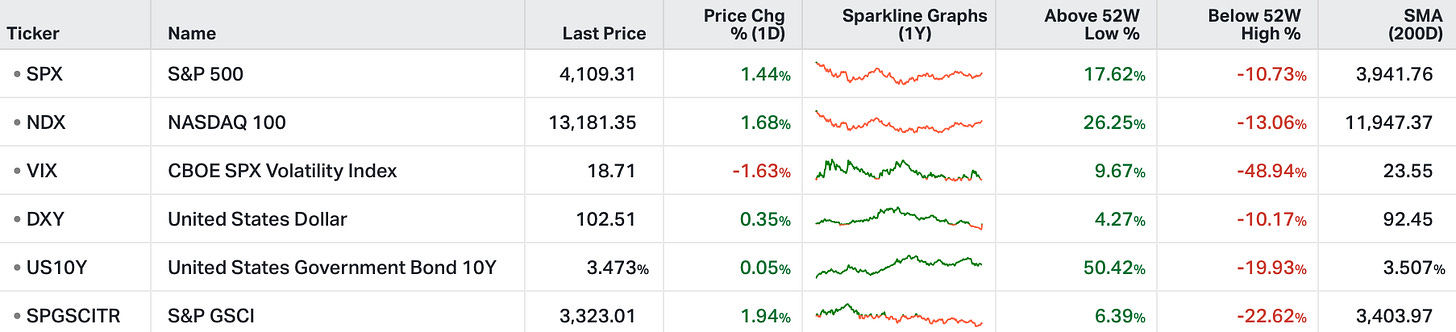

The broad stock market finished the first quarter up 7%.

As we head into Q2, the Fed is back to expanding the balance sheet again (QE), and the 10-year yield is back down to the mid 3% area - this is a recipe for a higher earnings multiple on stocks.

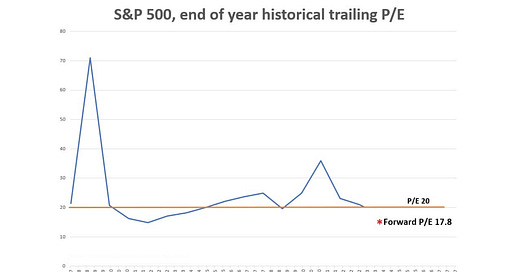

If we look back through the history of QE, and low market rates (a 10-year yield at 3.5% is still low relative to the historical average), the S&P 500 P/E tends to run north of 20.

Here's a look at the history of the past fifteen years, in the multiple-crisis/liberal-policy-intervention era.

Notably, all along the path, the market undershot on the earnings multiple.

And here we are again, with a forward P/E on stocks at 17.8 times. Even with earnings at the dialed down levels, if we apply a P/E of 20x for earnings expected over the next twelve months, we get a price target on the S&P 500 that implies 12% higher (from current levels).

With that, remember, going back to 1950, there has never been a 12-month period, following a midterm election, in which stocks were down - the average one-year return, following the eighteen midterm-elections of the past seventy years, was +15% (about double the long-term average return of the S&P 500).

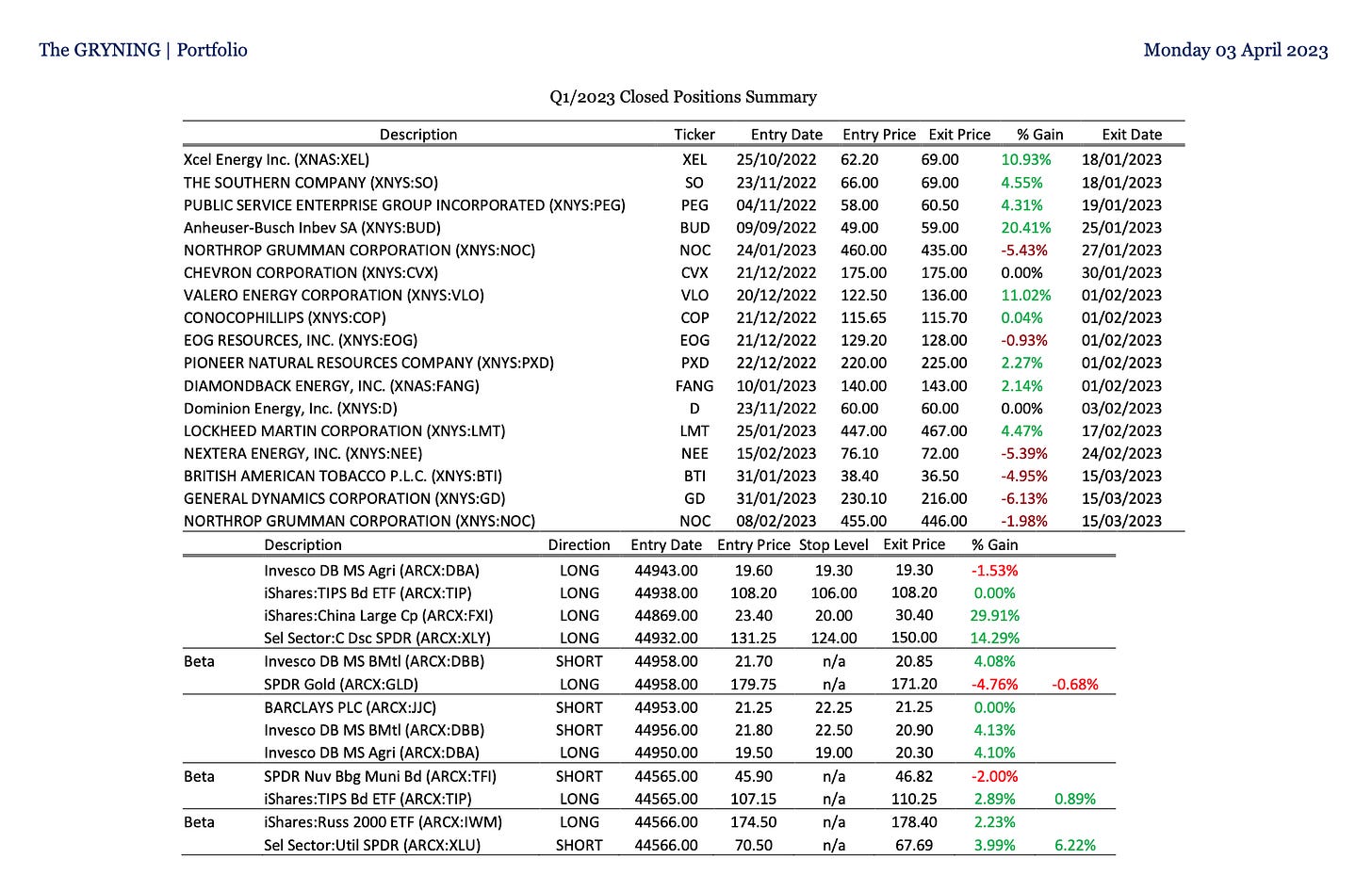

I would like to invite you to become a member of The Gryning | Portfolio - below I show closed position from Q1 from our Convexity & ETF Portfolio’s.