Powell's Game Plan

Macro Perspectives

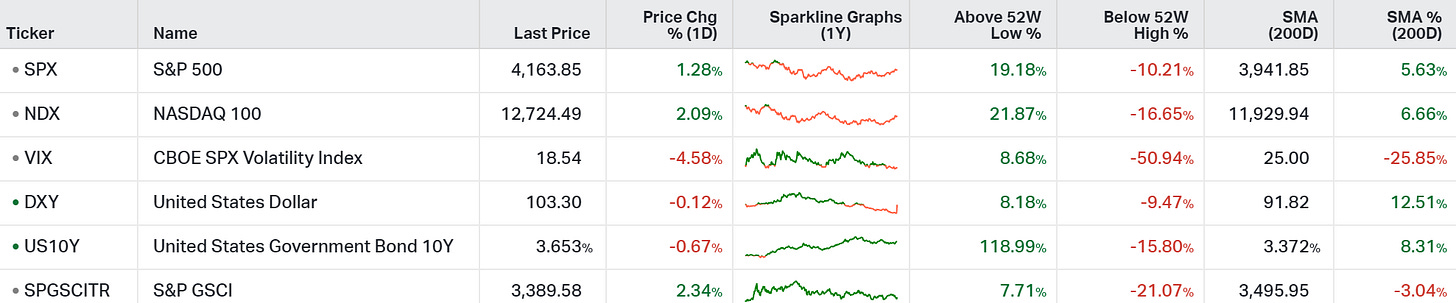

We heard from Jerome Powell yesterday. There was anticipation that he might use the day’s Q&A session at the Washington Economic Club to address Friday's hot jobs report.

Let's talk about what happened…

Remember, on Wednesday, despite telegraphing a continued, but slower, rise in interest rates toward the low 5% area, he did nothing to push back against a stock market that has been on a tear since the beginning of the year, and an interest rate market that has been pricing in rate CUTS by the end of the year.

As we discussed last week, this mix of higher equity prices and cheaper borrowing costs (based on benchmark market interest rates) is stimulative to the very economy that Powell and company have been trying to suffocate for the past ten months (in effort to bring inflation down).

So, did he use yesterday's platform as a second chance to tighten the grip on financial conditions (to talk down stocks and bonds)? He didn't.

Why?

As we also discussed last week, this recent Fed rate hike now puts the Fed Funds rate ABOVE the Fed's favored gauge of inflation (core PCE). That’s historically where the Fed has gone to get inflation under control. So it’s sensible to think the Fed should be satisfied and ready to step back and watch from here (i.e. pause).

But what about this 2% inflation target they keep going on about? The Fed's favored gauge of inflation is still at 4.4% - quite a distance away.

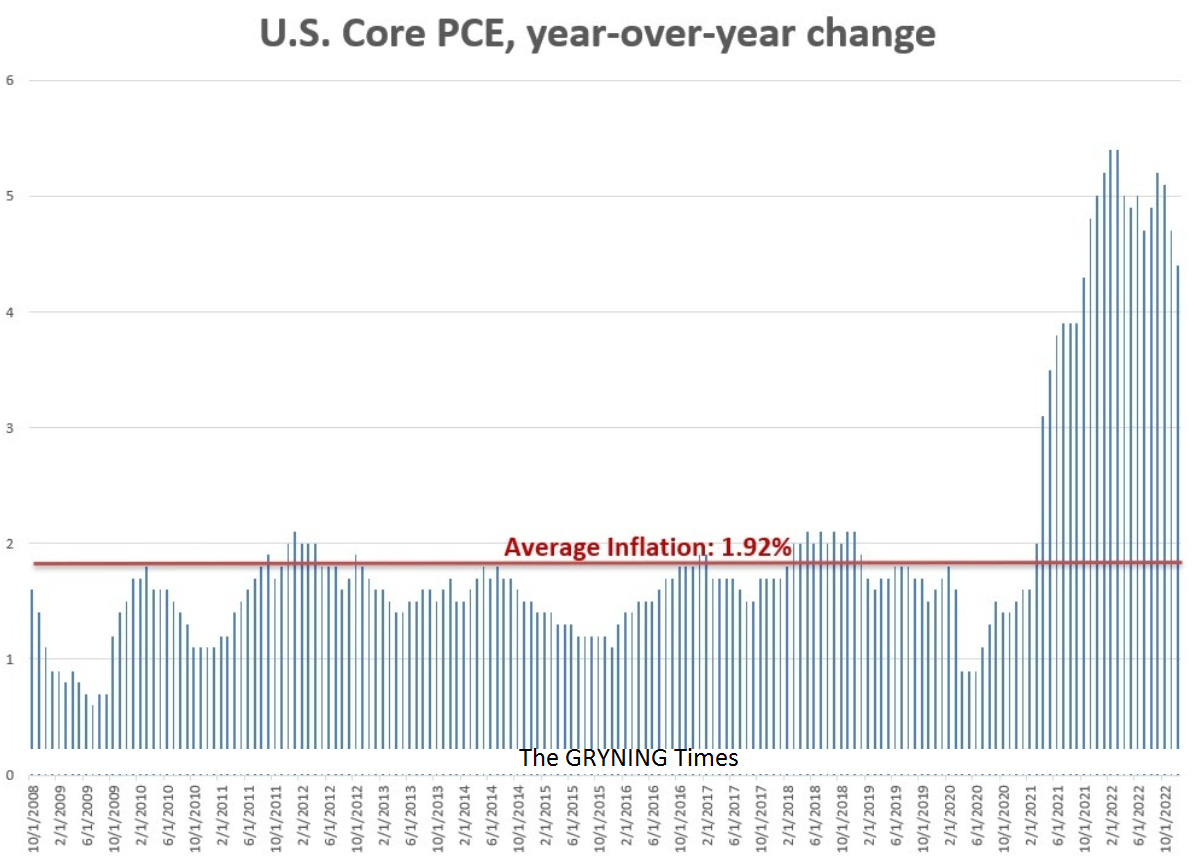

Let's address that by revisiting a very important keynote speech Jerome Powell gave back in 2020 at the annual global economic symposium in Jackson Hole. It was in that speech, that Powell made it official policy, that the Fed was changing the way it evaluates its 2% inflation target.

Here's the important part of his speech: "Our new statement indicates that we will seek to achieve inflation that averages 2% over time. Therefore following periods when inflation has been running below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time."

Translation: Inflation has been too low for too long (at the time of this speech in 2020). With this policy change, Powell told us he would let inflation run hot, to bring inflation back to 2% on average over time.

In that respect, he is (still) delivering.

Let's take a look at what this "average" looks like dating back to the ultra-low inflation era of the post-financial crisis, and into this pandemic era.

On average, inflation over the fifteen-year period remains below target - 13 years below target and past 2 years above target.

This policy objective for the Fed, argues that they should be happy with stable, but higher than target inflation for a while longer.

And this aligns with what we discussed in my note yesterday: We need a period of hot growth, rising wages, and stable (but higher than average) inflation (to inflate away debt).