The S&P 500 and the Nasdaq 100 cut some of the early gains to rise around 0.3% on Thursday while the Dow Jones reversed course to trade around the flatline, as investors digest key economic data and the Fed's decision.

Traders were also awaiting the jobs report due today and earnings from Apple, Amazon and Meta after the closing bell.

Meanwhile, the ISM manufacturing PMI pointed to a softer contraction in the factory sector.

The Fed kept interest rates steady and Chair Powell said it will be appropriate to start cutting rates although he doesn't think a March cut is likely.

Financials were the worst performing sector while communication services outperformed.

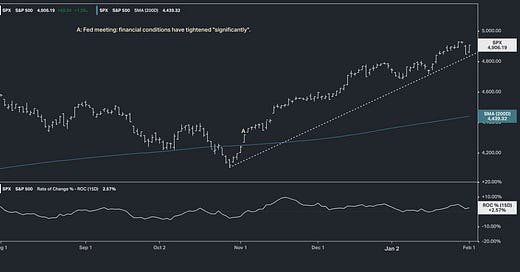

After the Fed, we talked about the shrug given from the interest rate market and despite Jerome Powell's best efforts to curb enthusiasm about the rate outlook, rates slid even lower yesterday.

We also talked about the trendline that was testing in stocks, following the sell-off.

Remember, we have a similar chart/ similar trendline in the Nasdaq, Dow and Russell 2000. In my previous note I mentioned: If this shallow dip in stocks were to hold this line, bounce, and make new highs, it would be extremely bullish for stocks - confirming the boom from the generative AI-driven technology revolution.

That was the case during the day, at least in the S&P futures. Fittingly, it traded to new highs after the earnings from three of the tech giants late in the afternoon; Amazon, Meta and Apple all put up big numbers.

So, we've now heard from the big four tech giants that are working on the frontier of generative AI (Microsoft, Google, Amazon and Meta) - it's all about generative AI. They're all building data centre capacity to handle AI workloads and they are all working on commercialising generative AI products for their customers. It's clear they are already benefiting internally from the productivity enhancements of generative AI.

As we've discussed over the past couple of quarters, this (gen AI) technological revolution is productivity-enhancing for the economy. It's a formula to grow the economic pie (and the size of the stock market). We averaged just 1% productivity growth for the decade prior to the pandemic and negative 0.7% since the fourth quarter of 2020 (through the middle of last year).

We had almost 5% productivity growth in Q3.

The Q4 report came in yesterday at 3.2% growth.

We are in a productivity boom, and high productivity growth is a driver of higher long-term potential economic growth. With that, we shouldn't be surprised by the strength of the economy, though the Wall Street and economist community continue to be. And as you can see in the chart below, early indications on Q1 growth look like more of the same ...