Rally Vindicated?

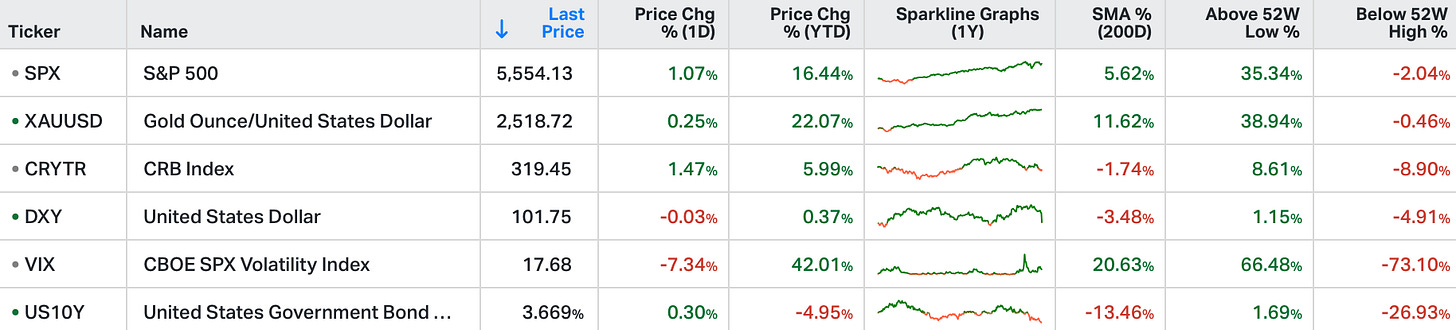

US Stocks closed sharply higher on Wednesday, boosted by tech stocks as investors assessed the latest inflation data and its implications for the Federal Reserve’s upcoming policy decision.

The S&P 500 rose 1%, extending its winning streak to three sessions, while the tech-heavy Nasdaq surged 2.2%, led by strong performances from chipmakers like Nvidia (+8%) and Broadcom (+6.7%).

Inflation data showed headline prices eased to a three-year low, but core inflation rose 0.3%, higher than expected.

This fueled speculation that the Fed will opt for a smaller 0.25% interest rate cut at next week's meeting, with traders reducing the likelihood of a 50-basis-point cut to just 13%.

On the political front, the presidential debate raised chances for a Kamala Harris election victory, boosting solar stocks and pushing crypto-linked ones down, including First Solar (+15.2%) and Coinbase (-1%).

Going into yesterday morning's inflation report, markets looked vulnerable;

The bond market has been telling us the Fed is way behind the curve — too slow to recognise the deterioration in the job market (and the economy).

Oil prices have been falling, sending a negative signal on the demand outlook.

