RISK | Divergence

Inspired by recent comments from & this post is my (first) attempt at formulating an understanding of global monetary policy risk.

I hope you find it of interest and value. Let me know if you would like me to make this a regular, monthly, addition to The Gryning Times - any/all feedback is welcomed.

RISK | Divergence

The era of NIRP and YCC, at least for now, has come to an end in Japan. On March 19, 2024 the Bank of Japan held their Monetary Policy Meeting, stating;

“At the Monetary Policy Meeting held today, the Policy Board of the Bank of Japan assessed the virtuous cycle between wages and prices, and judged it came in sight that the price stability target of 2 percent would be achieved in a sustainable and stable manner toward the end of the projection period of the January 2024 Outlook Report (Outlook for Economic Activity and Prices). The Bank considers that the policy framework of Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control and the negative interest rate policy to date have fulfilled their roles. With the price stability target of 2 percent, it will conduct monetary policy as appropriate, guiding the short-term interest rate as a primary policy tool, in response to developments in economic activity and prices as well as financial conditions from the perspective of sustainable and stable achievement of the target. Given the current outlook for economic activity and prices, the Bank anticipates that accommodative financial conditions will be maintained for the time being.”

Bank of Japan (BOJ) moved their policy rate from -0.10% to a range of 0.005 - 0.10%, ended Yield Curve Control (YCC), ceased the purchases of ETFs and J-REITs, and announced the phasing out of purchases of CP and corporate bonds.

In reality, as historic as it may seem, it was little more than just a token move by the BOJ; Interest rates barely moved, financial conditions stayed unprecedentedly loose, equity markets kept rising, and the Yen continued to weaken.

If Japan wants to tighten its financial conditions, they likely need to reverse the weakening trend of their currency.

So whether or not this baby-step change in monetary policy marks a historic turning point or not will depend on whether the actual course of monetary policy is significantly altered going forward. For some perspective on the point, here is 1yr government yields for Japan and the US, which for context should be considered against measures of price stability;

Japan CPI ex Fresh Food & Energy YoY% = 3.20

US Core PCE YoY% = 2.78

One positive effect of the BOJ’s bold monetary policy experiment over the past 11 years is that many people have belatedly come to realise that monetary easing is not a solution for the problems facing Japan. What they have achieved is loose financial conditions aligned with a weak currency. Comparing it against China, we can go all the way back to the circa 50% CNY devaluation of 1994.

The CNY/JPY cross rate shows the extreme of relative strength between the two currency pairs, at the moment, but the divergence of the two REERs since the CNY devaluation in 1994 and the JPY peak strength in May 1995, gives a good idea of just how far this divergence in relative value has accumulated. The PBOC has held the CNY remarkably steady in the face of an historically large growth of money and credit. To get some perspective, the chart below compares USD, CNY & JPY to the recently surging price of gold.

