Resilience

US stocks rallied on Friday, with the S&P 500 adding 1% to cross over the 6,000 mark and hitting its highest level since February, boosted by a stronger-than-expected jobs report and renewed optimism around US-China trade talks.

The Dow gained 442 points and the Nasdaq rose 1.2%, led by a sharp rebound in Tesla, which jumped 3.7% after tensions between Elon Musk and President Trump appeared to cool.

Meanwhile, Trump offered a glimmer of optimism on the trade front, announcing that US-China negotiations are set to resume next week in London.

Still, President Donald Trump called on Fed Chairman Powell to cut interest rates by a full percentage point, calling it "rocket fuel" for the economy.

Major tech stocks, including Nvidia (1.2%), Meta (1.9%), and Apple (2.1%) posted gains.

The S&P 500 edged higher last week, sitting just 2.4% below its all-time high. Despite weaker economic data, the stock market has shown remarkable resilience.

The May ISM Manufacturing Index, reported on Monday, dipped to 48.5% from 48.7% in April, indicating a slightly faster contraction in manufacturing.

The ISM Services PMI, reported on Wednesday, fell to 49.9% in May from 51.6% in April, below the expected 52%. This marks only the fourth time in the last 60 months that the Services PMI has dropped below 50.0%, signalling contraction.

A full labor market breakdown can be found in our 90 pg weekly Commodity Chartbook.

Together, manufacturing and services account for approximately 90% of the U.S. economy's activity. Contraction in both sectors would typically pressure the stock market lower.

Surprisingly, one factor supporting market resilience is consumer sentiment, which has been near its lowest level since 1971. Historically, such lows (1975, 1980, 2008, 2011, and 2022) have preceded strong 12-month market gains of 22.2%, 20.0%, 22.2%, 15.4%, and 17.6%, respectively.

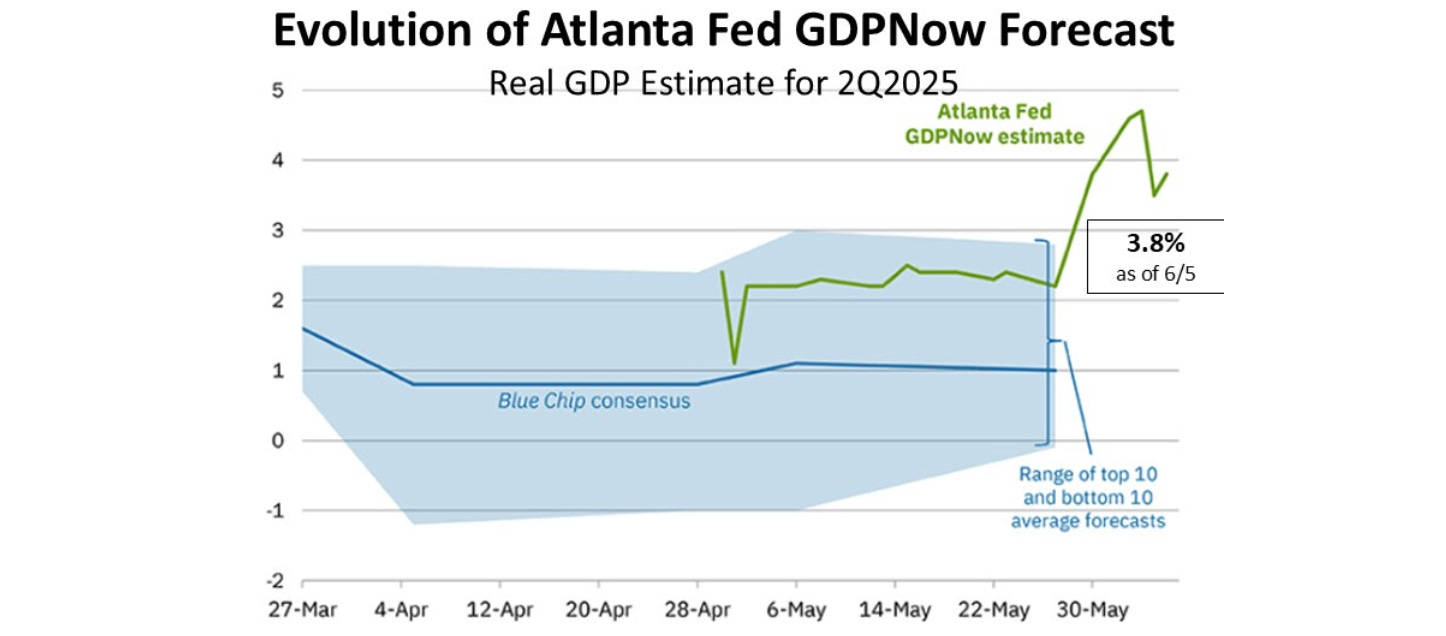

Additionally, the Atlanta Fed’s GDPNow model forecasts Q2 GDP growth at 3.8% far exceeding consensus expectations of ~1%.

This divergence, combined with low consumer sentiment, could spark a positive market reaction. Note that Q1 and Q2 GDP readings may be skewed by tariff-related front-running, which has disrupted typical import/export patterns.

April’s trade deficit, for example, plummeted to $61.6 billion from $138.3 billion in March. While GDP calculations have complexities, a headline 3.8% growth figure in a subdued sentiment environment could drive market optimism.

Position Your Portfolio for Success