Road Map

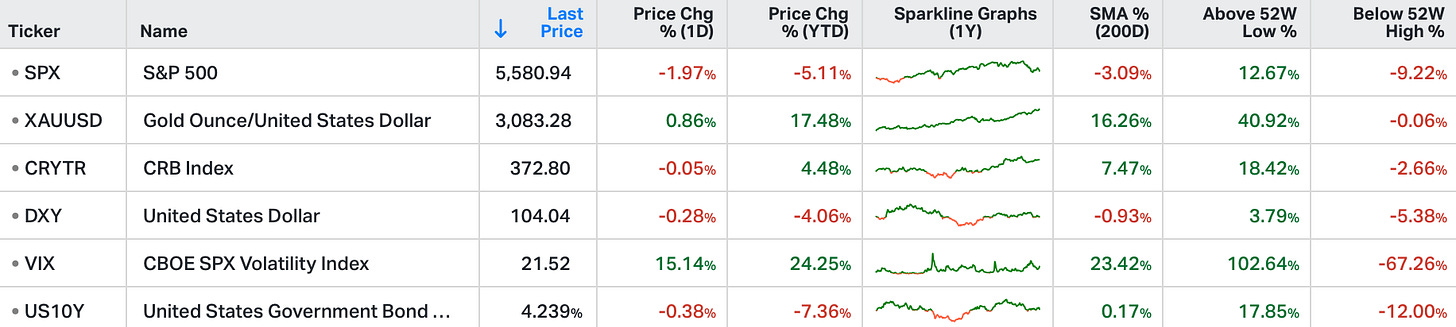

Stocks in the US closed sharply lower on Friday, weighed down by rising inflation concerns and growing trade policy uncertainty.

The S&P 500 slid 2%, the Dow Jones sank 715 points, and the Nasdaq 100 tumbled 2.7%.

Inflation worries intensified after the University of Michigan’s final consumer sentiment reading for March showed the highest long-term inflation expectations since 1993.

Meanwhile, the core PCE price index, the Fed’s preferred inflation measure, rose 2.8% in February, surpassing forecasts, while consumer spending grew 0.4%.

Investors braced for further trade disruptions as Trump’s 25% auto tariff takes effect next week, sparking concerns of retaliatory measures from key trading partners.

President Trump announced that there will be a 25% tariff on all imported passenger vehicles starting April 3 and select auto parts starting May 3. These tariffs, he said, will be permanent.

The top ten cars with the most U.S. content include no offerings from Ford or General Motors. The most American cars as a percent of content are made by Tesla, Honda, Toyota/Lexus and Volkswagen.

About 50% of parts content in US-made cars is foreign (per the White House fact sheet), suggesting that a 25% tariff could raise the cost of locally made vehicles by roughly $3K-$8K prior to any offsets.

The fundamental issue with car manufacturing is cars have become a globally produced commodity. Nearly half of the cars bought in the United States are foreign-made. Additionally, the technology shift from internal combustion engines to all-electric may further commoditise automobile manufacturing, reducing profit margins further – BYD in China is selling technology-leading electric cars for $10,000. Cost pressures in the car business are intense.

The tariff news is not new news. Tariffs have been in the headlines for months. Like all news, the market impact diminishes with time. In the wake of the tariff announcement(s) last week, the reaction by the S&P 500 was muted.

Economic Momentum

Helping support stock valuations are indications the U.S. economy continues to have forward momentum.

The third estimate of Q4 2024 GDP was revised up to 2.4% from 2.3%.

Initial jobless claims (a leading indicator) decreased slightly, indicating a solid labour market.

The high-yield spread (a measure of economic risk by the bond market – the differential between treasury rates and non-investment grade interest rates) has subsided from its recent peak and is near multi-year lows at 3.2%.

The Atlanta Fed adjusted its GDPNow model for imports and exports of gold, which were extraordinarily lopsided earlier this year. The “evolved” model now forecasts Q1 2025 GDP as slightly positive, up from a non-evolved forecast of negative 1.8%.

The Mag 7 and Market Trends

The largest driver of S&P 500 appreciation over the past several years has been the appreciation of the Magnificent 7 (Mag 7) stocks. Conversely, the Mag 7 led the market lower over the past six weeks.

The Mag 7 is down roughly 12% versus the S&P 500 down by about 3% year-to-date.

On a relative earnings and valuation basis, the Mag 7 has not looked so attractive going all the way back to 2018. Below is a chart showing an emerging relative earnings/valuation gap.

Next Friday, the non-farm payrolls report will be released. The following week, we will see the March Consumer Price Index (inflation) report. Earnings season begins in earnest during the week of April 14. Over the next three weeks, investors should gain increased clarity regarding the Big 3: employment, inflation and earnings.

*This note was written prior to market open on Friday; it does not take into account the price action to end the week.

Position Your Portfolio for Success

Gryning has a range of information packages to guide you through the investment process using institutional expertise. Whether you’re just starting out or refining a sophisticated portfolio, we bring decades of hands-on experience to help you navigate the markets and build lasting wealth.

Trader (The GRYNING Times Membership) - event-driven technical analysis for NYSE & NASDAQ exchange stocks, alongside option spread strategies focused on liquid ETFs.

Quantitative - This is for traders and portfolio managers who want to hit the ground running with access to robust, institutional-grade daily, weekly, and monthly signals and/or rules for 10 quantitative trading strategies. (Sample)

Value Model - The PRV framework & HEAT Maps are an internal model that translate underlying Fundamentals into metrics (Profitability, Risk, Value) that can be ranked and then compared relative to the broader market or intra-industry. (Sample)

Research - stock analytics, specialised portfolios and trade ideas – driven by explainable artificial intelligence – that empower you to take more intelligent risks and understand where to spot opportunities. (Sample)