We came into last week with a technical reversal signal working in the (very important) treasury market, specifically, the 2-year yield.

Then on Monday we had a similar signal in the 10-year yield.

Related to this, on Friday we had the report on the Fed's favored inflation gauge, core PCE - it confirmed the continuation of a steady decline, with a fall to 3.7% year-over-year change. The six-month average monthly change in core PCE now has us on path to sub-3% inflation by March of next year.

This, along with Jerome Powell's acknowledgement last week that financial conditions had tightened since their last meeting, should be enough to create some welcome downward pressure on market interest rates.

Now, all of this said we have the monetary-policy direction influence on rates (and markets, in general), and we have the Israel/Gaza war influence (and the risk of becoming global).

On the latter, the first place we should see clues on rising global war risk is the U.S. bond market, the safe-haven for global capital in times of heightened risk. Global capital tends to flow into the relative safety of U.S. Treasuries (bond prices up, yields down). To this point, it hasn't performed as such.

What is performing like a safe-haven? Gold.

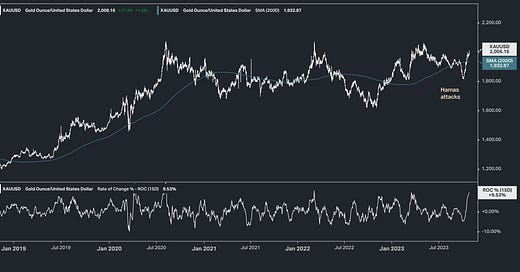

As we discussed in my October 18th note (here), the sharp one-day spike in gold prices, following the Hamas attacks on Israelis, put it in company with some major event-risk days of the past twenty-plus years. This was an early clue that this would continue to escalate and perhaps step toward a global war.

Gold is now up 11% since news of the Hamas attacks - the price of gold is back above $2,000, and another test of the record highs looks likely.

You can get leveraged exposure to rising gold prices through gold mining stocks, or track the price of gold through an ETF like (symbol) GLD.

PS: for those that missed it on Monday & Friday last week, I’ve attached the Gold focussed chartbook.