Last week, realised and implied volatility fell from 48% to 23% for the S&P 500 index, 21-day annualised and from 22.7% to 21.9% for the VIX index.

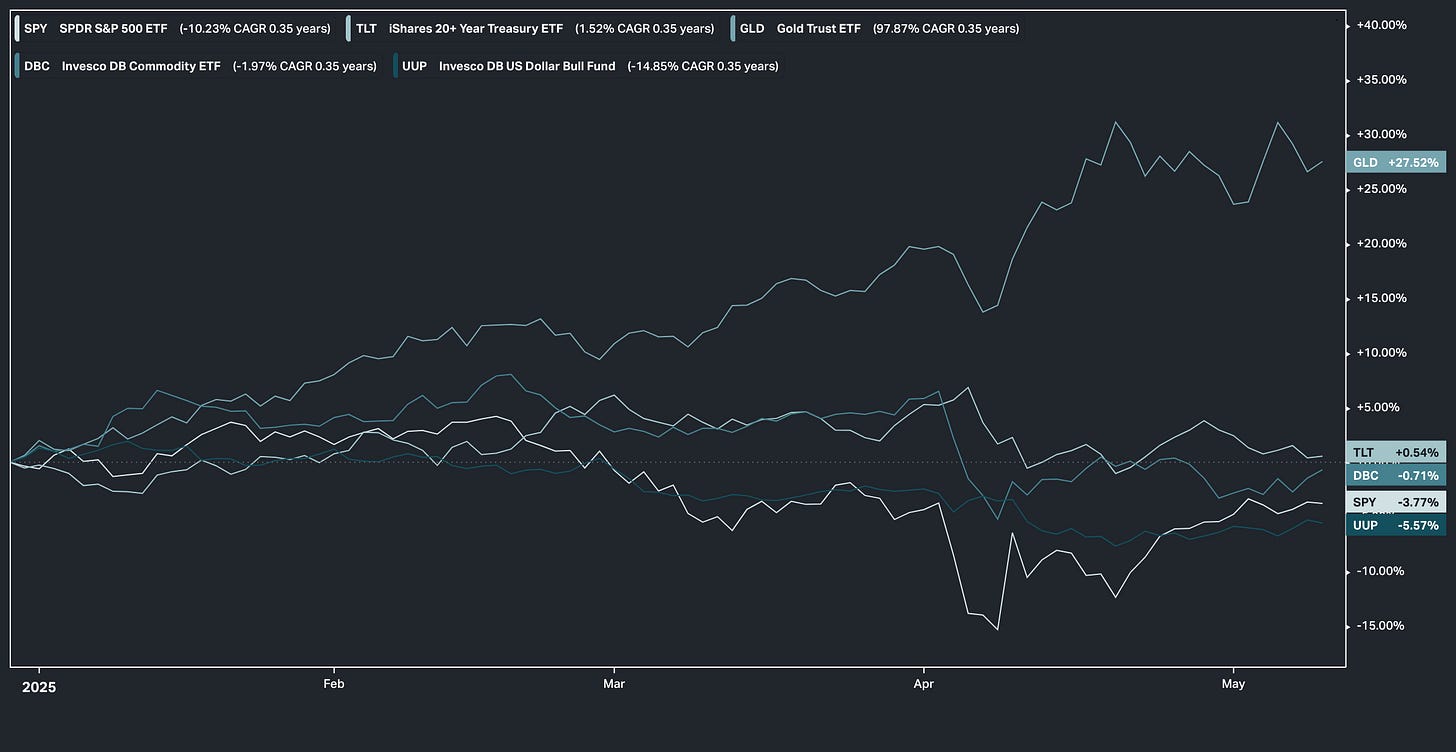

Stocks retreated slightly after challenging the 200-day moving average.

Large-cap stocks (SPY) ended the week with a 0.4% loss.

Gold (GLD) gained 3% after rallying nearly 6% to new, all-time highs earlier in the week.

Commodities (DBC) were up 1.7% due to gains in energy and metals.

Long-duration bonds (TLT) fell 0.8% after a hawkish Fed.

Bitcoin (IBIT) surged 6.3% in overbought territory on rumours of increasing institutional inflows.

The US dollar index (UUP) gained 0.5% on signs of tariff agreements.

The equally weighted Magnificent Seven stock index fell 0.4 % this week. Tesla (TSLA) gained 3.9%, while Alphabet (GOOG) plunged 6.9% after reports of falling search engine and browser market share.

This week’s market sector performance was mixed, with industrials up the most and healthcare down the most.

The stock market (S&P 500 index) has recovered from a 19% drawdown from all-time highs to 7.9%, but breadth remains low. Specifically, 246 stocks in the S&P 500 index are more than -20% below their all-time highs, and 263 stocks are down year-to-date. There has been constant rotation and frantic action to recapture the 200-day moving average. In the next two to four weeks, we may find out whether the odds of a bear market have diminished.

Weekly Option Spreads

Strategy Overview

Watchlist: Entry: Monday, May 12. Expiration: Friday, June 6. Only stocks with weekly options were considered for this cycle.

Example: RBLX

Example: ON

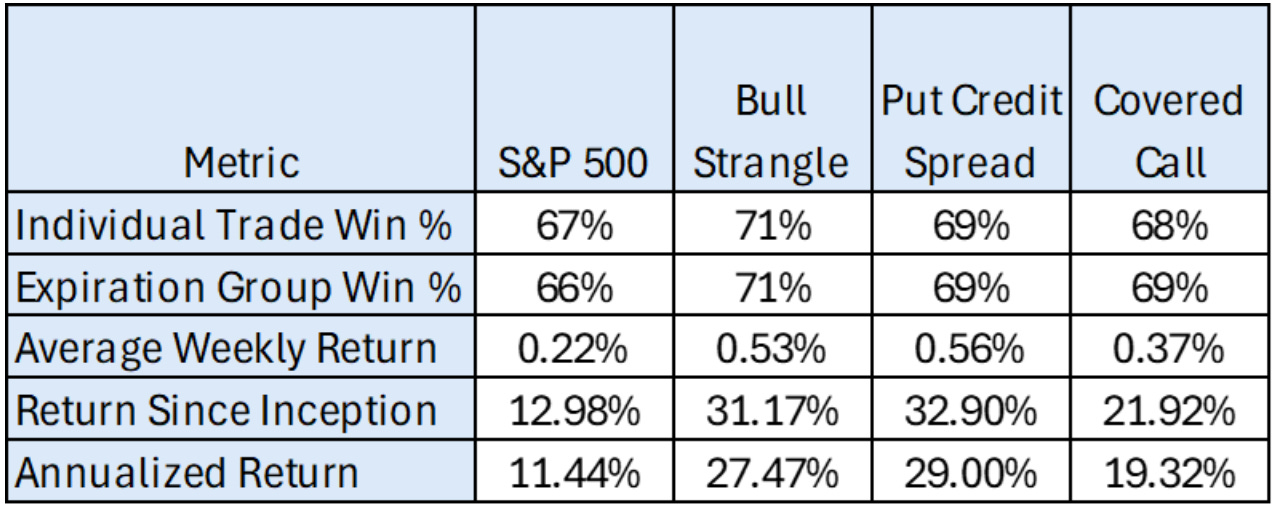

Past Performance: Performance on closed trades through May 9, 2025, since inception in February 2024

Commodity Chartbook | 12 May 2025

Global Trend Report

The Daily Trend Report and associated Trade Idea’s have been sent out to members via email. An example of a recently published trade idea can be found here.

Become a member to gain actionable insights designed to help you stay ahead in today’s fast-paced financial markets. Access this exclusive content by clicking the button below.