Recession Risk Fading

US stocks rallied on Friday, powered by strong earnings reports from major banks, setting an optimistic tone for the third-quarter earnings season.

The S&P 500 and the Dow Jones both hit new highs, gaining 0.6% and 1%, respectively buoyed by impressive earnings results from JPMorgan (4.4%) and Wells Fargo (5.6%).

Despite Tesla’s 8.8% drop due to its underwhelming robotaxi event, the tech-heavy Nasdaq managed to close 0.1% higher.

This positive momentum was further supported by economic data, where unchanged wholesale inflation indicated progress towards controlling inflation, while a hot inflation on Wednesday kept uncertainty around the Fed’s future rate cuts.

Nonetheless, investor sentiment remained strong, with weekly gains across all major indices: S&P 500 (+1.5%), Dow Jones (+1.4%), and Nasdaq 100 (+1.7%).

U.S. recession risk appears to be fading - growth data has improved recently:

The ISM services index increased by more than expected in September (54.9 versus forecast 51.7). Services comprise 70% of U.S. gross domestic product (GDP).

Nonfarm payrolls rose 254,000 in September versus an expected 150,000. August payroll data was revised higher and the unemployment rate declined from 4.2% to 4.1%. Average hourly earnings were up 0.4% sequentially versus an expected 0.3%.

The 10-year treasury rate is now above 4%, up from 3.6% recently, reflecting better growth rather than rising inflation.

Historically, since 1950, recessions have occurred on average once every seven years. Goldman Sachs just reduced their recession risk probability for the next twelve months to 15% from 20%.

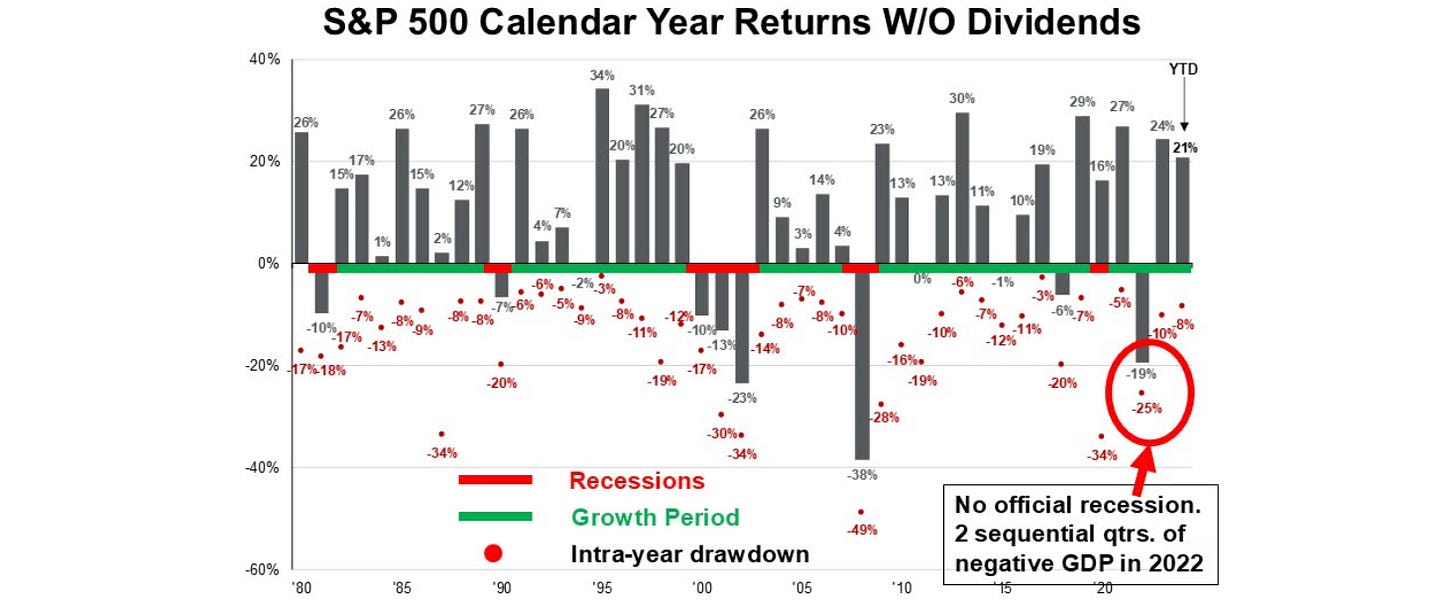

Recession risk is one of the biggest risks to stock investing with major losses in the market (>40% drawdown) have occurred during recessions. Outside of recessions, the calendar year returns of the S&P 500 are almost always positive since 1980. This is the case even though there are intra-year drawdowns every year (on average -14%).

The S&P 500 has been greatly supported by forward looking recession risk falling from about a 60% probability in past year or so to a much lower level today. The chart below shows S&P 500 price action by year since 1980.

The message is during non-recessionary periods, it is a good time to buy and hold growth assets like the S&P 500 Index. During recessionary periods, it is a good time to be more defensive.

If an investor understands the potential risks and is willing and able to bear the risk, it appears that next year has a reasonable chance of delivering positive returns.