We get the big inflation data on Wednesday, and then the banks will kick off Q2 earnings to end the week.

Let's talk about three factors that have already been revealed that will influence the June inflation number.

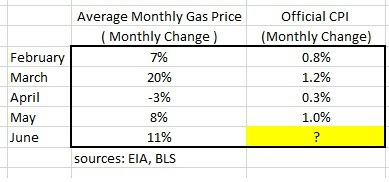

Gas prices:

This carries almost a 1/5th weighting in the CPI calculation - in the 10-year period between 2002 and 2012, gas prices and the consumer price index track very closely.

So what did gas prices do in June? The Energy Information Administration (EIA) does a weekly survey of gas stations across the country - those survey results show a rise in gas prices by about 11% from May to June.

That doesn't bode well for the inflation number.

As you can see in this above table, these sharp rises in gas prices have resulted in big monthly changes in CPI. The monthly CPI changes of around 1% represent an annualised inflation rate of double-digits (well above what has been the high year-over-year rate recorded thus far).

So, as far as Wednesday's number goes, this gas price input is bad news.

But there is some hope that the inflation report could come in softer, and therefore, take some pressure off of the Fed to act more aggressively. We looked at the wage data in my previous note..

Wage Data:

The Fed is worried about the wage pressure influence on prices (or worse, a wage spiral). On that note, the June jobs report showed average hourly earnings grew by 0.3% If we annualise that, we get 3.7% wage growth - that's significantly lower than the year-over-year change of 5%+.

That's good news (i.e. less pressure on prices).

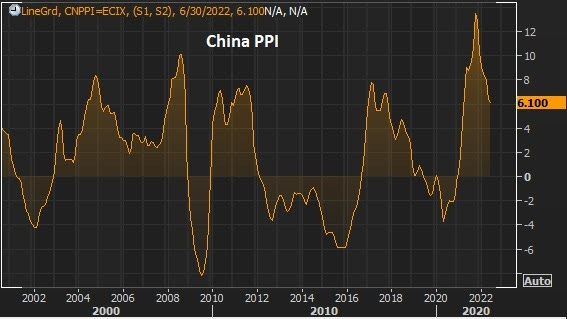

China PPI:

Finally, let's take a look at what's happening in China, where the products are made that we will be buying in the many months ahead...

Notice on the far right of this chart, producer prices in China were screaming higher late last year (at 13.5% year-over-year rate) - it was the hottest reading in 26 years. Meanwhile, whilst the Fed was still playing the inflation denial game, his data was clearly telling us what was happening, and what was coming. And we have seen it.

But, this number has since been falling like a stone, for eight consecutive months (now at 6.1%).

Again, this all relates to how aggressive the Fed will (at least threaten to) put the brakes on the economy.

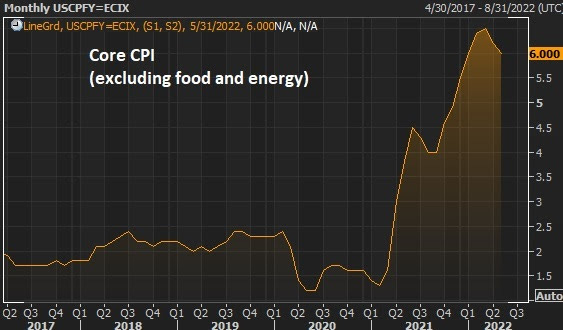

With the above in mind, with clear softening in the economy and in some of these inflation inputs, expect the Fed to start focusing the media and Wall Street on the core inflation number (chart below). This number excludes the effects of food and energy, which they like to justify by calling these inputs too "volatile." This has always been the number, with which they have positioned their policymaking.

If we see this core number continue to roll over, the Fed could be, in the coming months, in a position to claim victory (with the excuse to pause on tightening) - though the true cost of living pain, from food and energy, will continue.

PS: If you know someone that might like to receive my daily notes, they can sign up by clicking below ...