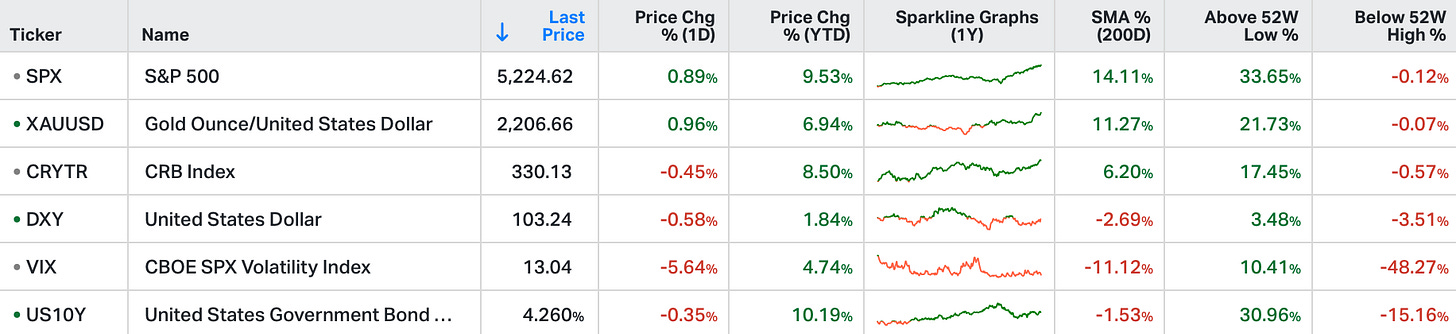

US stocks closed at record highs on Wednesday after the Federal Reserve held its outlook for interest rate cuts unchanged.

The S&P 500 surged 0.8% to break above 5,230, while the Dow Jones rallied 389 points, also reaching all-time highs.

Median expectations by FOMC members suggest a total of 75 basis points in rate cuts this year.

The dot plot also indicated three cuts in 2025, one fewer than in December, despite a slight upward revision for PCE inflation.

However, sharp upward revisions to projections of US GDP continued to support US equities, reflecting this year's rally that has defied the Fed's restrictive policy.

Earlier this month, we talked about the takeaways from Jerome Powell's semi-annual testimony on Capitol Hill, and from the surrounding media-tour chatter from Powell's colleagues.

The Fed seemed comfortable not messing with an economy that was doing well, despite a Fed Funds rate north of 5%. Following yesterday's Fed meeting, that seems to remain the case.

Interestingly, they made some tweaks to their December Summary of Economic Projections - after undershooting on growth all of the last year, by a lot, they dialled UP growth estimates (through 2026). They see employment remaining strong, and inflation getting to target ("over time"). Take a look at this highlighted area ...

These projections suggest the economy will be stronger, without stoking inflation, all while the Fed will be tighter than they thought just three months ago. As you can see, they've revised up the Fed Funds rate for 2025, 2026 AND in the longer run.

What would explain this? Maybe the productivity boom that is underway yet continues to be a topic the Fed is bizarrely quiet about.

Generative AI might be the productivity enhancing technological advancement of our lifetime. Hot productivity gains promote wage growth (which we're seeing), which is needed to reset wages to the increased level of prices (which restores quality of life).

It can do so without stoking inflation, and that formula is playing out.

As for economic growth, Jerome Powell himself, presented back in 2016, on productivity growth as a driver of the long-term potential growth rate of the economy. Let's take a look at some charts ...

Heading into this Fed decision stocks have continued to hug this trendline, which originated from October, when Jerome Powell verbally signalled the end of the tightening cycle (similar line for Nasdaq) - and we finish on new record highs (again).

This "end of the tightening cycle," has been just that, to this point - no easing. However yesterday, Jerome Powell introduced the coming taper of quantitative tightening. What does that mean? They will slow the reversal of the Fed's balance sheet, and they will slow it "fairly soon" he says, making steps toward stopping/ending QT. This first step will slow the decline of the line in the chart below, slowing the extraction of liquidity from the economy.

As we discussed yesterday, the Bank of Japan has played the critical role of global liquidity provider the past two years (the liquidity offset to the Western world's liquidity extraction/tightening policies) - they just made the first step toward exiting this role.