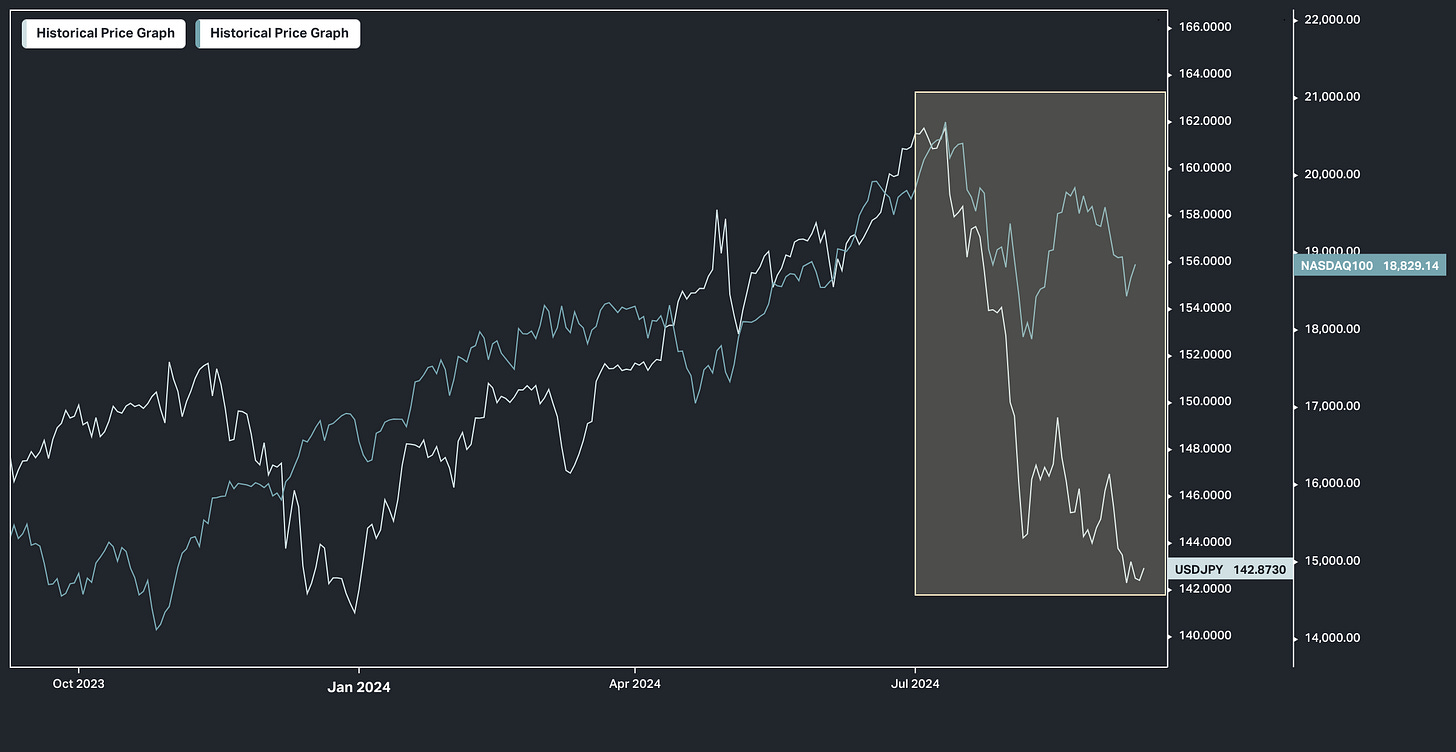

And this chart below, we've been watching, was projecting more downside for the Nasdaq/big tech stocks.

Dollar/Yen exchange rate and the Nasdaq have tracked closely, resulting from the flow of global capital driven by the "yen carry trade" (i.e. borrowing Japanese yen effectively for free, converting that yen to dollars, and investing those dollars in the highest quality dollar-denominated assets).

But as we've discussed over the past month, the prospects of rate cuts to come from the Fed, combined with tightening policy in Japan, have triggered a reversal of the yen carry trade (yellow box) — out of dollars and dollar-denominated assets, and back into the yen.

So, the inflation data was the final catalyst heading into what will be the Fed's first rate cut next week. And with no surprise in the inflation picture, it seemed clear that the continuation of the reversal of the yen carry trade would ensue.

Indeed, the morning started with aggressive selling in stocks. But at 11am EST, it all reversed — stocks, commodities, yields, bitcoin … everything.

What happened? Commentary hit the wires from the founder/CEO of the most important company in the world. Jensen Huang took the stage at a Goldman Sachs tech conference - he said the demand for the new Blackwell chip is "so great … everybody wants to be first, and everybody wants to be most."

Did this turn markets? Maybe. But it's nothing new.

If we look back at Nvidia's August earnings, we already know demand is insatiable.

It's the rapid design cadence in accelerated computing and supply constraints that have capped Nvidia's growth capacity (at least at this point) — at a trend of $4 billion of new revenue a quarter. And if that trend continues, the year-over-year growth rate for Nvidia will be cut in half by this time next year (to something closer to 50%, from triple digits).

