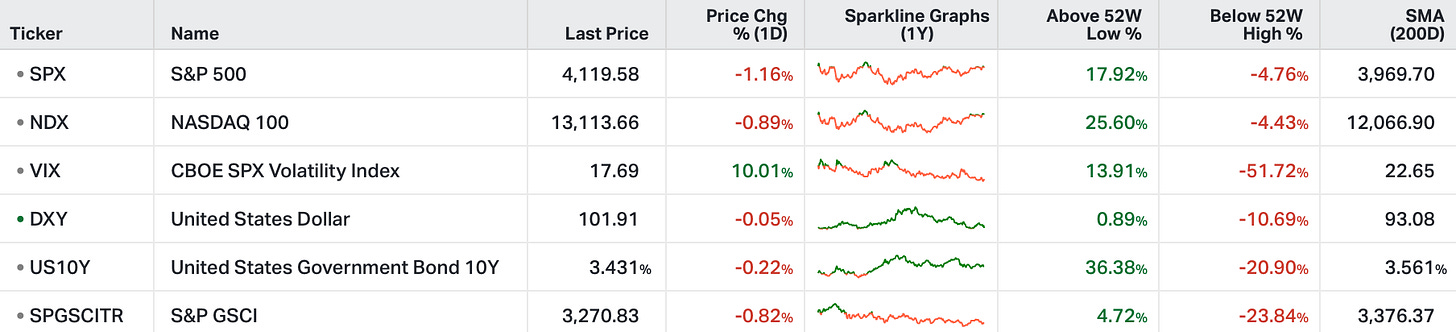

After JP Morgan took over First Republic Bank (snap shot of the deal shown below), Jamie Dimon said "the banking system is very stable . . . there are only so many banks that were offside this way . . . there may be another small one, but this pretty much resolves them all . . . this part of the crisis is over."

Remember, he's not just speaking from an industry perspective, as CEO of the biggest bank in the U.S., he's in the conversations with the Fed Chair, Treasury Secretary, White House economic advisors and regulators in times of crisis in the financial system.

Despite the statement from Dimon, the short sellers went after the regional banks yesterday. This, driven by the thesis that the vulnerabilities in Silicon Valley Bank, Signature Bank and First Republic Bank were canaries in the coal mine - just an early warning of the vulnerabilities in regional banks.

But these three banks had a lot more in common with each other, and a lot less in common with regional banks, broadly.

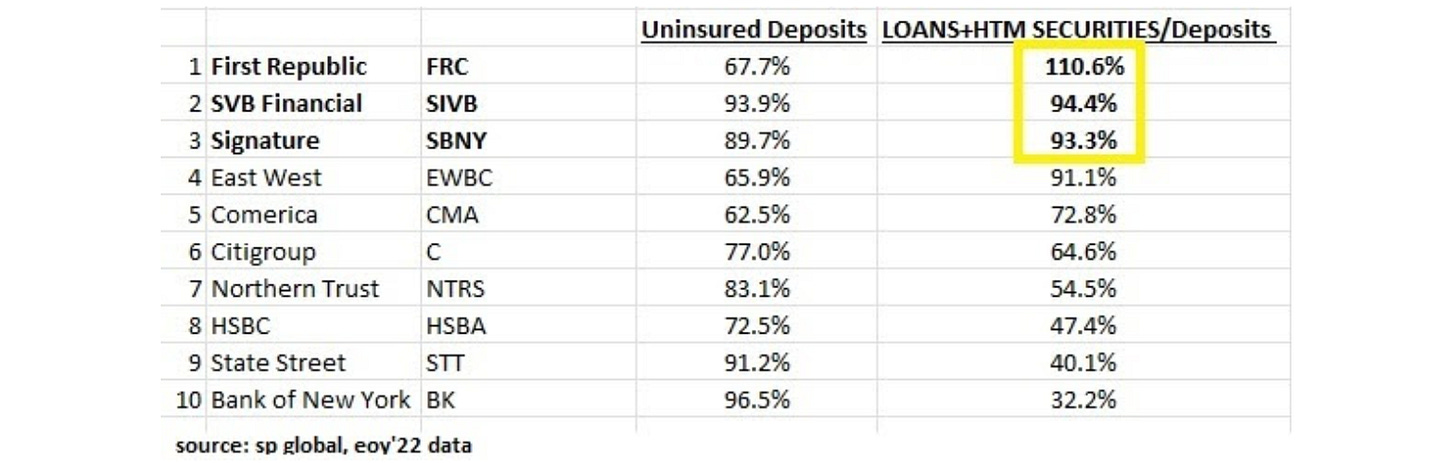

They all had a very high percentage of deposits that were uninsured (balance greater than the FDIC insurance limit). In large part, that had to do with banking venture capital firms, and the ultra-high net worth - but mostly this is about banking venture capital firms. And just as a kicker, SVB and SBNY also banked crypto firms.

These were all, what I would call, specialty banks. And you'll see what else these three banks had in common in this next table.

These three banks had the highest duration risk. This becomes especially problematic when the securities they intended to hold to maturity have lost significant value - which they have, thanks to rising interest rates (rates up, bond prices down). When forced to sell, to fulfill depositor demand for cash, they sell at a loss.

Interestingly, the fourth bank on this list (with high duration risk) had this to say: "East West is a very different bank from both SVB and Signature, which has substantial concentrations in volatile venture capital and crypto deposits."

This statement was from March 12th. They knew early on, it was the unique specialty banking feature that was driving these bank failures.

East West lost only 2% of deposit assets in Q1, and by their April earnings call, had trimmed the percent of uninsured deposits down to 41%.

With all of the above in mind, the short sellers are looking for more blood, hoping that dominoes are lined up to fall in regional banks.

But the evidence doesn't fit the narrative.

I wonder why you'd invest in any bank. The return profile is similar to the market, but the risk is higher-borderline unquantifiable. Love to hear any thoughts.