We ended the week with the warning signals of a meltdown.

Stocks retested the June lows, while U.S. 10-year yields spiked up to 3.82%.

This comes following last Wednesday's Fed meeting, which suggested, via the Fed's economic projections, that they are planning to ramp rates another 125 basis points by year end.

As we've discussed in recent days, that rate scenario would bury the economy in a deep recession. It is also a threat to the solvency of global sovereign debt.

As we know, the rise in U.S. yields tends to pull global yields higher—the recent spike in U.S. yields has directly affected the yields on vulnerable Italian sovereign debt, which went to nine-year highs (to 4.36%).

Importantly, that's ABOVE the June highs—a level that triggered an emergency response from the ECB, where they designed a plan to become buyers of last resort of fragile sovereign debt in the eurozone (more QE). This is a strategy intended to defend their vulnerable constituent countries in the euro zone from a sovereign debt default.

So, with this move in rates, the ECB will likely be forced back into printing euros to finance debt and deficits in the eurozone.

That problem comes with another problem: when the rest of the world has exited QE and you're still printing, your currency will devalue.

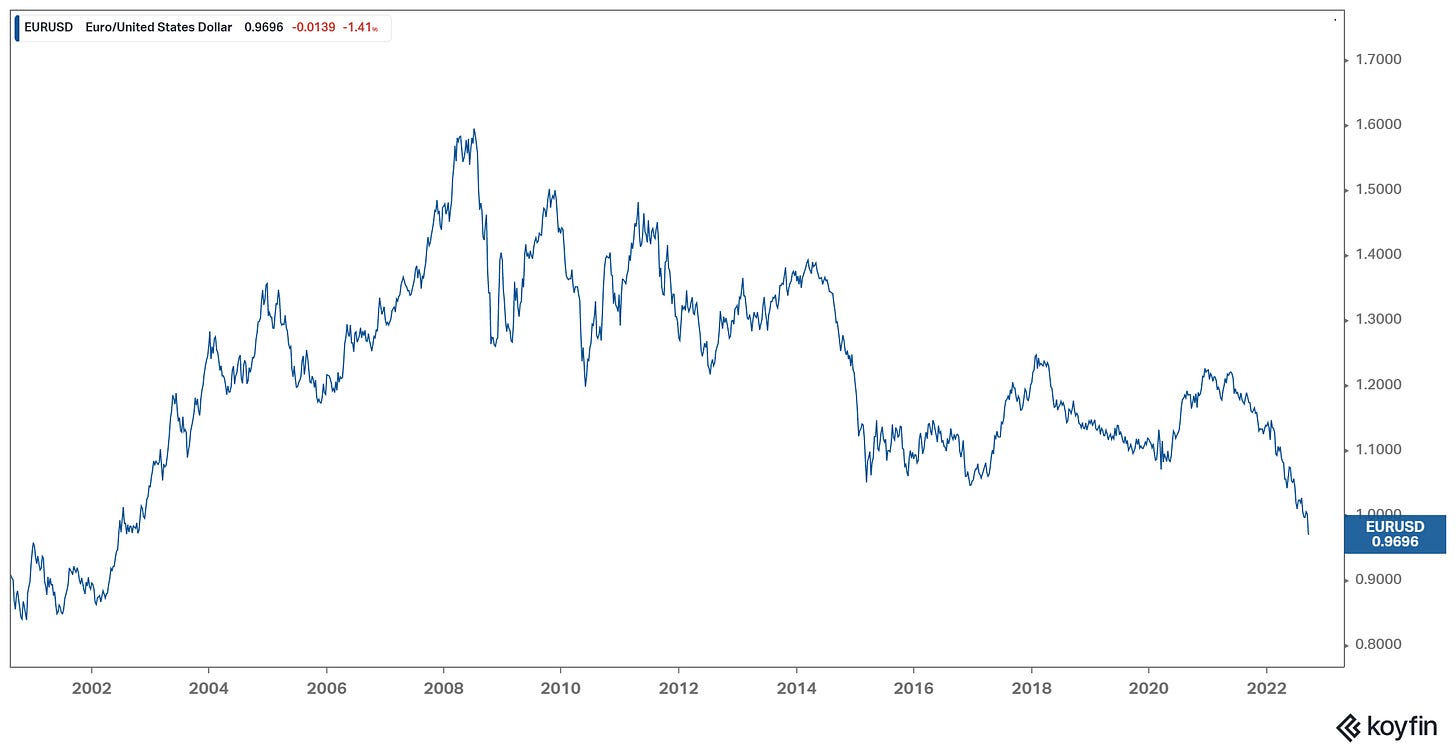

We've seen it with the yen. On Friday, we saw what may be an important day in the history of the euro (the most widely held currency in the world). The euro traded to new 20-year lows yesterday and is now well under parity with the dollar.

A weak euro, like a weak yen, isn't unwelcome. Weakness at a rapid pace (i.e., a crash), however, tends to be accompanied by debt defaults.

This is all part of the fine line the Fed has been walking in trying to tame inflation without creating a bigger, more dangerous, and more global crisis. The markets are telling them that this recent guidance on the rate path has gone a step too far. We may see some damage control from the Fed next week (some walking back).

A Message from the Sponsor

The Gryning Times is more than a commentary outlet—the views expressed in my daily notes are implemented in the market place.

I employ long (buy) and short (sell) positions in derivatives, primarily futures and forward contracts, across the broad asset classes of equities, fixed income, currencies, and commodities.

This is a hedge fund strategy, at a fraction of the cost, giving you a diversified portfolio with dynamic (market condition-adjusting) asset allocation to maximize returns with minimal market correlation and drawdown control.

Month to-date returns:

Green = Gryning | Portfolio.

Blue = SPX.