's a double-whammy.

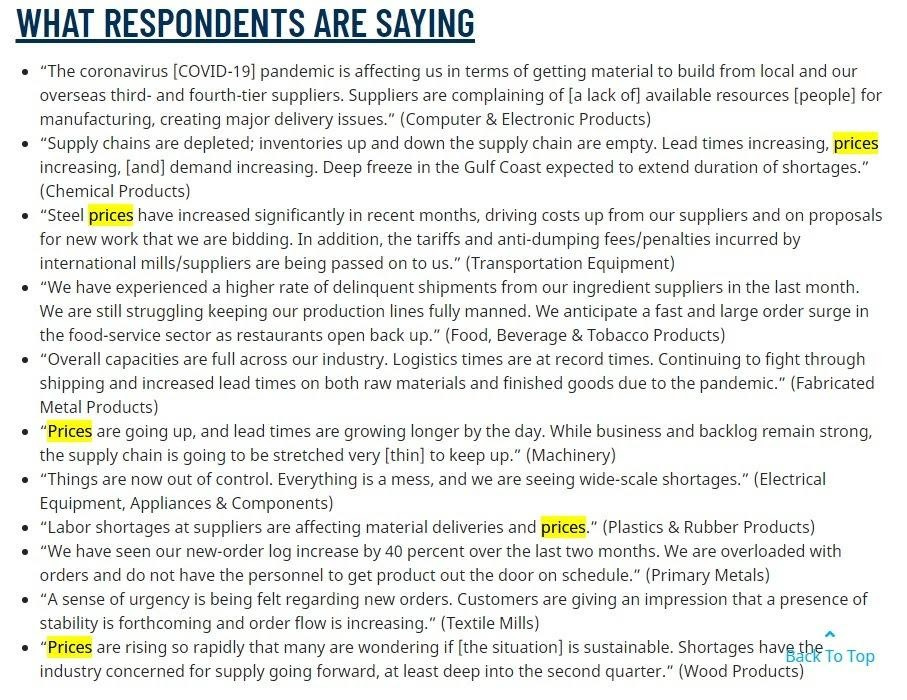

I'm going to copy in the comments from the survey participants in the report. There is a clear theme, inflation: supply shortages, labor shortages to deal with overwhelming demand and rising input prices...

With the above in mind, from a quality of life perspective, the wage growth picture has been as good as we've seen in a long time, but wages are going to have to surge aggressively to keep up with rising prices.