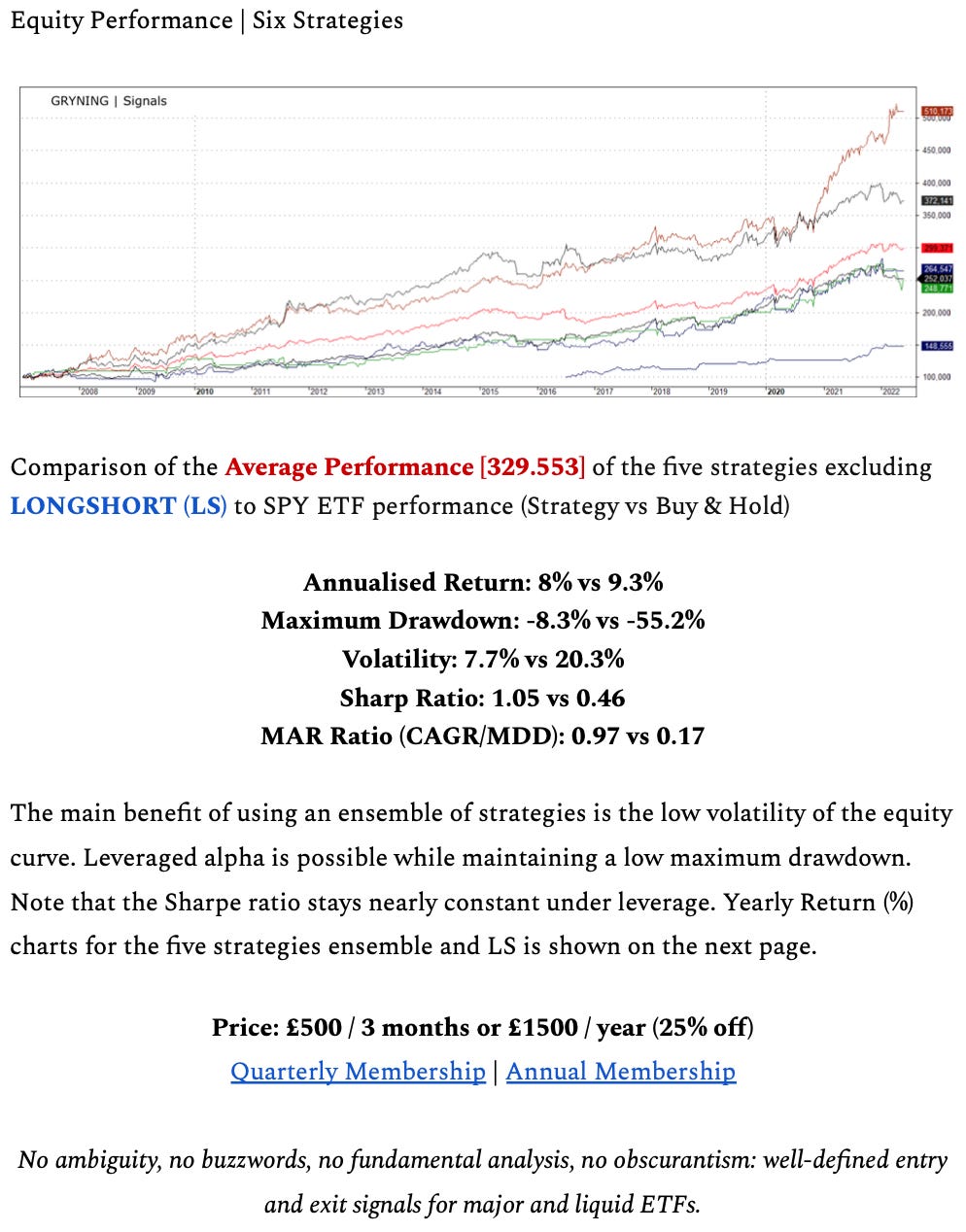

GRYNING | Signals - providing durable and consistent return streams independent of beta.