With that, it is perhaps no coincidence that the Fed is ready to wind down the liquidity extraction. Jerome Powell has the scars of 2019 - after the Fed spent nearly two years draining liquidity from the financial system (quantitative tightening), they created a cash crunch (a scramble for dollars in the interbank lending market).

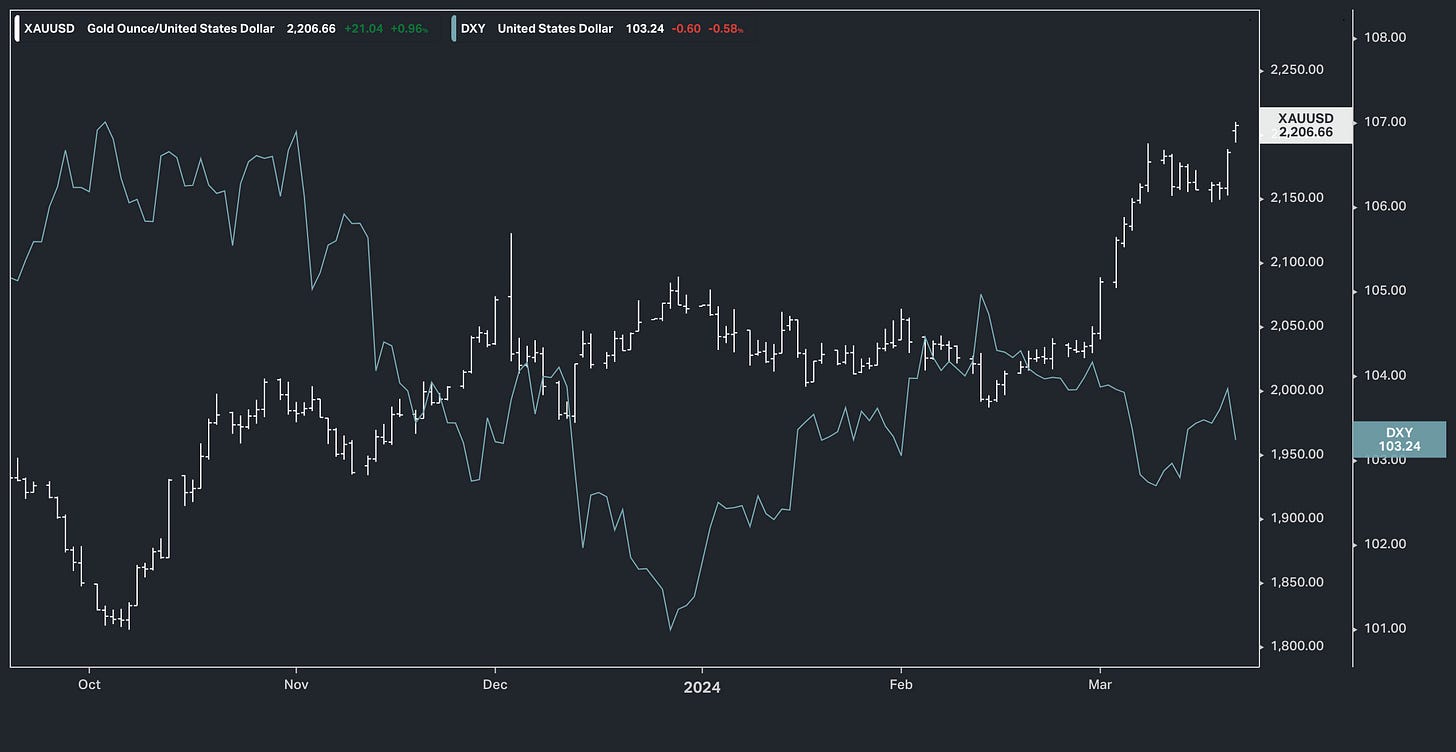

The pendulum swung from too much liquidity, to too little. And the Fed was forced to pump liquidity back into the financial system, and at a record rate (i.e. a return to QE). With that in mind, the notable charts of the day were the dollar, which put in a bearish technical reversal signal (outside day)... Whilst commodities, led by gold, which may make new record highs tonight ...