Inflation was a hot topic in Jay Powell's testimony to Congress yesterday morning.

Some of the senate was clearly concerned about the risks of a spike in inflation, J Powell was not.

Even with the aggressive move in asset prices, hot import/ export prices, hot economic data and an economy that, J Powell admits, could run as hot as 6% growth this year (before another massive fiscal spending package), he continued to downplay concerns about inflation. Moreover, he said the greater risk to inflation is on the downside.

Does he mean it? I doubt it. But it's his job to signal to markets that rates will stay ultra-low and QE will continue. As part of that signaling, J Powell (and the Fed) continue to promote an extremely passive plan toward addressing a ramp in inflation when/if it rises above their target of 2%.

Make no mistake, this is meant to set expectations that the Fed will be providing maximum support for years. The intent is to keep the constraints off of the recovery, at this stage.

When we do get a rise in the Fed's favored inflation measures, I suspect we will see them act, not sit on their hands.

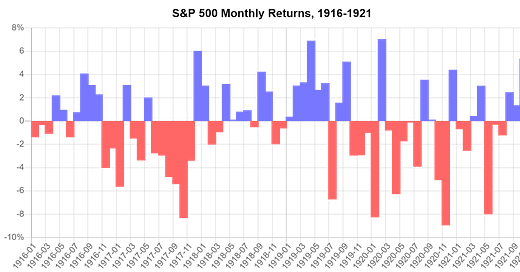

Perhaps the Spanish Flu era inflation is a good lesson on why they need to be ready. From 1916 to 1921, the nominal return on investment would be 17.95%, however when accounting for inflation - CPI starting at 10.90 in 1916 and ending 1921 at 17.90 - the inflation adjusted return would have been -28.18%.