The price action in stocks should have the bears very worried.

Regardless of where the futures markets have traded overnight, for the past four sessions, when the cash market opens, stocks have gone straight up (orange arrows).

What does it mean?

The speculator types can dominate futures trading overnight, and at times can set the tone for the way the cash market trades on the day. In this case, when the "real money" comes into the market (i.e. large institutional money managers), there is clearly an appetite to put cash to work.

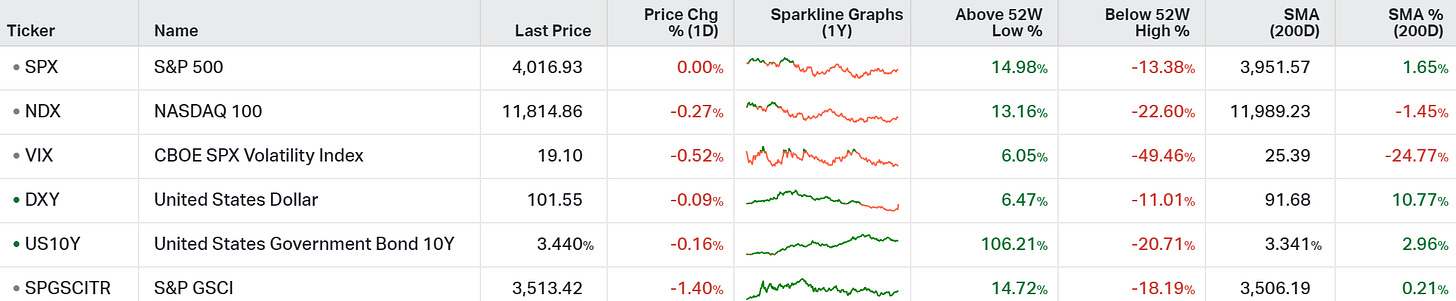

This comes as the world's stock market proxy (S&P 500) has technically broken out (a bullish breakout). And it comes as we head into next weekend's Fed meeting.

Of course, Fed policy has been the primary burden on the stock market for the past year - that burden might be lifted as soon as next Wednesday, with any indication that they are ready to pause the rate cycle.

On the latter, the Bank of Canada may have kicked off this new "pause" phase on global monetary policy yesterday morning.

Here's what they said:

"If economic developments evolve broadly in line with the forecast we published today, we expect to hold the policy rate at its current level while we assess the impact of the cumulative 425 basis point increase in our policy rate. We have raised rates rapidly, and now it's time to pause and assess whether monetary policy is sufficiently restrictive to bring inflation back to the 2% target."

The Gryning | Portfolio generates research that guides you through market fundamentals; helping you anticipate resulting movements and execute timely trades.

I look at how economies move by analysing the macroeconomic variables that drive asset prices. My goal is to help members exploit trading opportunities inherent in macroeconomic and policy-related developments.

The research empowers you to take more intelligent risks and understand where to spot opportunities.