The Fed didn't provide any surprises yesterday.

They had already guided to an end of QE by March. Given that Jay Powell told us back in December that they wouldn't start the liftoff on rates until they concluded their bond buying program, we could deduce that March could be the earliest they would move on rates.

Markets in the past month have priced in that scenario (a March hike) - Powell has now confirmed that. The other piece of the "tightening" plan, shrinking the balance sheet, has been telegraphed to come in the summer - nothing was said to change that course (probably June).

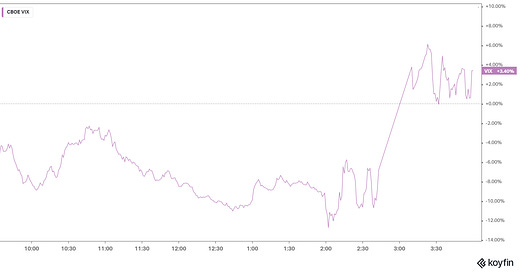

So, if no surprises, why the violent reaction in markets?

The Fed has a good record of managing stability through manipulating expectations on the policy path. On the latter, Powell was sloppy in his press conference (maybe on purpose). He created a gap between what the Fed has been guiding and what he expressed (in words) as a reality.

Keep in mind, the Fed continues to fuel the inflation pain through QE and zero rates, until March. Yet, Powell expressed how inflation was hurting people's ability to afford basic needs and he said it has gotten "slightly worse." Add to that, he said that affordability will become more painful, as fiscal spending is no longer stimulative and price pressures from supply chain constraints will persist - into next year (according to Powell).

Is he setting us up for a more aggressive path? He should be. Unlike the "taper tantrum" of 2013, the policy error this time isn't removing emergency policies prematurely. It's a Fed that has been/is too late.