Risk Averted?

Stocks in the US were lower in the afternoon session as Wall Street digested renewed US-China trade developments and rising concerns about the labor market.

President Trump confirmed a phone call with President Xi Jinping, which both sides characterized as positive, lifting initial investor sentiment.

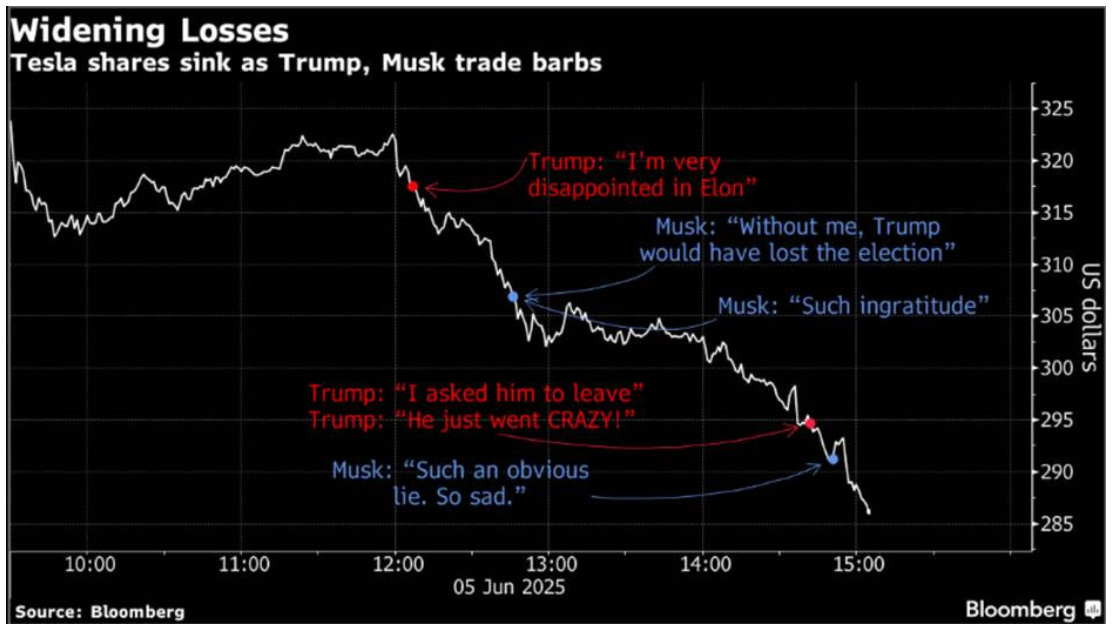

Meanwhile, Tesla shares tumbled 14% after a public spat between Trump and Elon Musk intensified, with Trump voicing disappointment in Musk’s stance on his tax policy bill.

Labor market worries also weighed on sentiment, as weekly jobless claims climbed to 247K—the highest in eight months—and private payroll growth disappointed.

Markets are now focused on Friday’s jobs report for further clues on the economy.

We talked yesterday about the three big developments that have taken place over the past several days.

Among them, the breakdown of the deal behind the U.S./China 90-day tariff reduction and the resulting potential for a return to an effective embargo on trade with China.

Trump and Xi talked.

Trump described the call as "resulting in a very positive conclusion for both countries."

The Chinese report on the call says the Geneva agreement last month was very successful and produced a good deal – and said both the U.S. and China would execute on the deal.

So, with this call, the risk of an imminent return to peak tariffs seems to have been averted. Good news.

Still, the risks have risen in recent days on the Ukraine/Russia war, and on the U.S. budget front (more infighting, which raises the risk of getting the Trump tax cut extension across the finish line).

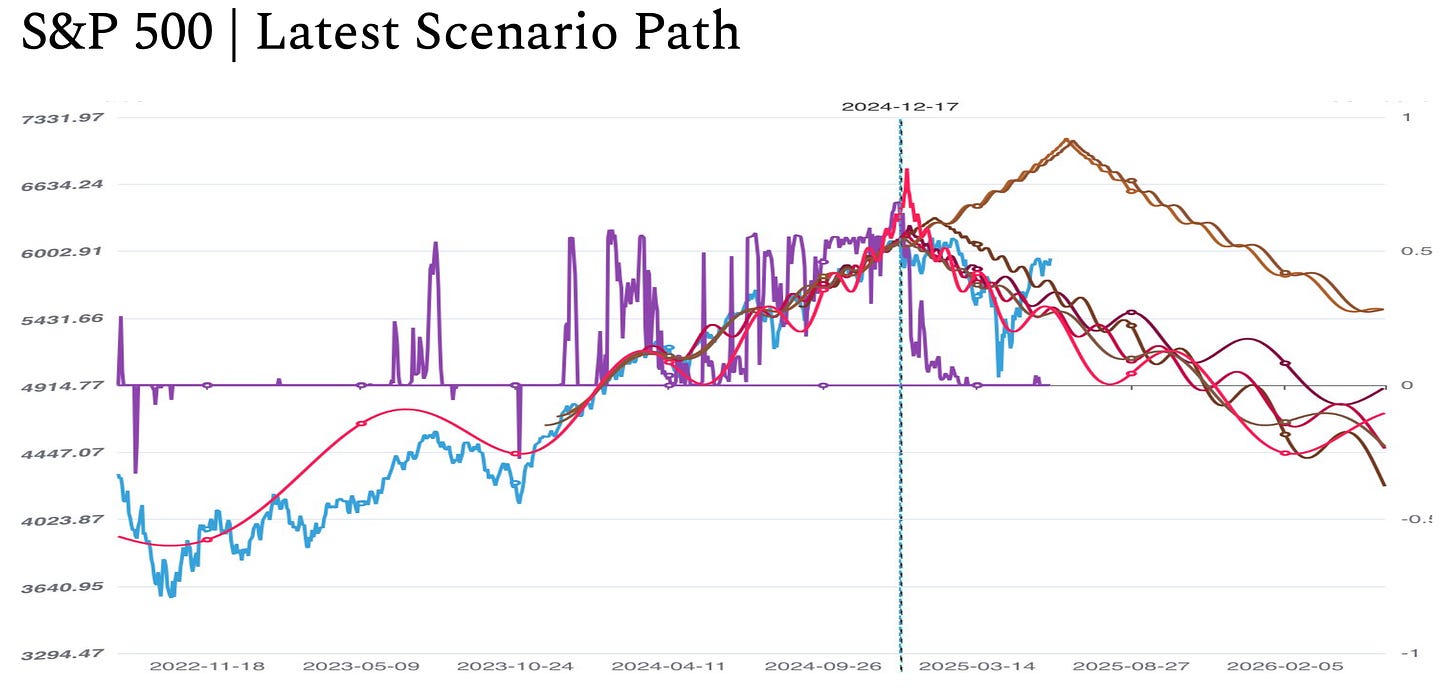

With those bubbling risks, the S&P 500 put in the tightest range of the year – and we get a technical reversal signal (an outside day).

A noteworthy sign that things are changing is the breakup between Trump and Musk, which appears to have been driven by either Trump not delivering on his EV credits or Elon’s disgust with the obscene scale of the fiscal giveaway.

Tesla stock was down around 14% from its closing level the previous night.

Do you feel like the markets are spinning? The macro landscape shifting. And the old playbook doesn’t quite seem to work? Become a member below to access our Global Trend Report and get real-time guidance.