Re-Orientation

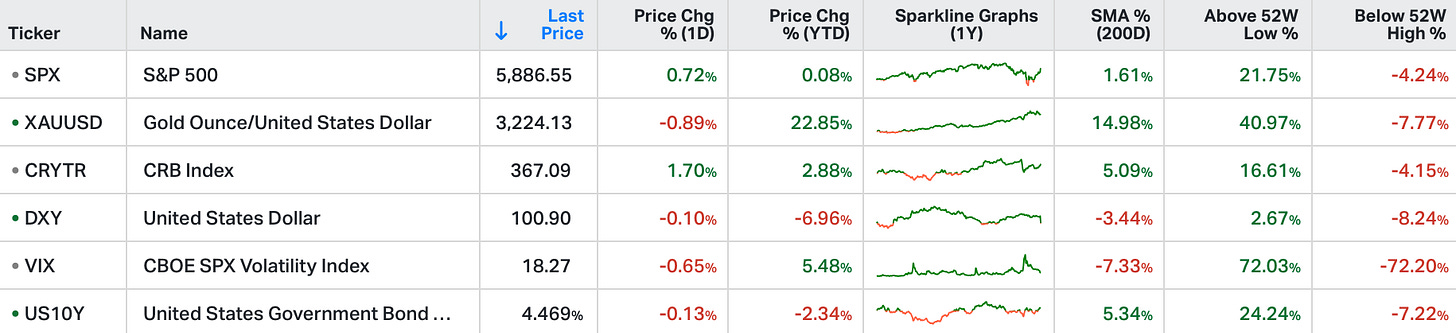

Wall Street extended its rally on Tuesday as easing US-China trade tensions and softer inflation data boosted investor confidence.

The S&P 500 closed 0.7% higher, reclaiming positive territory for 2025, while the Nasdaq 100 jumped 1.6%, driven by a sharp rebound in chipmakers.

The Dow lagged behind, falling 270 points as UnitedHealth shares plunged 17.8% following the CEO’s departure and the suspension of forward guidance.

April’s consumer price index rose just 2.3% year over year, slightly below expectations, reinforcing hopes that inflation is easing and bringing rate cuts closer.

Investor sentiment was further buoyed by a $600 billion investment initiative from the White House and renewed optimism over a 90-day pause in US-China tariffs.

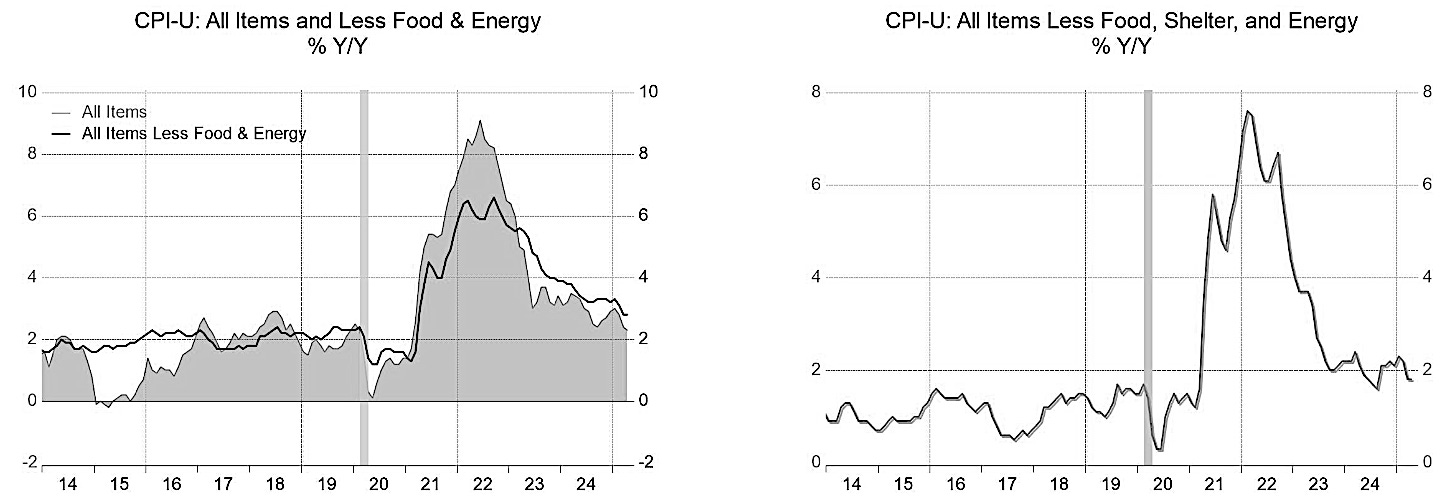

April inflation (headline CPI) came in at 2.3%.

That's in-line with the number we discussed yesterday, and that's the lowest inflation since early 2021, and lower than the level of inflation in September of last year, which is the month the Fed kicked off its easing campaign.

Still, the Fed is holding the real rate at 200 basis points (Fed funds rate minus inflation) - historically tight level. With the 90-day tariff windows not due to close until July and August, the next big focus for markets will be the budget bill and debt ceiling raise - along with the rising debt service burden which is being amplified by the Fed's chosen interest rate level.

As we discussed last week, Moody's has already telegraphed a U.S. credit downgrade (back in March), which only matters to the extent that it could be a catalyst for a broader market reckoning on global sovereign debt.

With that in mind, highly indebted countries with no credible growth plan, no plan to grow the denominator in Debt/GDP, could find themselves in trouble.

This brings us to Trump's speech in Saudi Arabia, which draws the distinction.

Trump is building a new global coalition of trade partnerships and mutually beneficial relationships around re-industrialisation, including abundant and affordable energy (access to U.S. energy), AI infrastructure and innovation (access to U.S. chips and compute), and military commerce (access to U.S. armament and security) - all in pursuit of each countri’s respective national interests.

This re-orientation is already resulting in trillions of dollars of business deals and commitments. This is an explicit rejection of the globalist, centralised control, climate-agenda driven managed decline of the past four years.

So, there's a new growth agenda happening in the world. And conversely, there are some countries doubling down on the de-growth climate agenda. I suspect we'll begin to see the distinction in sovereign debt markets in the coming months . . . join us below if you would like to navigate the financial markets with us.

Our Global Trend Report provides indicators and diagnostics to help assess the current state of financial markets across various asset classes and regions.

We offer a clear and actionable overview of emerging trends and growing instabilities in today’s financial markets.

We are designed for all parties with investment performance responsibility or those that are managing financial risk.

The report is the result of an extensive analysis applied to about 450 systemic assets and about 850 single stocks. The systemic assets are bond, equity and commodity indices, as well as a selection of currency pairs. The single stocks are mainly US and European equities.