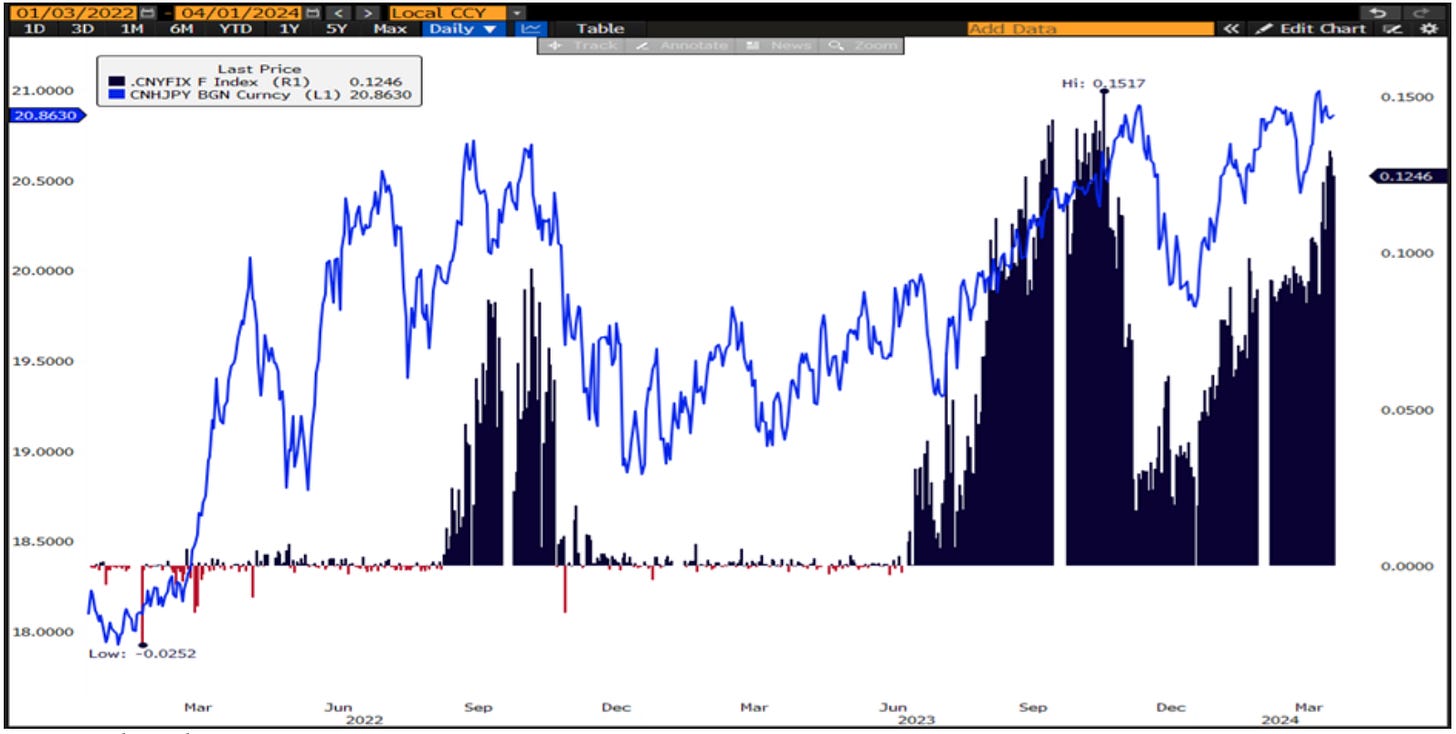

One could look at the above chart and use it as representation of the declining relevance of China’s FX reserves as a moat around the behemoth of domestically created money (alternatively China FX Reserves / M2 Money Supply shows the ratio at a 30 year low). I suspect the above has something to do with the PBOC applying their Counter Cyclical Factor (CCF) for an extended period. The dark bars below show the divergence from model of the PBOC’s daily fixing of USD/CNY (above 0.00 line indicates a stronger than model fix for the CNY) - we have now been through a good nine months of consistently stronger than model fixes.

It is not for me to say what is or isn’t ‘fair value’. However, if you want to get people pondering the question, I suspect circumventing your own methodology day after day, for nine months, will get that job done. Does PBOC need to ignore the mechanism around which they have explicitly defined the allowed adjustments of their currency’s value? Does BOJ need to continue to set policy rates at essentially 0% and continue relentless QE?

What I can say is, the roles of the PBOC and the BOJ seem to be at desynchronised stages relative to the rest of the USD reserve-based fiat-world of today. Not surprisingly, the current path seems unsustainable.

Disclaimer:

This communication is issued by Gryning Times and/or affiliates of Gryning Times; GRYNING CAPITAL, Gryning AI. This is not a personal recommendation, nor an offer to buy or sell nor a solicitation to buy or sell any securities, investment products or other financial instruments or services. This material is distributed for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice.The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

Gryning times. All rights reserved. Intended for recipient only and not for further distribution without the consent of Gryning Times. ("Gryning") email briefings, newsletters, alerts, insights, and similar publications "Publications" do not reflect any opinions of Gryning or its affiliates. Publications are meant for informational purposes only, are not intended to serve as a recommendation to buy or sell any security in a brokerage account or any platform, and are not an offer or sale of a security nor an endorsement or advertisement of the same. While Gryning seeks to ensure the accuracy of the information it presents, it has no obligation and shall not be liable for errors in any data, information, or Publications accessible through Gryning products or services. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Gryning is not a broker-dealer nor an investment adviser, and makes no representations or warranties, express or implied, and disclaims any and all warranties with respect to any information accessible via any Gryning Publications or Gryning data.