Jerome Powell spent two hours in front of the Senate Banking Committee. Today he will do the same with the House Financial Service Committee.

Just a week ago the Fed made the biggest rate hike in 28 years, raised interest rate and inflation projections, and the Fed chair spent over an hour answering questions from financial media. What more could he reveal today that markets don't already know?

Nothing. He maintained the Fed's stance that they will "expeditiously" raise rates to the neutral level, though he admitted that the Fed doesn't have the tools to deal with oil and food prices.

So, the Fed is guiding to a slower growth-high price economy, rather than a high growth-high price economy. It doesn't make sense - even the most intellectually dishonest of the Senate Banking Committee are poking holes in the logic. This "guidance" on the rate path by the Fed continues to look like lip service. If we look at their actions, rather than listen to their words, we see a 1.6% effective Fed Funds rate in an alleged effort to fight 8.6% inflation.

That said, the tough talk, alone, has taken a toll on confidence (record low). Financial conditions have tightened. The stock market is in a bear market.

As we discussed last week, after the 75 basis point hike, it's possible that the Fed could be done.

What's happened since? The S&P 500 opened at 3740 on the day of the Fed decision last week, yesterday, it was at 3740. The 10-year yield opened at 3.45% on the day of the Fed decision, yesterday it closed at 3.14%.

So, after an "historic" rate hike, as the media called it, stocks are flat, not down. Yields are down, not up.

In fact, two key rate markets posted “technical” reversal signals last week.

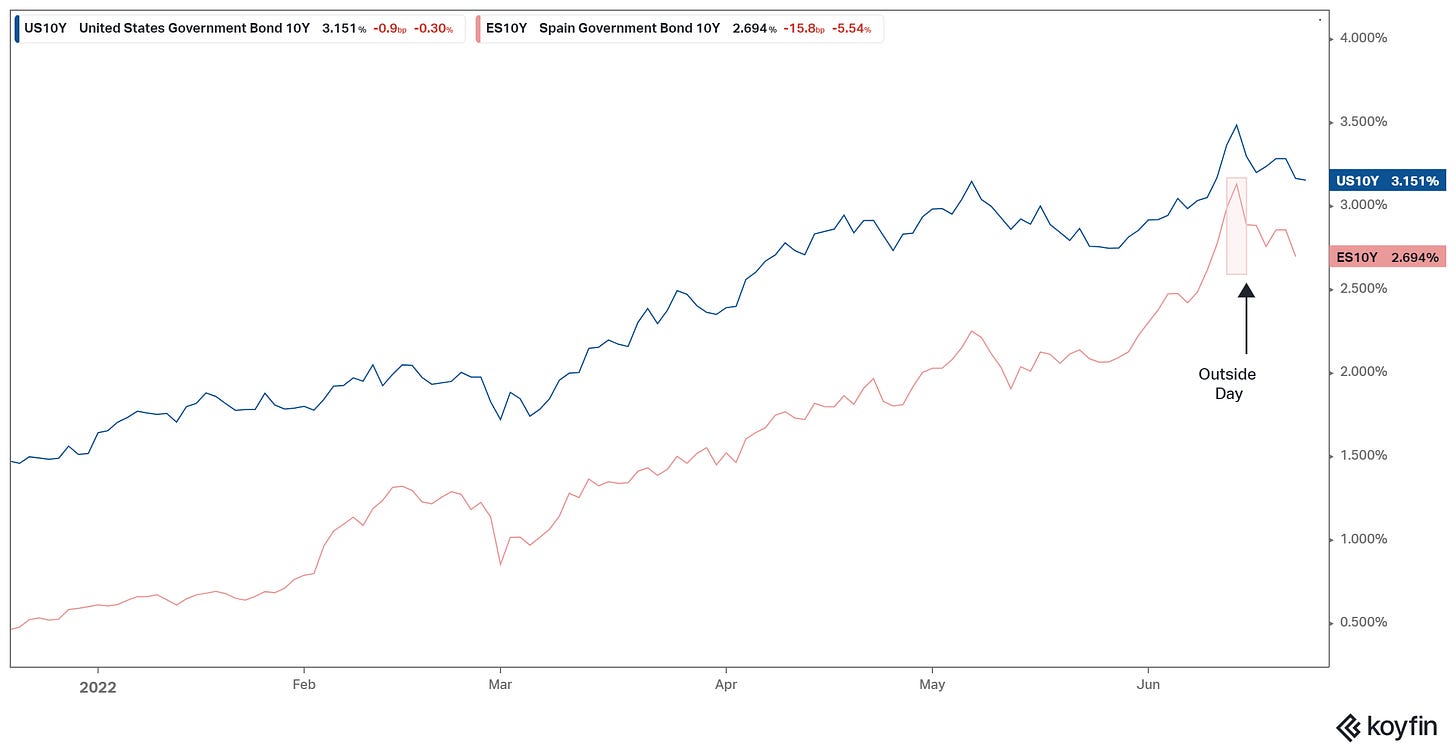

Spanish bond yields have been a proxy on the probability of another European sovereign debt crisis. This was quickly flaring up as of early last week, but has now reversed by 50 basis points in six trading days.

The U.S. 10-year yield has reversed from 3.5% to 3.14% in four trading days.

The drivers? The European Central Bank and the Bank of Japan.

The former (the ECB), showed how quickly they can fold on their policy plans last Wednesday. They responded to rising bond yields in the weaker spots of the euro zone (namely, Spain and Italy) with an emergency meeting and threats to backstop (again) the European sovereign debt market. The chart above is the result.

The latter (the BOJ), on Friday, doubled down on their unlimited QE strategy (i.e. they are the global asset buyer of last resort). This means demand for U.S. Treasuries.

The result? A sharp reversal in U.S. yields. Again, this dynamic sets up well for a rebound in stocks.