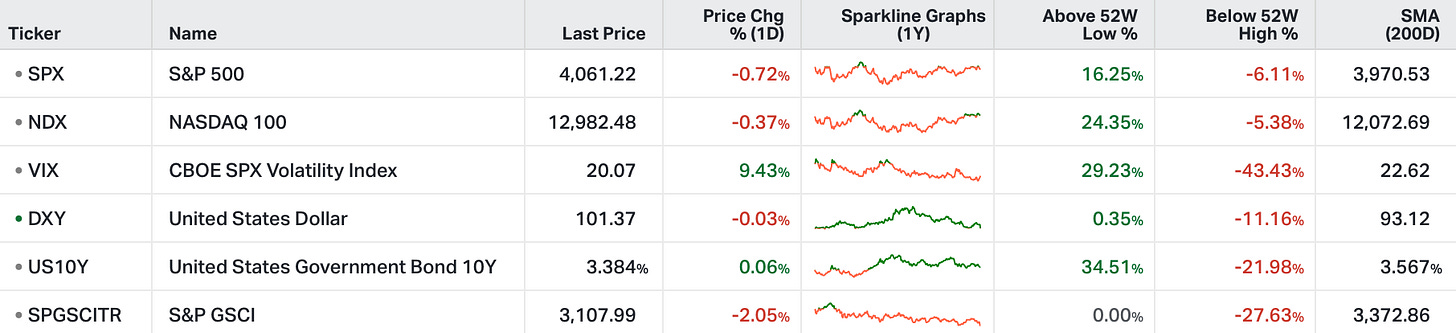

The Nasdaq is up 15% year-to-date.

The S&P 500 is up 6% year-to-date.

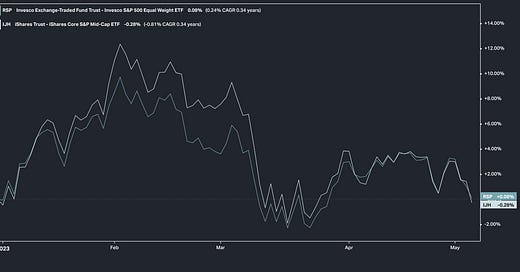

When adjusted for market cap (if we equal weight the S&P 500), the stock market is flat on the year.

Similarly, the light green line excludes the top 100 market cap stocks in the S&P 500 - it’s flat.

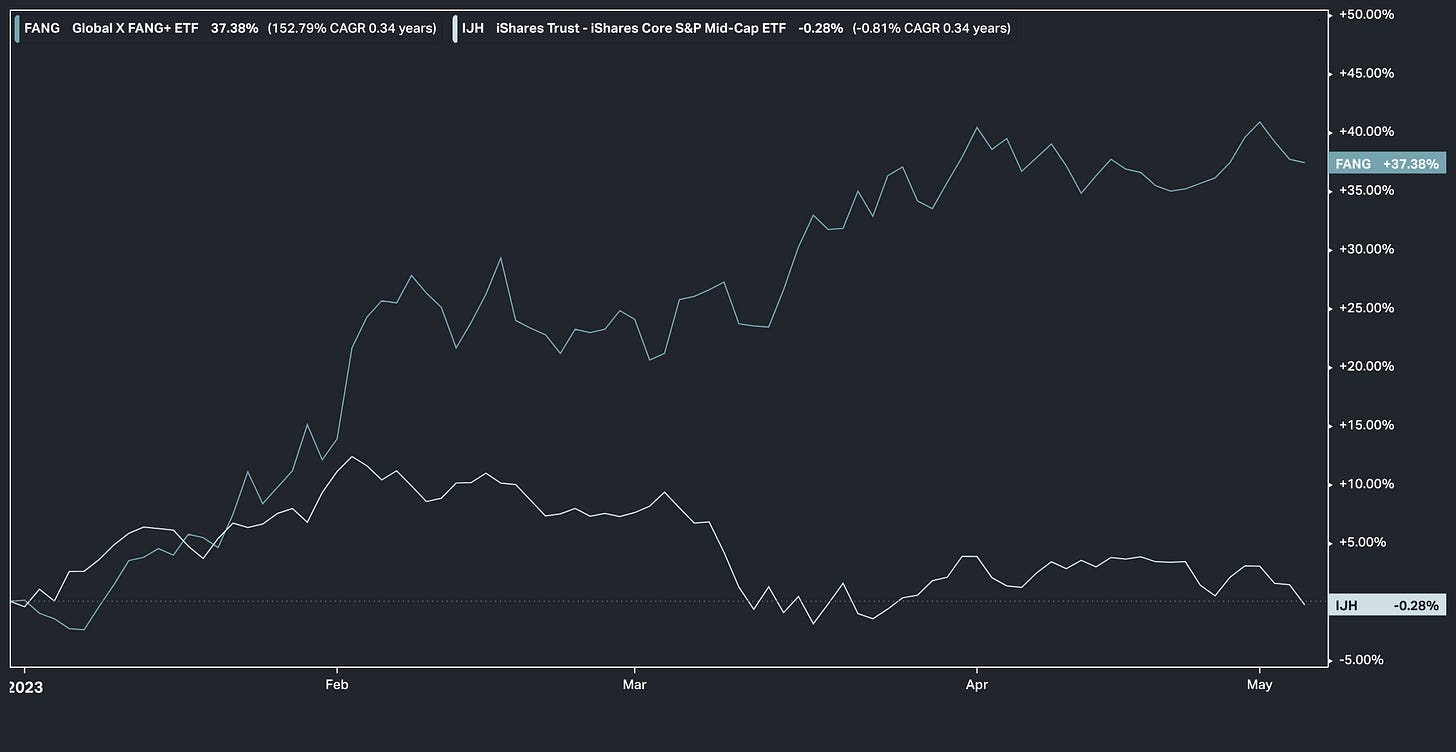

Where’s all the performance? Below is the FANG+ Index, which includes Meta, Apple, Amazon, Netflix, Microsoft, Google, Tesla, Nvidia, Snowflake and AMD - it’s up 35%!

What should we attribute to this outperformance? In the post-covid environment, these stocks soared on easy money, and multiple expansion. And when the switch finally flipped on the policy cycle, these stocks were punished, as the valuation models were introduced to the concept of an interest rate - multiples contracted.

But why the snapback rally this year, despite what has been a continuation of the tightening cycle? Is it anticipation of the end of the cycle? Or does it reflect the market acknowledgement of consolidation of power in the economy, allocating to market dominance?

Let’s take a look at the regional banks.

As you can see, this ETF is trading back toward covid-era levels.

We’ve looked at the commonalities in the bank failures to this point - it remains contained to specialty banks, with the most extreme duration risk, and significant exposure to volatile venture capital, startup, and in cases, crypto deposits.

On that note, the fear of regional bank shareholders, and the motivation of short sellers, seems to be surrounding the concept of a “next shoe to drop” in commercial real estate (CRE).

Moody’s has some research on this, calling fears of the commercial real estate market reliance on small and mid-size banks “overstated or misstated.” What about small and mid-size bank exposure to CRE defaults? At a worst case scenario, where asset values fall by 40%, they see the average CRE loan loss at 8%. They see “a manageable downcycle for the CRE sector and its lenders.”

Probably a dip to buy in this ETF.

PS: If your looking to gain a quantitative edge for your stock picking, Gryning AI has your back.