News In 5

Stocks in the US finished mixed on Tuesday, following a tech rally in the previous session, as investors await US consumer inflation due Thursday.

The Dow Jones slid 157 points, the S&P 500 lost 0.1% while the Nasdaq added roughly 0.1%.

Nvidia rose 1.7% after reaching a new record high during the session, and Amazon and Alphabet also saw gains of 1.5% each.

On the other hand, Tesla lost 2.3% and JetBlue sank 10.2% after BofA Securities downgraded the stock to Underperform from Neutral.

Traders continue to adjust their bets for rate cuts while awaiting crucial economic data due later in the week including the CPI and the kick-off of the earnings season

Macro Perspectives

Fourth quarter earnings kick off on Friday, with the big banks.

Will the trend of falling inflation, and the coming change in the direction of monetary policy, manifest in a weak earnings season?

If so, it would not be a negative surprise for markets. Wall Street has already dramatically lowered the expectations bar for us (as they do). We started Q4 with expectations of 8% year-over-year earnings growth. That has now been revised down to just 1.3% growth.

Keep in mind, this comes in an economy that was running at a 2.2% annualised pace (based on the Atlanta Fed's GDP model).

The analyst community continues to undershoot on earnings and undershoot on economic growth. So once again, we head into earnings season with a setup for positive surprises.

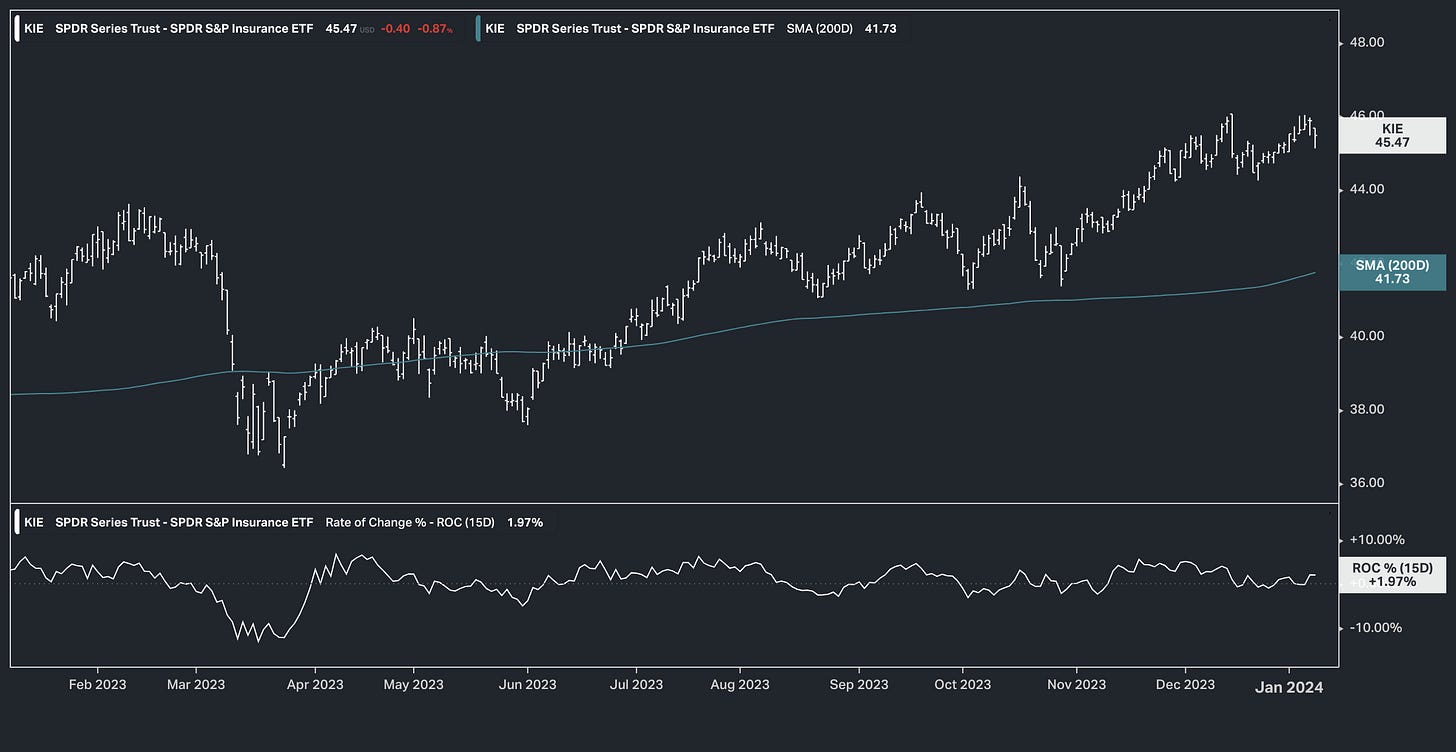

On a related note, we talked last month about the impact of rising insurance premiums on the CPI data (namely shelter, physician services and transportation).

The yearly change in the motor vehicle insurance component of CPI (for November) was up 19.2%. From pre-covid levels, it was up 35%.

Insurance companies are expected to have grown earnings by 26% over the past year.