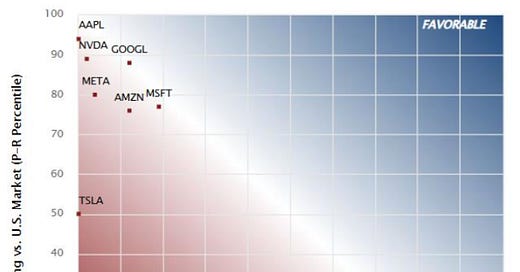

Chart of the Week: S&P 500 Future Growth Reliance (FGR)

In the chart of the week, we show our Valuation measure, Future Growth Reliance (FGR), for the S&P 500 fell from 46% at the end of March to 39% on April 8th (dashed line). Although having pulled back from the very elevated levels at the beginning of the year, the measure is still above the upper long-term range of 30% (green line) seen in November 2020 and April 2015.

FGR equates to the percentage of market value dependent on the future growth in PRV. The higher the number, the higher the dependency and the ratio that can be used, similar to a P/E ratio. See this week’s U.S. Equities: “Be Greedy When Others Are Fearful” report for more.

Names in the News: TAP & DPZ - free

This week, we look at two names that look attractive in the PRV framework with strong Quality levels that have maintained a positive YTD return amidst the very high market volatility over the last few months.

U.S. Equities: “Be Greedy When Others Are Fearful” - free

What a week! The S&P 500 was down 18% from the February high on Tuesday, before a startling recovery of 9.5% on Wednesday, on President Trump’s decision to pause tariffs for many trading partners for 90 days. In this report we look at the level of Valuation and PRV Fundamentals for the S&P 500. We also show the latest PRV performance of the Mag 7.

Industry Snapshot: Global Marine Transportation - free

With large uncertainty on trade ahead, the shipping industry is starting from a state of recovery, with higher freight rates posted in 2024 having driven the improvement in economic profitability. Aggregate economic profitability had been trending high around 6.5%. The market has moved to quickly reflect the slowdown in trade, but the valuation discount is likely to widen out in the short term for firms exposed to U.S. container imports.

Telecommunications Update (April 2025 Edition) - membership

In our January Global Communication Services 2025 Outlook, we provided several lists of Telecommunications names. The figures in this report show the current PRV scores, current ESG scores, and total shareholder return since the roadmap was published on January 16, 2025.

Consumer Staples: Firms with Low Volatility and a Deep Economic Moat - membership

In this report, we look beyond just defensive companies seeking out Staples with deep economic moats and relatively lower volatility, as these names should be better positioned not only to weather the storm but provide long-term ownership opportunities.

HEAT Zone Performance in Downturns – Large Cap Emerging Markets - membership

In this report, we provide the alpha generation coming from each zone during previous downturns, which we defined as;

the average market performance is below -2% for three months,

the three trailing months are all negative.

Our Expensive But Worth It (EBWI) zone generates the best performance versus the market, averaging 189bps/month of outperformance. Report includes a screen of the most attractive names in EM.

PRV Factor Report: Asia including Japan (April 2025) - membership

In AxJ, investors began favouring high-Quality names in mid-March. Cheap Value trended up through early March before rolling over in the latter part of the month. PRV rebounded a week before Quality inflected up.

In Japan, PRV performance had been sliding in the new year but popped with the spike in Valuation in early March. Quality had been declining until turning up near the end of March.

The weekly research reports allow investors to parse through thousands of companies globally with comparable accounting adjustments to drive informed investment decision-making on a systematic basis.

Each week we produce 5-7 timely and actionable reports to highlight key themes, trends, and opportunities from the framework. These reports are aggregated into our Weekly Roundup and sent to clients with priority. For more information and to become a member, please click on the button below: