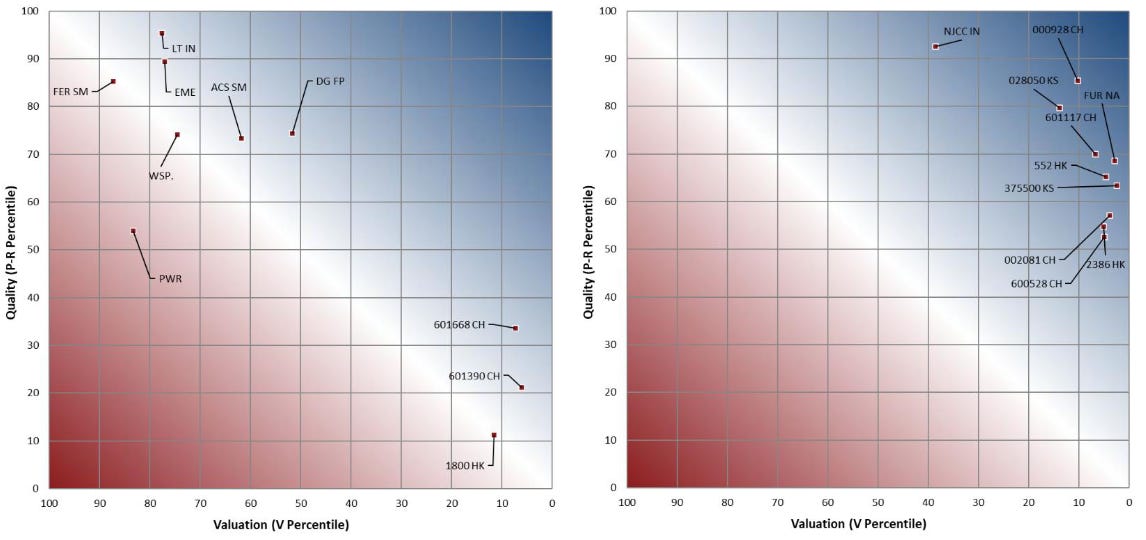

Our HEAT map is the visual trade-off between Quality and Valuation: companies in the favourable (blue) area offer higher quality and/or cheaper valuation than those in the unfavourable (red) area.

The reports highlighted in this series are sent out to clients on Monday at 07:00 EST. More information on the PRV framework can be found here.

Chart of the Week: High Economic Profitability & Cheap

The PRV Heat Map above is from this week’s High Economic Profitability & Cheap DM Stocks report highlighting firms that fit the criteria of having a deep economic moat and trading at a relatively cheap level of Valuation.

Names in the News: ASML and EZJ LN

We look at two names this week that look attractive in the PRV framework, ASML and EZJ LN, both rated Overweight. ASML was upgraded last month on improving Risk-Adjusted Profitability. The firm saw an initial move higher in its share price today along, with other AI names following bullish NVDA (rated, Overweight) guidance overnight and the U.S. court ruling on tariffs. EZJ LN has had a strong run up in stock price over the last month, with the firm reportedly seeing strong demand this summer season.

High Economic Profitability & Cheap DM Stocks

In this report we screen developed market (DM) stocks for firms that have a deep economic moat, having a PRV Margin of 10% or greater. The firms have a much higher level of economic profitability compared to the global average PRV Margin of 2.2% for the 29k companies under coverage. For reference, the U.S. aggregate PRV Margin was 3.7% at the end of April. The stocks not only must have a high level of economic Profitability they must also be relatively cheap with the firms having a moderate to low Valuation score.

Industry Snapshot: Global Broadline Retail

EBITDA Margin has seen a sustained expansion since early 2023 to new record highs, driving the improvement in aggregate economic profitability. Top-line growth has contracted through 2025, and new investment has rapidly expanded, pressuring PRV Fundamentals. Investors have turned less optimistic on the outlook for value creation going forward in recent months. Large cap firms maintain strong Quality but look unattractive in the PRV framework due to the high Valuations, especially given the strong run-up in many stocks on a year-to-date basis.

Industry Snapshot: Global Construction & Engineering

Economic profitability of the industry has deteriorated further since our last snapshot, dropping to 22-year lows, impacted by Sales growth collapsing and asset efficiency worsening. PRV Margin has turned increasingly negative, having contracted to a multi decade low, and the industry continues to destroy value. High quality large-cap names are trading at expensive Valuations as investors are willing to pay a premium for firms with strong PRV Fundamentals.

Russell 2000 Value Index: Dissecting Value

A few times each year, we re-visit the Russell 2000 Value and Growth Indexes to identify discrepancies between our view of value and growth and Russell’s. Last week we published a similar report for the Russell 2000 Growth Index. In this report we look at the performance of the Russell 2000 Value Index when the names we consider expensive are removed.

The ‘V < 80’ line removes the most expensive quintile of Value from the index.

The ‘V < 60’ line removes the two most expensive quintiles of Value from the index.

The ‘V < 40’ removes the three most expensive.

PRV Factor Report – Mexico

The Mexican market has been up 20% year-to-date, some of the strongest performance of any country. In this report we look at the performance of Quality, Value, and PRV for the Mexican market over the last two years. The market performance has spiked since early April, driven by high-Quality names.

Quant Corner: May 29, 2025

PRV spreads were positive in Europe, Asia ex Japan, Japan, the Emerging Markets, and the Global universe through the final week of May. Quality had been working everywhere in April, started May in negative territory in most regions, and is now positive everywhere except the U.S. Cheap Value outperformed expensive Value in all regions except the U.S., Japan, and the Global universes.