The political focus this week will turn to the negotiations on Biden's massive "answer" to an economy so troubled that it is, likely as I write, already producing a new record high in economic output.

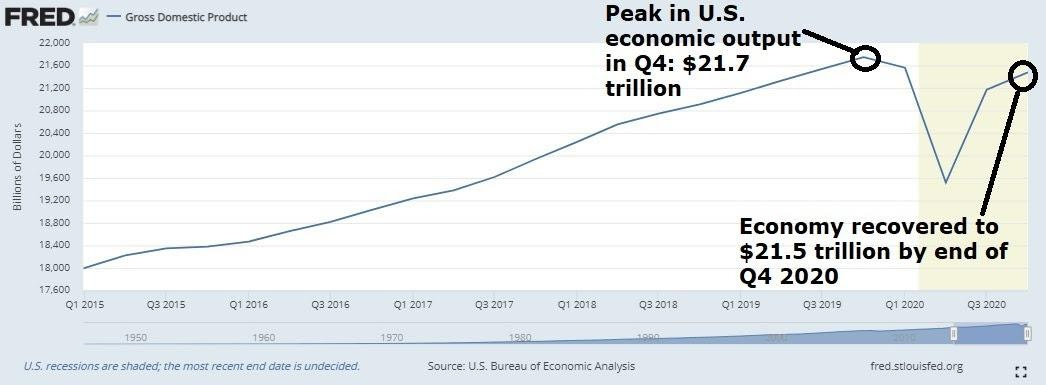

Remember this chart...

The peak in economic output prior to the pandemic was $21.7 trillion, a year later (by Q4 2020), the economic output had already recovered to $21.5 trillion. That's a near full recovery, and that was before the new $900 billion in aid was disbursed (and this disbursement is still in early stages).

Still, the Biden team is painting a grim picture of the economy, demanding that they "go big" on new aid.

"Go big" is what the Trump administration already did, in March of last year. Within eleven days of the "stay-at-home" orders, a $2.2 trillion plan that protected the balance sheets of consumers and businesses was signed into law. That's why we have the chart above and that's why we have this chart of unemployment...

So, despite what the economic data says, this week the democrat Congress will cram through another $1.9 trillion to "rebuild" the economy. When the massive deficit spending doesn't match the needs, there will be pain. In this case, it doesn't appear that the pain will be in the bond market anytime soon. But the pain is clearly coming in the devaluation of the dollar (and paper currencies globally) relative to asset prices.

Stocks, record highs. Housing prices, record highs. Bitcoin, record highs. More markets to come.