The Fed has now formalized their strategy to let inflation run hot, to insure that the economic recovery, that they've paid trillions of dollars for, is secure. Again, this is not new information. They've been telling us this even before the pandemic, and they've made it more abundantly clear in recent months. Now it's formal policy, to allow a period of hot inflation, to compensate for the long period of below target inflation.

What does it all mean? It means the Fed's pandemic policy response is, by design, inflating GDP, inflating away debt, and consequently resetting the price of everything higher (consumer stables, consumer products, services, labor, stocks, real estate, commodities…everything). They will do nothing to risk choking it off too early.

So rates will remain at zero for quite some time, and as we've discussed, with zero rates, the multiple on stocks can go much, much higher - for a lack of alternatives for return.

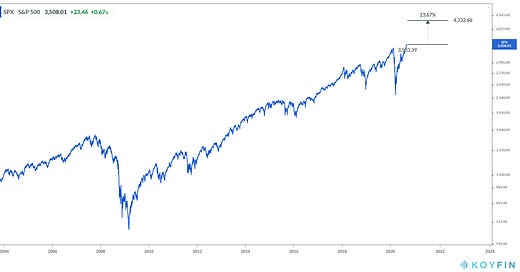

With this in mind, the S&P 500 traded above 3,500 last week…

But ignoring the rate environment, and ignoring the deluge of liquidity that has been dropped on the world in recent months, and those that try to call tops and constantly see bubbles are getting noisy - for reasons like, "too far, too fast" or "too expensive" or they just don't like the level of the index (the eye test, "too high").

For perspective on where this can go, let's revisit my analysis on the long term trajectory of stocks, and what it would take to put us back on path of 8% annualized, from the pre-global financial crisis peak of 2007.

Had the S&P 500 continued its long-run annualized growth rate of 8% from the 2007 (pre-crisis) peak. We would have an S&P 500 near 4,300. That's 23% higher than today's close.

Even though we're up big from 2009 bottom, and we're up big from the March lows of this year, we still have not recovered the lost growth in stocks of the past decade.

The recipe is now in place to close that gap.