I want to revisit an excerpt from my July 15 Macro Perspectives (found here), and then talk about how it's playing out.

The Fed doesn't have the appetite for big rate hikes - if they did, they would have acted bigger, and more aggressively already.

High inflation environments, historically, have only been resolved when short term rates (the rates the Fed sets) are raised above the rate of inflation. The Fed is currently almost eight percentage points behind. We can only assume, at this point, that it's intentional.

Also, when asked about the inflationary risks of QE, back in 2010, the former Fed Chair (Ben Bernanke) said dealing with inflation is no problem; "We could raise rates in 15 minutes." They haven't done that.

Add to this: The current Fed Chair has told us that they were going to aggressively attack inflation, by "expeditiously" raising interest rates, and "significantly" reducing the Fed's balance sheet. They have done neither.

So they have the tools, they understand the formula for resolving inflation, but they aren't acting.

Why? Even if the U.S. economy (including the government's ability to service its debt) could withstand the pain of nearly double-digit interest rates, the rest of the world can't. That's it…

Capital is already flying out of all parts of the world, and into the dollar. Is it because U.S. bonds are finally paying interest? Partly. Mostly, it's because the U.S. is pulling global interest rates higher, which makes sovereign debt more expensive (more likely, unsustainable), particularly in the more economically fragile emerging market countries. Rising U.S. rates accelerate global sovereign bond markets toward default/ sovereign bankruptcy.

And historically, sovereign debt crises tend to be contagious (i.e. you get a cascading effect around the world). So far, we've seen defaults by Sri Lanka and Russia.

Let's fast forward to today. The Fed has now raised the effective Fed Funds rate to 3.08%. The balance sheet? At this point, the Fed is scheduled to have reduced the size by $237.5 billion—they’ve done just $100 billion. Inflation, of course, remains much higher than the Fed Funds rate.

So the Fed still hasn't delivered on the tough talk . . . They haven't because they can't. Still, as we discussed yesterday, they may now have gone too far with the tough talk.

Projecting another 125 basis points of tightening in the U.S. over the next three months has destabilized global markets. U.S. stocks have traded to June lows, and more importantly, the vulnerabilities in Europe have become amplified.

Yields on Italian government debt are spiking, now 40 basis points above the June levels—levels that prompted an emergency meeting by the ECB. This should trigger the ECB's new bond buying program, to curtail the rise in these yields and protect the solvency of Italy. But it will come at the expense of the euro.

With that, the euro continues to trade at new 20-year lows. Sovereign debt yields in the UK are also spiking, and the British pound is collapsing (down as much as 8% in the past two trading days, falling to 37-year lows). It’s important to remember that rapidly declining currencies tend to come with (ultimately) debt defaults (even with central banks putting up a fight).

Where is the money going that's leaving Europe? The U.S. dollar and dollar denominated assets It's a (global) flight to safety (somewhat positive for U.S. assets, very negative for global assets). So, this is all heading in the direction that we discussed back in July.

And to be sure, it has been triggered by the Fed. They have miscalculated—even at the (still) relatively low levels of interest rates.

Remember, back in 2019, after a shallow rate hiking campaign and attempts to "normalize" the balance sheet (from the Global Financial Crisis response), the Fed was forced to stop and reverse (to cut rates and go back to QE). The reason: things started breaking in the financial system. To be specific, we had this 300 basis point spike in the overnight lending market.

What's happening now? Things are beginning to break in the financial system (this time in sovereign debt markets).

With that, the market will continue to look for the Fed chair to walk back on the hawkish rhetoric and projections from last week's meeting. He had a chance on Friday, at the "Fed Listens" conference. He said nothing. Powell is on the calendar for a prepared speech again this week—on Wednesday.

Do you, or someone you know, want to gain access to a hedge fund strategy, for a fraction of the cost, to protect your wealth and outperform the market?

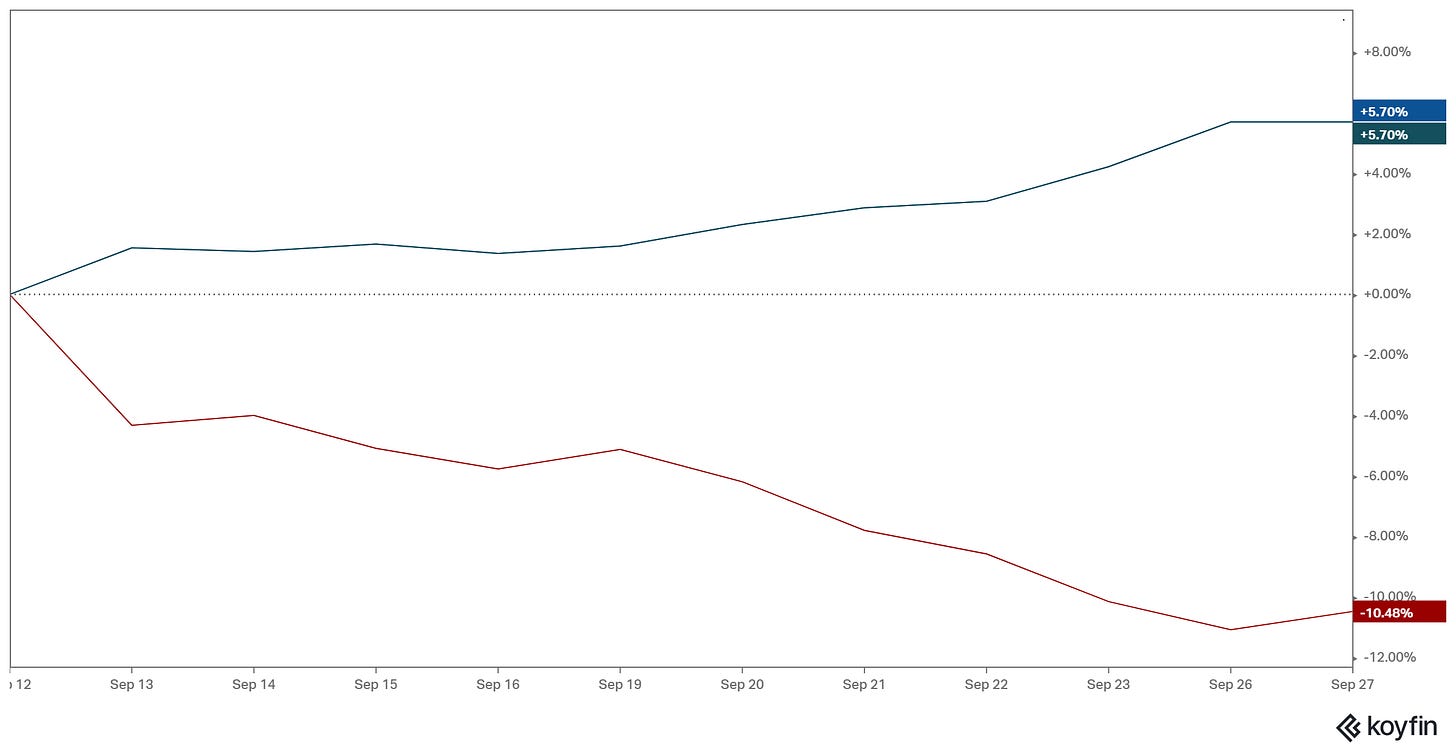

PS: In a previous note (click here), at the bottom, I disclosed the Gryning|Portfolio holdings. Whilst the positions are adjusted daily, the core has remained the same. The chart below shows (in Blue) how the portfolio has performed (excluding costs) against SPX (in Red).